FXTM Review 2020 – Is this broker good?

| General Information |

|

|---|---|

| Broker Name: | FXTM (ForexTime Ltd.) |

| Broker Type: | Forex |

| Country: | Cyprus |

| Operating since year: | 2013 |

| International offices: | Kuwait, Nigeria, United Kingdom |

| Regulation: | •CySEC, 185/12 •FCA (UK), 777911 •FSB (South Africa), 46614 •IFSC (Belize), SC/60/345/TS and IFSC/60/345/APM |

| Address: | Limassol, Cyprus |

| Broker status: | Regulated |

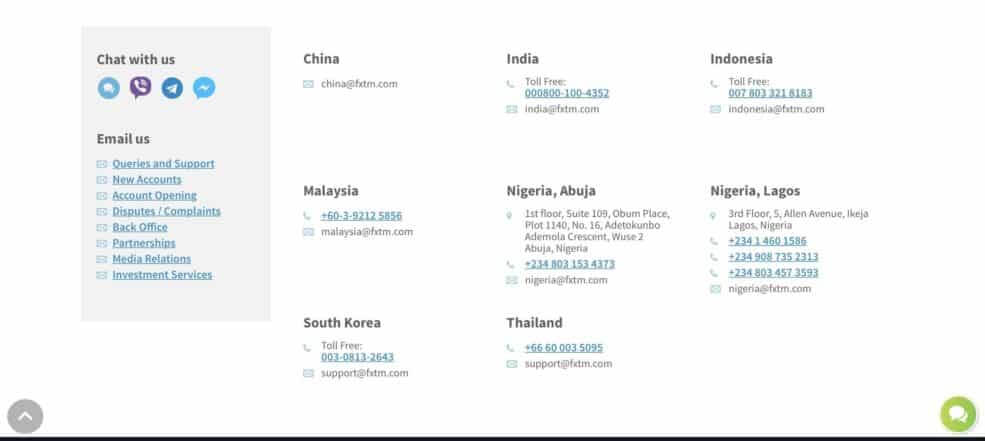

| Customer Service | |

| Phone: | +44 203 734 1025 |

| Email: | [email protected] |

| Languages: | English, Arabic, Armenian, Bahasa, Bengali, Cantonese, Chinese, Czech, Farsi, French, German, Hindi, Igbo, Indonesian, Italian, Korean, Malay, Maratchi, Pashto, Polish, Portuguese, Punjabi, Russian, Saraiki, Slovak, Spanish, Thai, Ukraine, Urdu, Vietnamese, Yoruba |

