EUR/NZD analysis for April 5, 2021

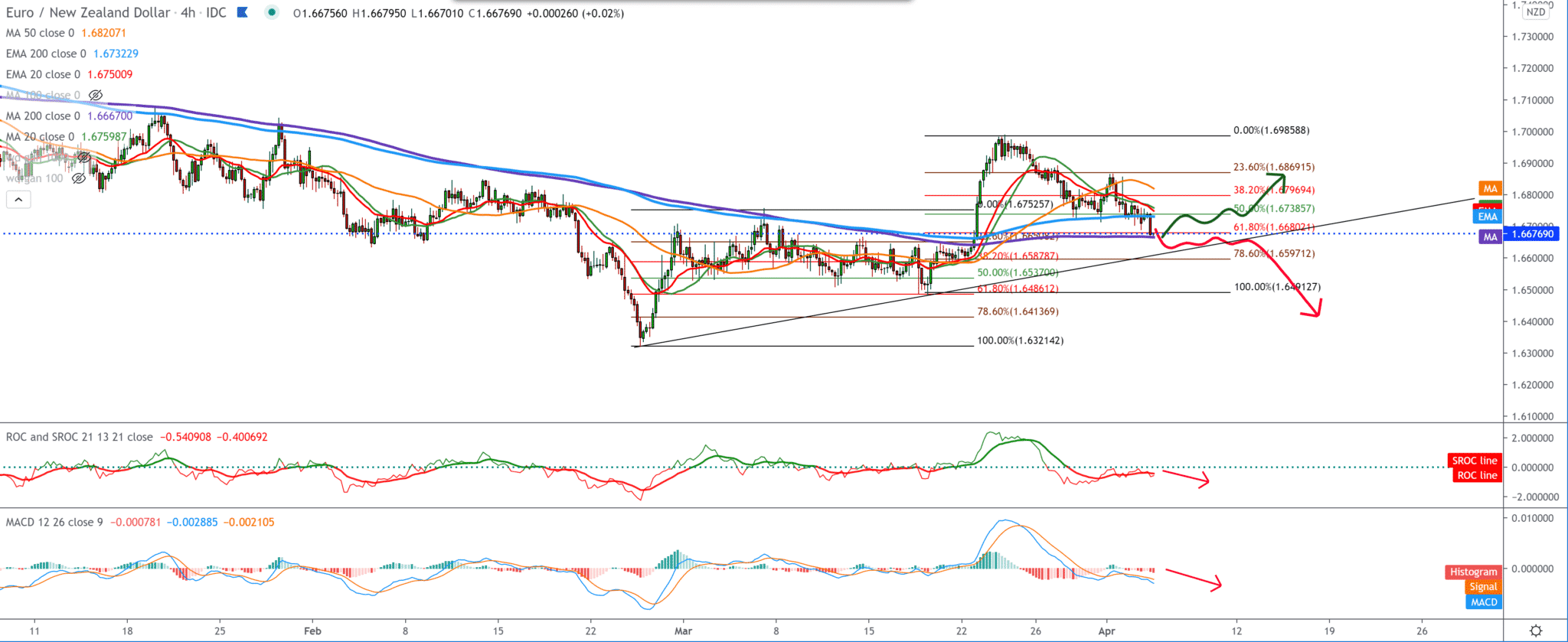

Looking at the chart on the four-hour time frame, we see that the EUR/NZD pair has come to a very important level. Firstly we test significant support on the moving average MA200. Secondly, by setting the Fibonacci retracement level, we see that the previous rejection was at 61.8% and that we are currently testing that level again at 1.66800.

Other smaller moving averages are on the bearish side and put pressure on the EUR/NZD pair to continue the bearish trend, and if they succeed in that or, then it drops 1.65000 to the previous low.

