Gold and Silver price: Close to the last week’s maximum?

- During the Asian session, the price of gold rose.

- During the Asian session, the price of silver found support at $ 21.80

- Today, participants will focus on publishing ADP employment data and initial unemployment claims in the United States.

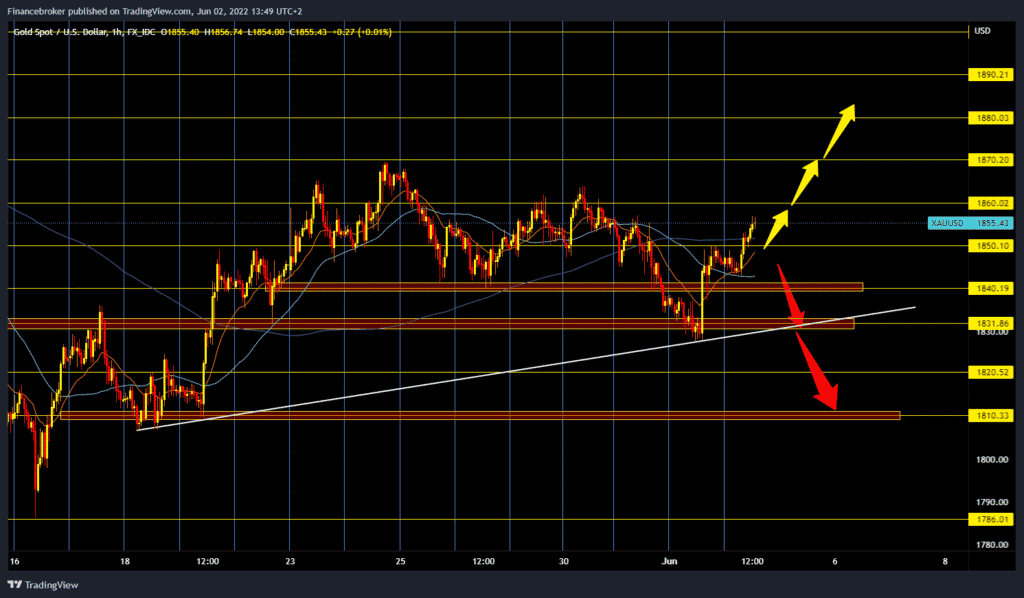

Gold chart analysis

During the Asian session, the price of gold rose. Yesterday, the price of gold recovered after the meeting between Joe Biden, the President of the USA, and Jerome Powell, the first man of the Fed. The meeting was interpreted as a slight pressure on the US Federal Reserve to hurry up with tightening monetary policy. Also, one member of the Fed’s monetary board, Christopher Waller, two days earlier, said that the interest rate should be increased by 50,0% in September as well.

That sent yesterday a bad signal to gold. However, most of the losses have been compensated, and gold is growing at the expense of rising inflation. The price of gold is trading at around 1855 dollars per fine ounce, which represents a price increase of 0.52% since the beginning of trading last night. We need continuation of the positive consolidation and break above the $ 1860 price for the bullish option. After that, gold could re-test last week’s high at $ 1,870. Our potential following bullish targets are $ 1880, $ 1890 and $ 1900. For the bearish option, we need a negative consolidation and a pullback to $ 1850. Then if the price doesn’t find support at this level, then we’ll see a break below and a drop to $ 1840, or $ 1830. An additional support price at the $ 1830 level is the lower trend line.

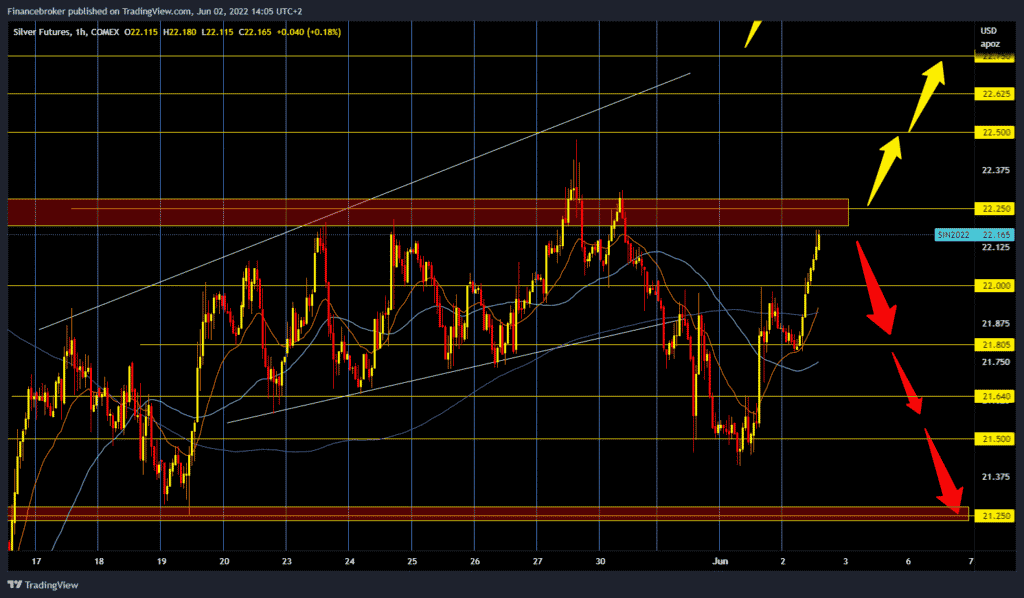

Silver chart analysis

During the Asian session, the price of silver found support at $ 21.80, after which we introduced a strong bullish impulse that raised the price above $ 22.00. It is now priced at $ 22.15, and we are very close to the previous high at $ 22.30. It is not excluded that we will test last week’s maximum at $ 22.48 again. We need a new negative consolidation and pullback up to $ 22.00 for the bearish option. Break prices below would increase bearish pressure, and we could retest the previous low of $ 21.80. Potential lower targets are $ 21.65, $ 21.50, $ 21.25 level.

Market overview

ADP Nonfarm Employment

Today, participants will focus on publishing ADP employment data and initial unemployment claims in the United States. The price rose despite a significant appreciation of the US dollar and a further increase in bond yields. The increase is all the more significant considering that the gold ETFs monitored by Bloomberg yesterday also registered outflows of 2.7 tons. The US labor market is very tight, which serves as a key argument for increasing the Fed’s rates. Robust data today could further raise expectations about the rate increase and put pressure on the price of gold again.