GBP/CAD analysis for April 5, 2021

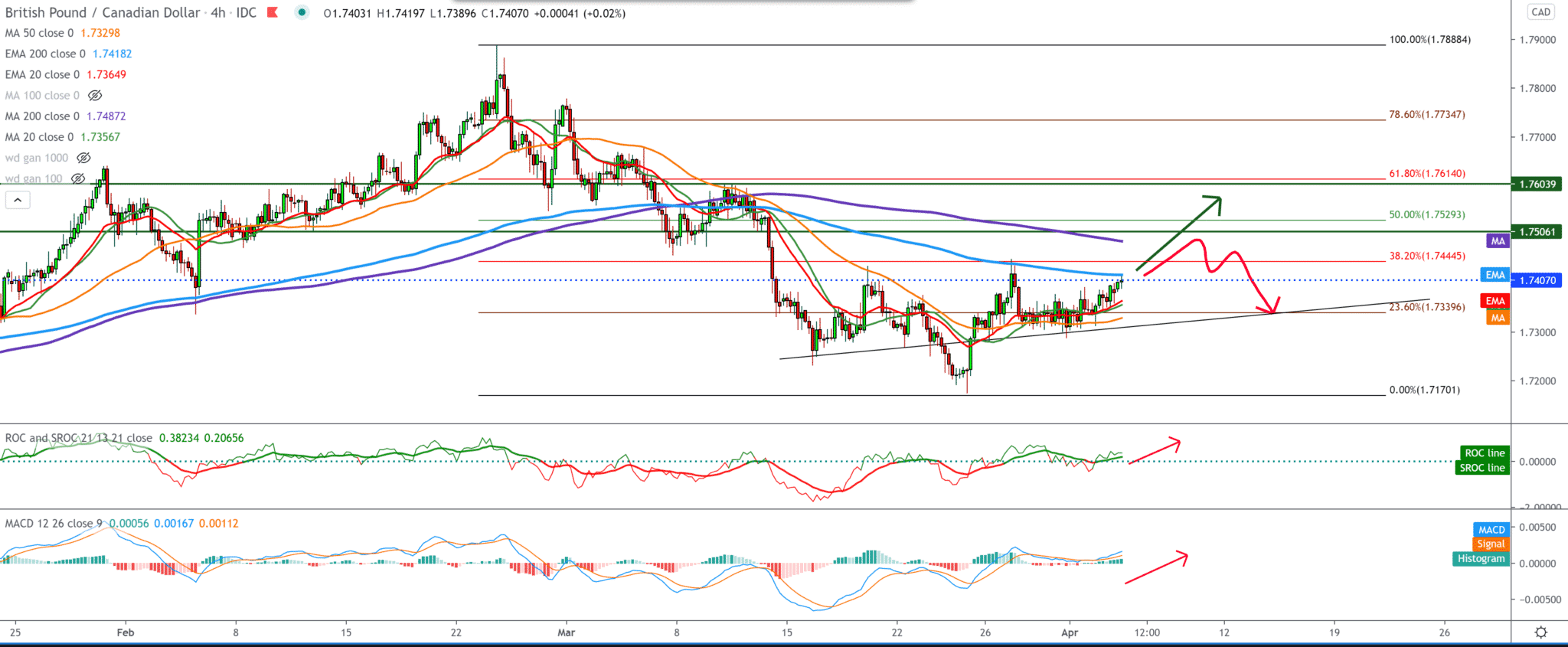

Looking at the four-hour time frame graph, we see that the GBP/CAD pair found support around 1.73400 on Fibonacci retracement 23.6% level. The GBP/CAD pair also finds support in the moving averages of the MA20, EMA20, and MA50, and we are currently testing the EMA200 at 1.74000.

Above the first next resistance is 38.2% Fibonacci level at 1.74450, the break above leads us first to MA200 close to a 1.75000 and 50.0% Fibonacci level at 1.75300. If we look at bearish, we should wait for stronger resistance at 38.2% level and pull down to previous support at 1.73400.

