Gold and Silver – downtrend

- During the Asian session, the price of gold fell after a few days of very solid gains.

- During the Asian session, the price of Silver withdrew from $ 22.15 to the current $ 21.76.

- The price of gold is retreating from the two-week high of 1,870 dollars.

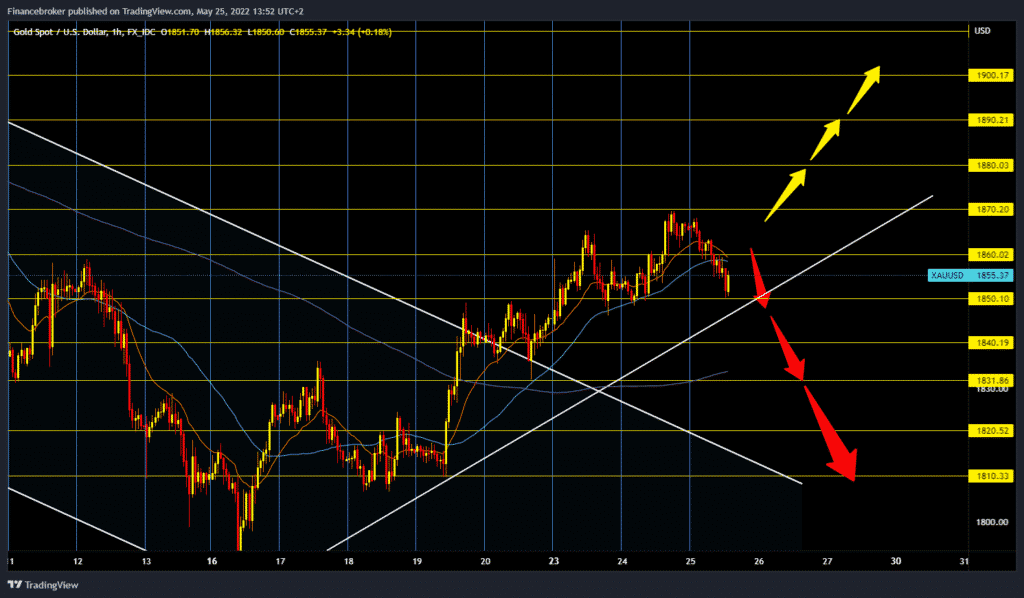

Gold chart analysis

During the Asian session, the price of gold fell after a few days of very solid gains. Price inflation in the world’s leading economies indicates that it will remain so for a long time, and such a reality supports the price of the precious metal in the long run. Gold was oversold, and a strong rebound from the 1800 level followed. The price of gold is trading around 1854 dollars per fine ounce, representing a price drop of 0.63% since the beginning of trading tonight. Today’s support is our $ 1,850 level. Additional support at that level is in the bottom trend line. Breaking prices below would increase bearish pressure, and we could continue further in negative territory. Potential bearish targets are $ 1840, $ 1830 and $ 1820 levels. For the bullish option, we need a continuation of the previous positive consolidation and a break above yesterday’s high of $ 1,870. After that, we could expect the bullish trend to continue. Potential bullish targets above yesterday’s high are $ 1880, $ 1890 and $ 1900.

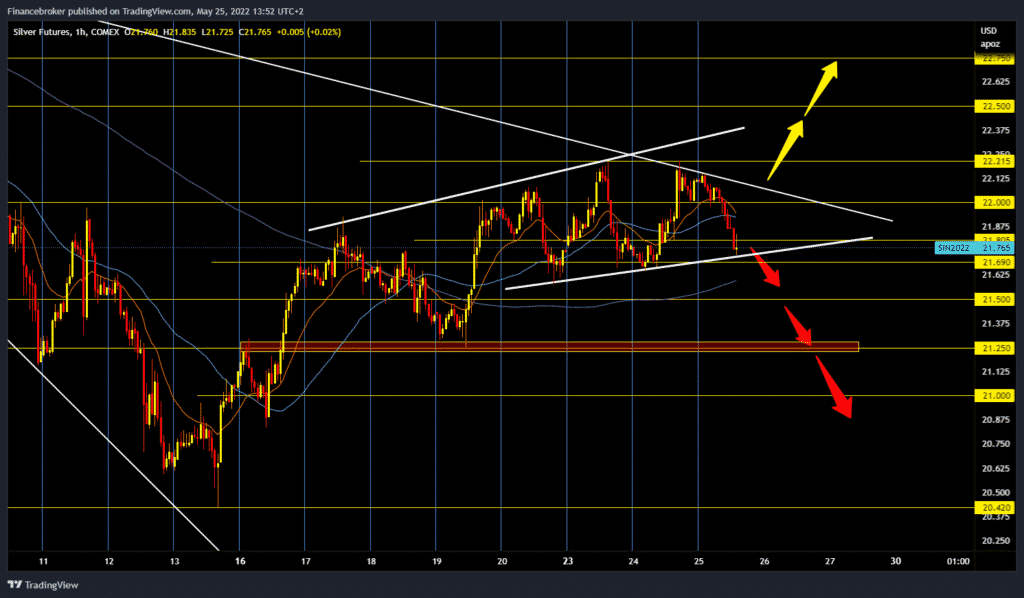

Silver chart analysis

During the Asian session, the price of Silver withdrew from $ 22.15 to the current $ 21.76. Yesterday, Silver confirmed the previous resistance at $ 22.21 and started a bearish pullback. We can look for potential support in the zone around $ 21.60. If the price breaks below this support zone, we will probably see a drop first to the 21.50 level before visiting the previous low to $ 21.25. With a break below, the price could drop to $ 21.00 or $ 20.42 on the May low. For the bullish option, we need a break out of 21.22 levels. Only then can we expect a potential recovery in prices. Potential targets above are the $ 22.50 and $ 22.75 levels.

Market overview

The price of gold is retreating from the two-week high of 1,870 dollars as tensions are rising ahead of the minutes of the meeting on Fed policy in May, which will probably give new hints about the tightening of the central bank’s path. The broad recovery of the US dollar, despite the cautious mood in the market, is negatively affecting the light metal. The Fed’s latest comment expressed concern over the decline in US Treasury yields.

The downside seems limited amid deteriorating global economic prospects. Investors remain concerned that a more aggressive move by large central banks to curb inflation could pose challenges to global economic growth. In addition, the war between Russia and Ukraine and the latest COVID-19 epidemic in China is fueling fears of a recession.