| Availability: | Mon-Fri 24 hours GMT+3 during Daylight Saving Time |

| Trading | |

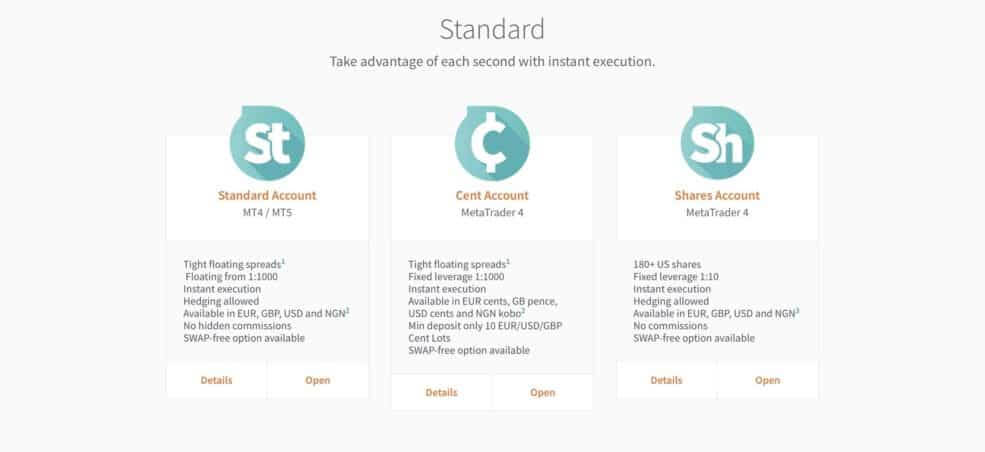

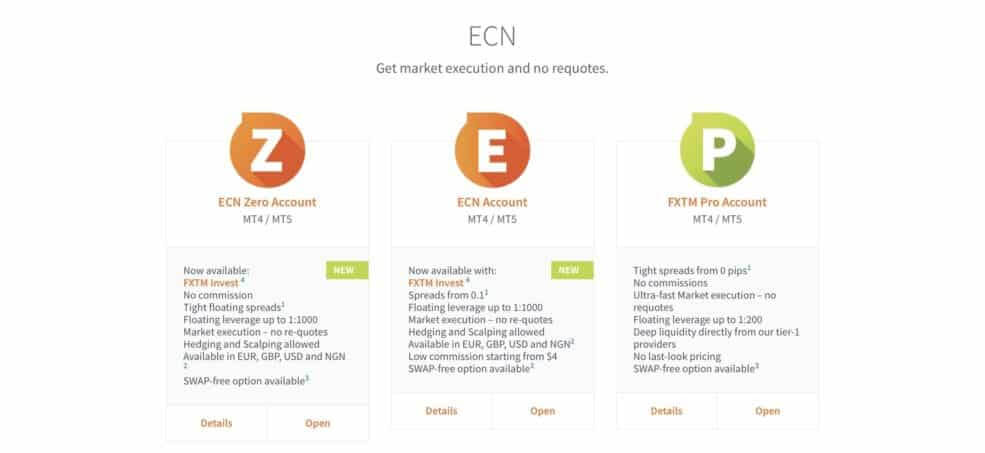

| Trading Platforms: | MT4 & MT5 (Compatible with iOS and Android) |

| Trading platform(s) timezone: | GMT+3 |

| Demo Account: | Yes |

| Mobile trading: | Yes |

| Web based trading: | Yes |

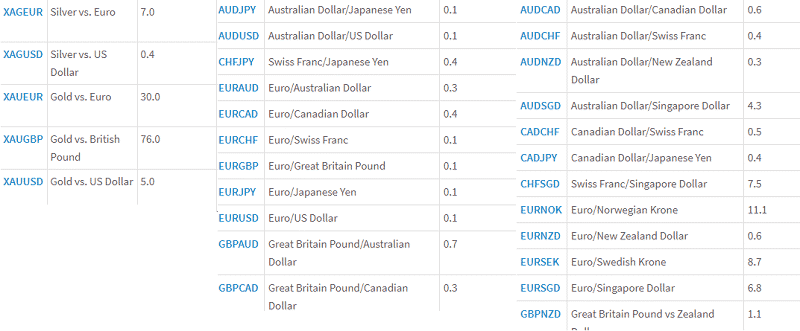

| Other trading instruments: | currencies, spot metals, shares, and commodities as well as cryptocurrencies CFD’s. |

| Account | |

| Minimum deposit ($) | $5 |

| Maximal leverage (1:?) | 1:1000 |

| Spread | Variable |

| Scalping allowed | Yes |

Overall

4.5

-

Support

(4.5)

-

Platform

(4.5)

-

Spread

(4.5)

-

Trading Instrument

(4.5)

Did not allow withdrawal

Did not allow me to withdraw. Avoid this broker.

Did you find this review helpful? Yes No

Poor broker service

Slow withdrawals and poor customer service. No good reason to keep and recommend them.

Did you find this review helpful? Yes No

Unregulated broker

They do not have regulations and are only trying to get money from people.

Did you find this review helpful? Yes No

Rude brokers

Do not deal with this broker. Poor customer service. Lack of patience and full of rudeness.

Did you find this review helpful? Yes No

Bad customer service

Bad customer service. They sounded lazy over the phone, sarcastic, and very unhelpful. They keep on connecting me from one person to another but my issues were never resolved.

Did you find this review helpful? Yes No