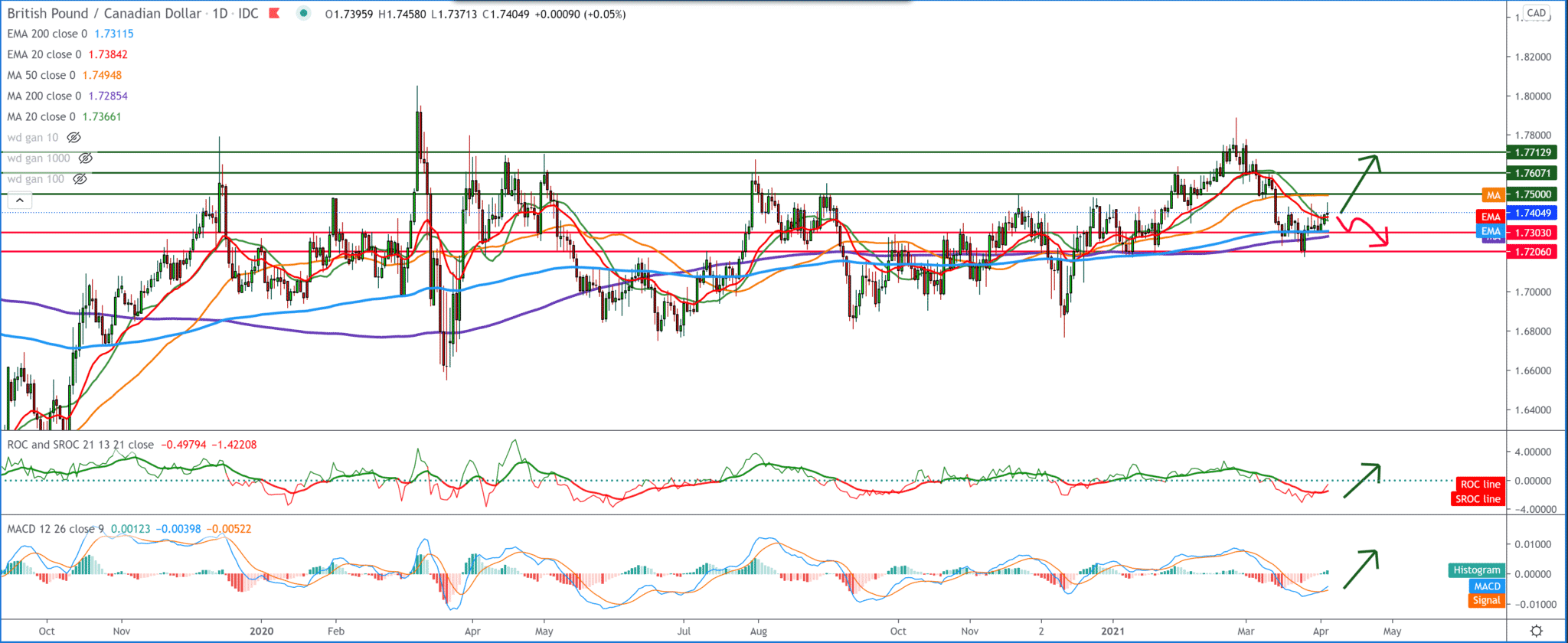

On the daily time frame, we see that the GBP/CAD pair is sitting on the support of the moving averages MA200 and EMA200 with the current support of MA20 and EMA20. We can expect further growth of the GBP/CAD pair on that chart, and our first target is MA50 at 1.75000.

If we see a break above MA50, then we are looking at the previous high at 1.76000. For the bearish scenario, we need stronger CAD, a pull below the MA200 and EMA200, as a better confirmation for the continuation of that bearish trend, and we are looking at the previous low at 1.72000.