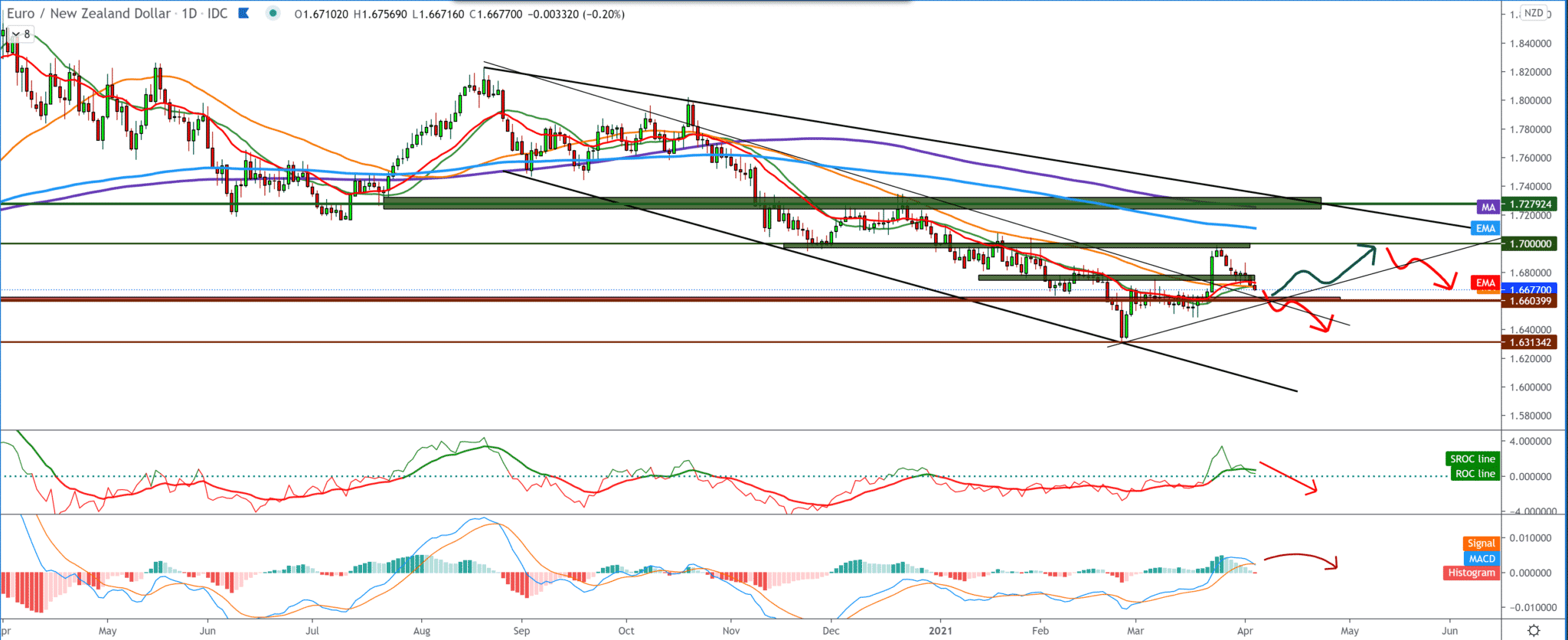

In the daily time frame, we see movement within a large descending channel, assuming the bearish trend will continue. The EUR/NZD pair embarked on a previous pullback but stopped at 1.70000 seems to be an important psychological level for investors.

After the rejection, the EUR/NZD pair retreats again to the current 1.66700. If the break happens below 1.66000, then we look at the previous low at 1.63130 as the next target. Following the MACD indicator, we see that the blue MACD line is slightly below the signal line and that the first red histogram is formed as a signal for the probable continuation of the bearish trend.

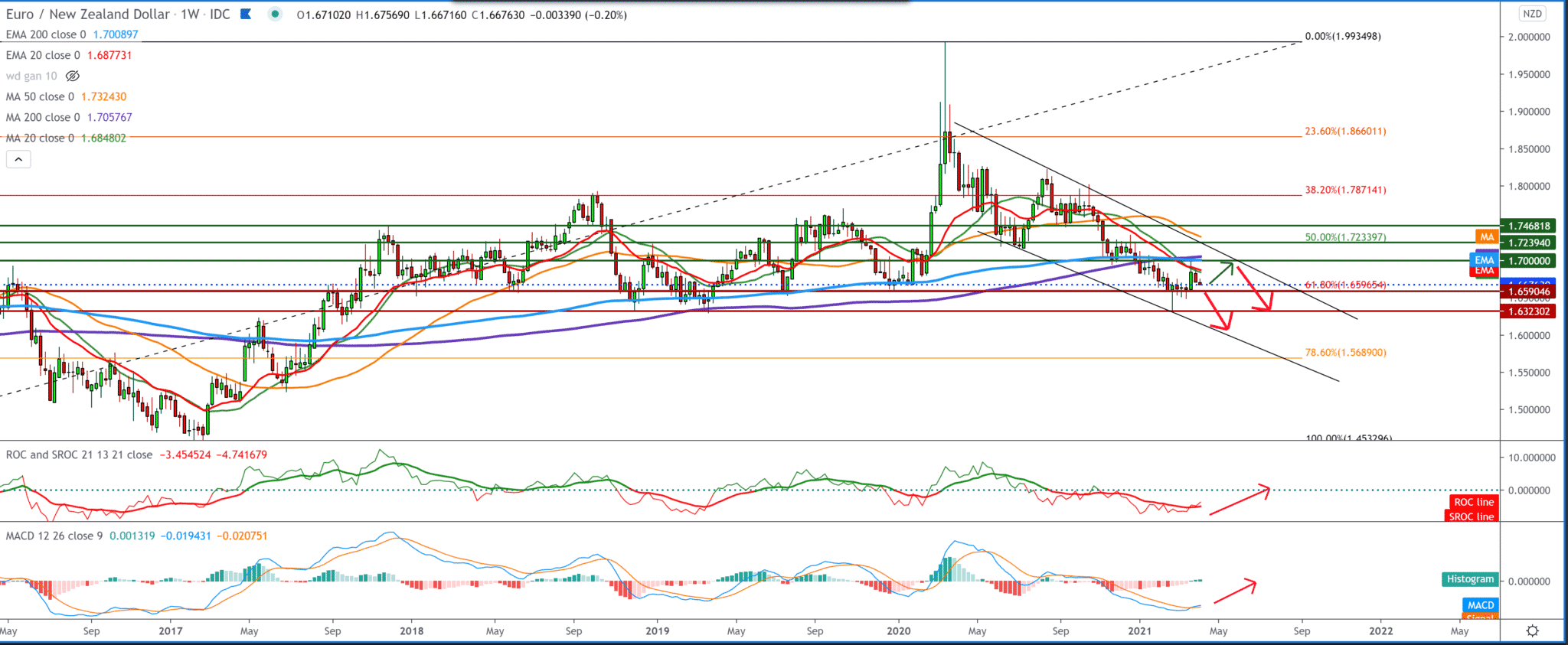

On the weekly time frame, we see that the pair, after falling below the moving averages of MA20 and EMA20, fails to climb above again. We also see that MA20 and EMA20 have made a cross-section below MA200 and EMA200, which is a powerful sign that we will continue the bearish trend.

Looking at the Fibonacci level, we see that we are still testing the 61.8% level at 1.66000 and that there is now a chance that this support will break and go even lower on the chart targeting the previous low at 1.63200. In any case, where we are now, we can expect longer consolidation and hesitation regarding the future direction of the trend.

-

Support

-

Platform

-

Spread

-

Trading Instrument