Gold and silver: gold is consolidating around $1,950

- During the Asian trading session, we saw a pullback in the price of gold to the $1952 level.

- During the Asian trading session, the price of silver retreated to the $24.20 level of support.

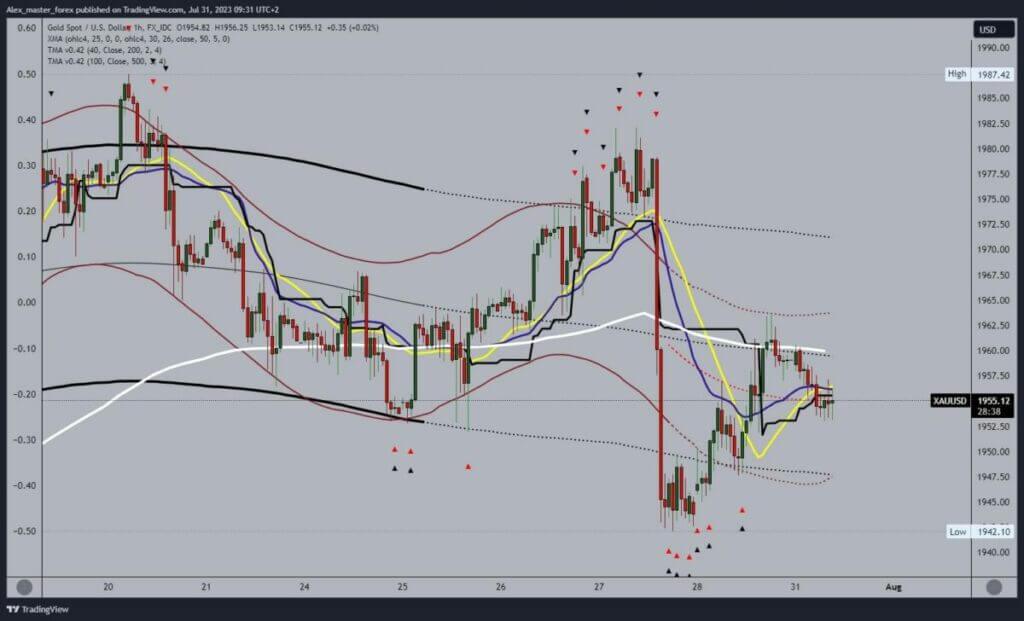

Gold chart analysis

During the Asian trading session, we saw a pullback in the price of gold to the $1952 level. In the EU session, the fall was stopped at that level, and the price recovered to $1955. We now expect to see a continuation of the recovery and a move to the $1960 level. Additional resistance in that zone is the EMA50 moving average, and we need a break above it for further continuation to the bullish side. Potential higher targets are $1965 and $1970 levels.

We need a negative consolidation and pullback below the $1950 level for a bearish option. In this way, we would initiate a decline in the price of gold, which could lead to a visit to the previous support levels. Potential lower targets are $1945 and $1940 levels.

Silver chart analysis

During the Asian trading session, the price of silver retreated to the $24.20 level of support. We remain under pressure below the $24.40 level and need a break above it to continue on the bullish side. We immediately encounter the EMA50 moving average up there, and we need a move above it to get its support. Potential higher targets are $24.50 and $24.60 levels.

We need a negative consolidation and a drop to the $24.00 support level for a bearish option. A fall below would form a new low and thus confirm the fall in the price of silver and the bearish side. Potential lower targets are $23.90 and $23.80 levels.