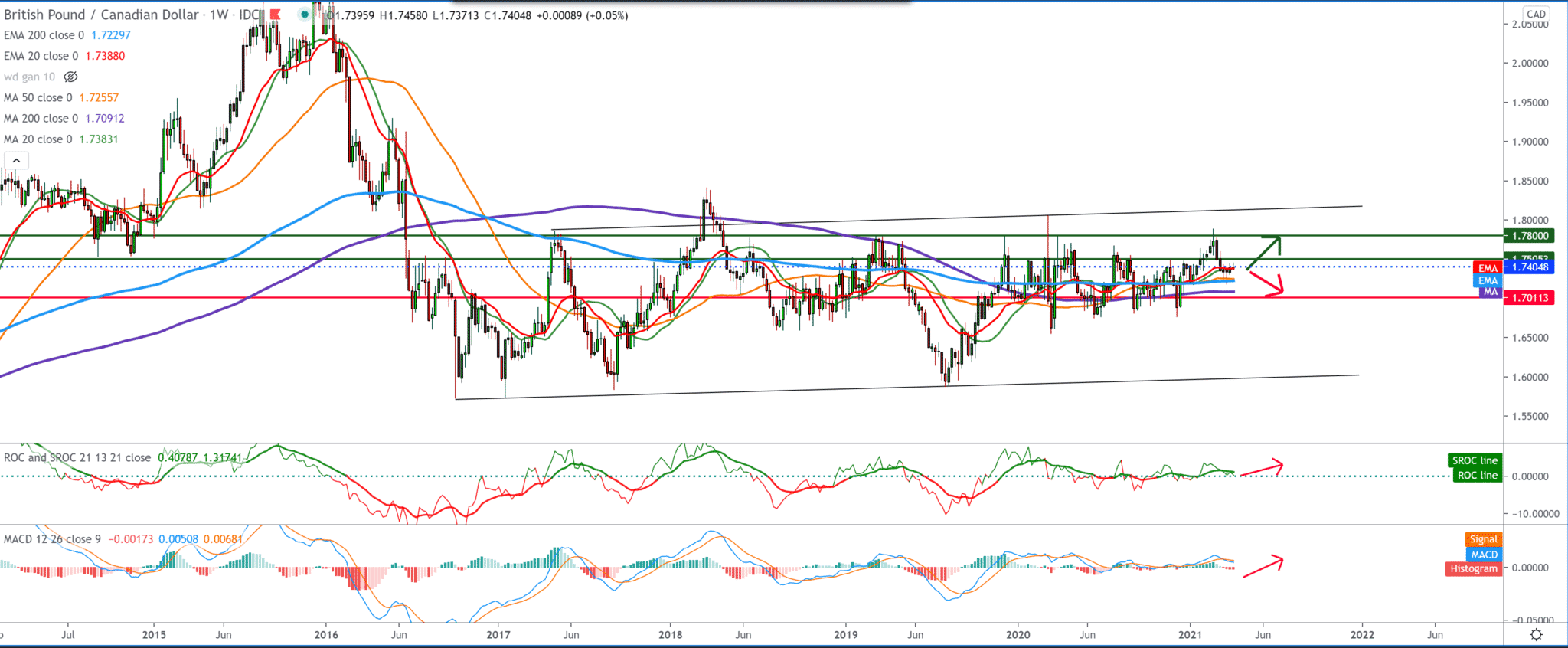

On the weekly time frame, we see that the GBP/CAD pair is supported by moving averages for a long time and that the GBP/CAD pair moves sideways a little above and below the moving averages. If we look at the previous break and jump to 1.78000, then pullback can now be seen as a potential retest to moving averages and a zone around 1.74000.

We now expect the GBP to make a stronger momentum towards higher levels, and we are waiting for a break above 1.75000 to move back to the previous high at 1.78000 and perhaps testing 1.80000 levels.

-

Support

-

Platform

-

Spread

-

Trading Instrument