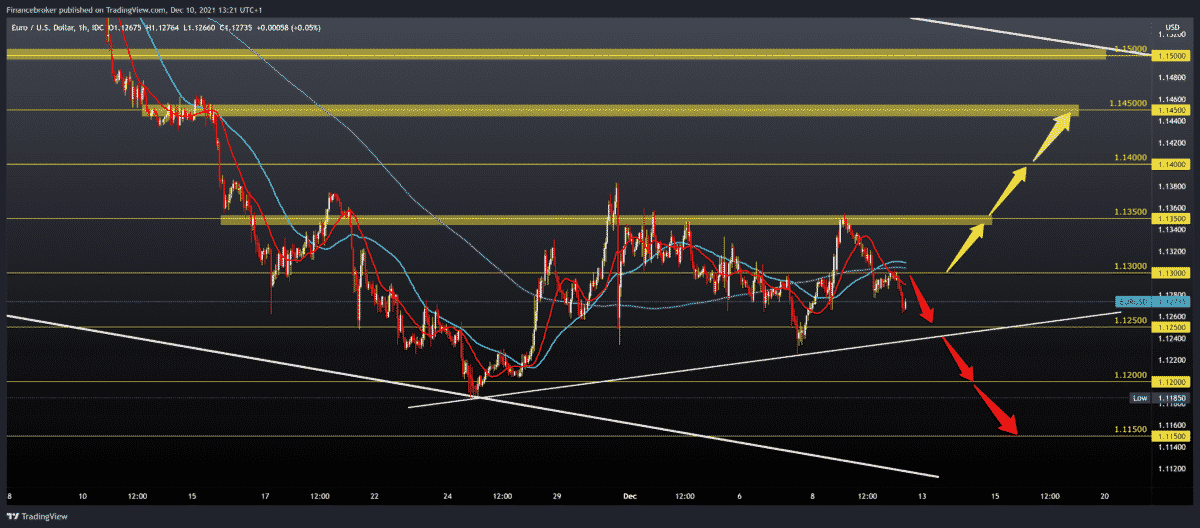

EURUSD and GBPUSD stay at annual lows

After testing the zone at 1.13500, the EURUSD pair makes a pullback to the current 1.12700. We are now following EURUSD to see if it will be able to find support at 1.12500. Looking at moving averages, everyone is on the bearish side, creating extra pressure on the pair.

Bullish scenario:

- We need a new positive consolidation that will lead us to 1.13000. Above, we have resistance in moving averages that may be an obstacle to continuing the bullish trend.

- Below above, our next resistance is at 1.13500, the previous resistance zone this month.

- A break above this zone can climb EURUSD to 1.14000, then to 1.14500.

Bearish scenario:

- We need a continuation of this negative consolidation and a new test of the 1.12500 zone.

- As additional support at that level, we have a lower trend line, and the break below would form a new lower low to amplify the bearish trend.

- Next below support is at 1.12000, close to this year’s low.

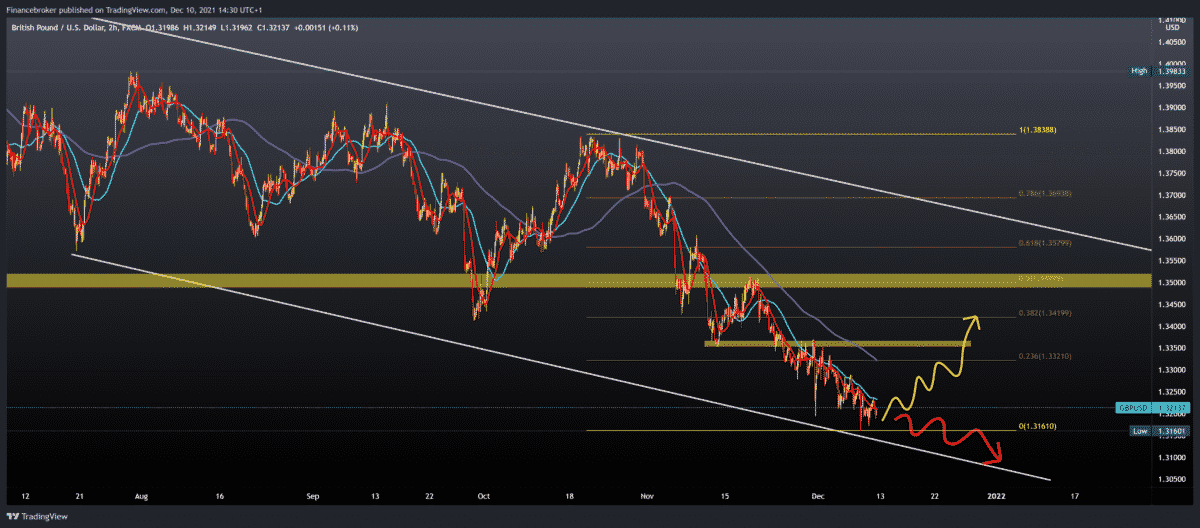

GBPUSD chart analysis

Pair GBPUSD has so far found support at 1.31600, and after that, we see that we have progressed a bit to 1.32000. From November 22, the pair is below the MA20 and MA50 moving averages. We must make the transition above these moving averages in the coming period in order to reverse the current bearish trend.

Bullish scenario:

- We need new positive consolidation and a break above 1.32500 and MA20 and MA50 moving averages.

- Then we can expect the pair to continue towards 1.33000 and approach the first 23.6% Fibonacci level, where we can expect the next higher resistance.

- At that level, the additional resistance is in the MA200 moving average. If the pair breaks, we get extra support.

Bearish scenario:

- We need continued negative consolidation, retreating below 1.32000 and re-testing this year’s low to 1.31600.

- Further withdrawal will form new lows this year toward 1,30000 psychological level.

Market overview

Inflation expectations for next year have risen among Britons. Most expect interest rates to rise over the next 12 months, the results of a quarterly survey on inflation attitudes by the Bank of England and market research firm Kantar showed on Friday.

In October, the UK economy only expanded as the service sector grew, while supply chain problems hampered construction and production.

According to the Central Bureau of Statistics on Friday, gross domestic product increased by only 0.1 percent compared to September, when it increased by 0.6 percent. This was also much slower than the 0.4 percent expansion expected by economists.

The government’s recently imposed Covid “Plan B” restrictions could cut GDP by 0.0-0.5 percent in December, said Paul Dales, an economist at Capital Economics. This means there is a real risk of an economic downturn in December.

“In that context, we doubt that the Bank of England will raise interest rates next Thursday,” the economist added.

In the three months to October, GDP grew by 0.9 percent, reflecting the strong performance of the services sector in September.

In October, services output climbed 0.4 percent and reached its pre- crown (COVID-19) pandemic level.

The manufacturing sector in New Zealand continued to grow in November, albeit at a much slower pace. The latest BusinessNZ survey on Friday showed a manufacturing PMI score of 50.6.

It is down from 54.3 in October, although it remains above the rise or fall line of 50 that separates expansion from contraction.

The implications of PMI on economic growth and employment growth seem clear – soft. “But with the obvious difficulties that remain on the supply side, the recommendations are that inflation continues to rise,” said Doug Steel, a senior BNZ economist.

-

Support

-

Platform

-

Spread

-

Trading Instrument