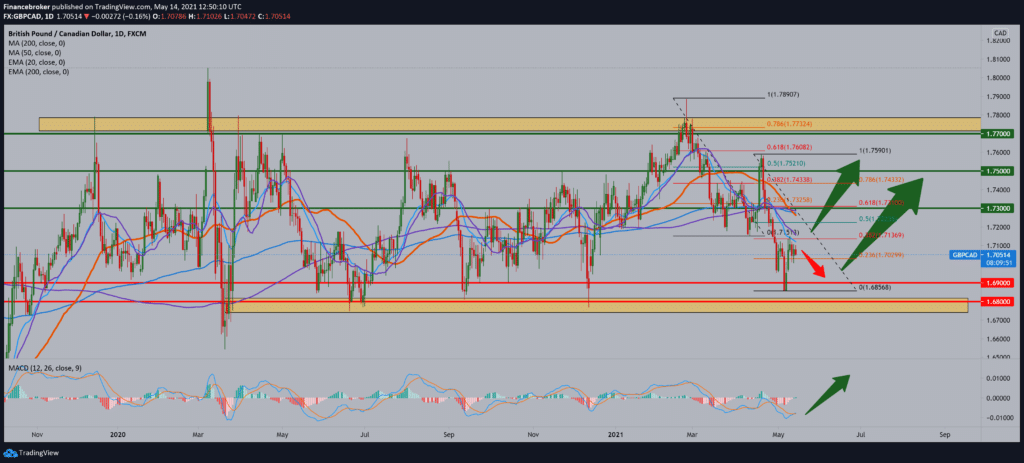

GBP/CAD jump from support zone, analysis for May 14, 2021

Looking at the chart on the daily time frame, we can do the following technical analysis. We see the GBP/CAD pair moving between the two zones. Below we have zone 1.67000-1.68000, while at the top, we have the zone around 1.77000-1.78000. At the beginning of May, we touched the lower zone, and after that, we have rejection and some growth. We are currently testing moving averages of MA20 and EMA20, and if a break occurs above, our target is the zone around MA200 and EMA200 in the zone around 1.72000. By setting the Fibonacci retracement level, we see that the first pullback was up to 61.8% level and that now again, there is a probability that the same thing will happen, and that level coincides with MA200 and EMA200 at 1.73000. A smaller pullback is certainly possible but as a test on a psychological level at 1.70000. Looking at the MACD indicator, we see that the blue MACD line has just crossed over the signal line, which can give us a signal for a potentially bullish signal. We can only wait another day or two for better confirmation on the chart.

For the GBP/CAD currency pair, we can single out the following economic news and certain official statements: Capital Economics analysts now expect inflation to exceed the Bank of Canada’s range of 1% to 3% for most of the rest of the year. Still, they think inflation will fall to less than 2% in 2022. The focus was on U.S. inflation this week, and, after a surprise in April, we now expect inflation to be above 4% for most of the year. Similar price pressures will be visible in Canada as the economy reopens, but there are two key reasons why inflation is unlikely to rise by that much. The attitude of policymakers on both sides of the border that inflation growth will be temporary seems more justified in Canada. The exchange rate plays a larger role in determining inflation, and the rise in the share, which has risen 15% year-on-year against the USD, will soon put pressure on commodity inflation. Given that the CAD acts as a pressure valve and a small sign that wage growth will start, we expect both core and core inflation to fall to less than 2% in 2022. This means that inflation will again be below 2%, by the time they acquire conditions for an increase in interest rates. I don’t think the situation with low-interest rates will change significantly, Bank of England (BoE) Governor Andrew Bailey said on Thursday. He also added the following statements: that Digital Currency would have implications for setting interest rates in the future. There is currently no prospect of an agreement with the EU on post-Brexit equivalence rules for financial services. There is a price worth paying for the equivalence of financial sector rules with the EU, but that price is not infinite. There is no lack of goodwill between the UK and the EU in terms of financial services.

-

Support

-

Platform

-

Spread

-

Trading Instrument