EURUSD and GBPUSD: the recovery of the euro and the pound

- During the Asian trading session, the euro continued this week’s bullish trend, rising to the 1.03500 level.

- During the Asian trading session, the pound continues to rise against the US currency.

EURUSD chart analysis

During the Asian trading session, the euro continued this week’s bullish trend, rising to the 1.03500 level. We are currently seeing a minor halt and pullback to the 1.03000 support level. From this negative consolidation, the fall of the euro could be extended to this week’s support zone around the 1.02000 level.

A break below would only increase the bearish pressure, which would lead to a continuation of the decline of the European currency. Potential lower targets are 1.01500 and 1.01000 levels. For a bullish option, we need a positive consolidation and a retest of this morning’s resistance zone at 1.03500. If we manage to break above, then we have a chance to move up to the 1.04000 level, the previous high from Friday. Potential higher targets are 1.04500 and 1.05000 levels.

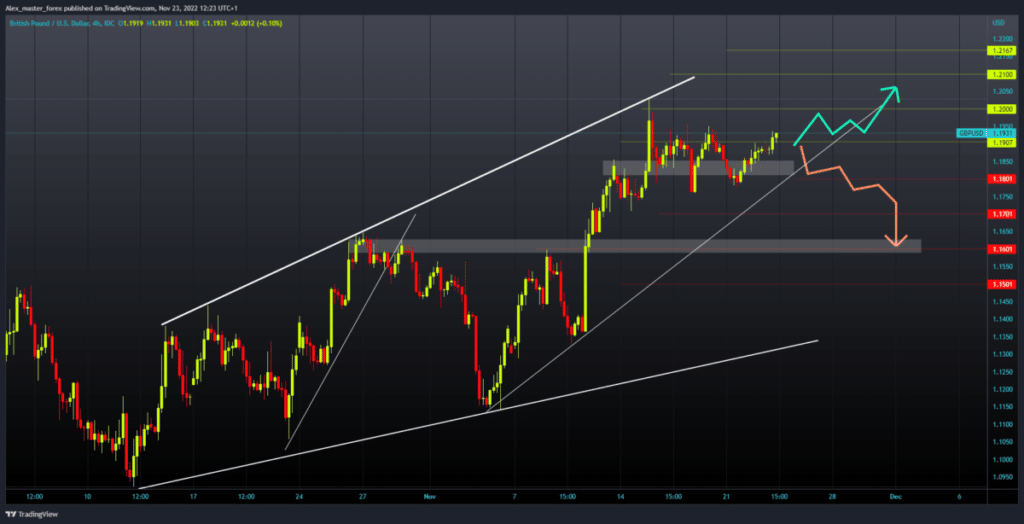

GBPUSD chart analysis

During the Asian trading session, the pound continues to rise against the US currency. This morning’s bullish impulse moved us to the 1.19500 level, and we are now testing the prior high from last week. For a bullish option, we need a continuation of the positive consolidation and a move up to the 1.20000 level.

A breakout of the pound above and staying there would be very helpful. And with the next bullish impulse, we could see a further pound recovery. Potential higher targets are 1.21000 and 1.22000 levels. For a bearish option, we need a negative consolidation and a return to the 1.18000 support level. A break below that level would show the pound’s weakness to remain on the bullish side. Below, we would see a pullback to lower support levels. Potential lower targets are 1.17000 and 1.16000 levels.