EURUSD and GBPUSD: Are You Ready for Uptrend?

- During the Asian trading session, the euro remained stable above the 0.97000 level.

- At the beginning of the European session, the euro gained strength and moved towards 0.97500, where we have some resistance for now.

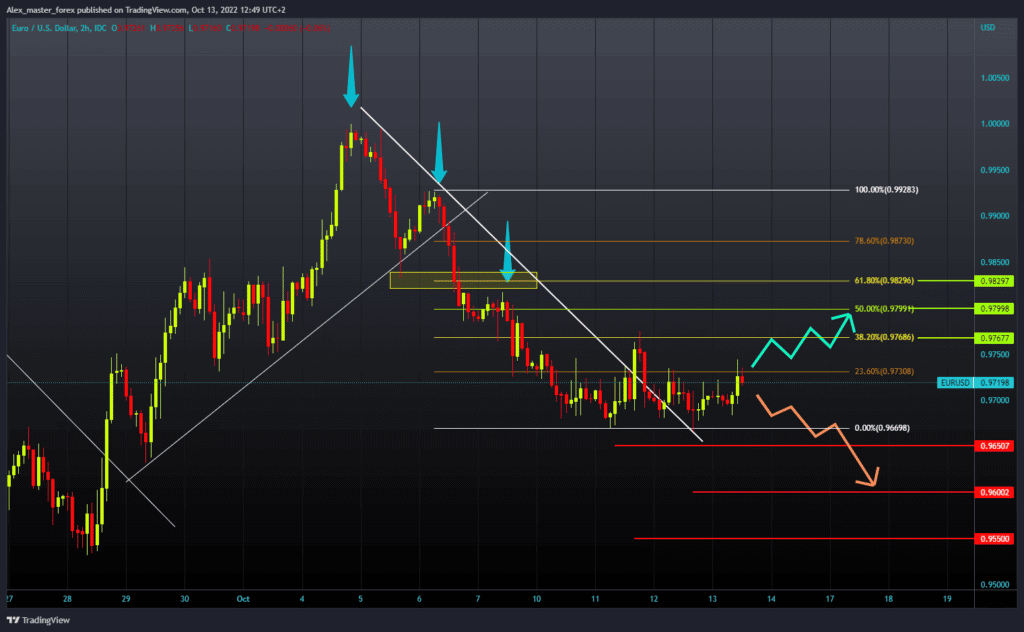

EURUSD chart analysis

During the Asian trading session, the euro remained stable above the 0.97000 level. At the beginning of the European session, the euro gained strength and moved towards 0.97500, where we have some resistance for now.

For a bullish option, we need a positive consolidation. After that, the pair could climb up to 0.97700 to the previous high. Then we must stay there and continue the recovery with a new bullish impulse. Potential higher targets are 0.98000 and 0.98300 levels.

We need a negative consolidation and pullback to the 0.97000 support zone for a bearish option. Increased pressure could further push the pair below this support and continue the bearish pullback. Potential lower targets are 0.96500 and 0.96000 levels.

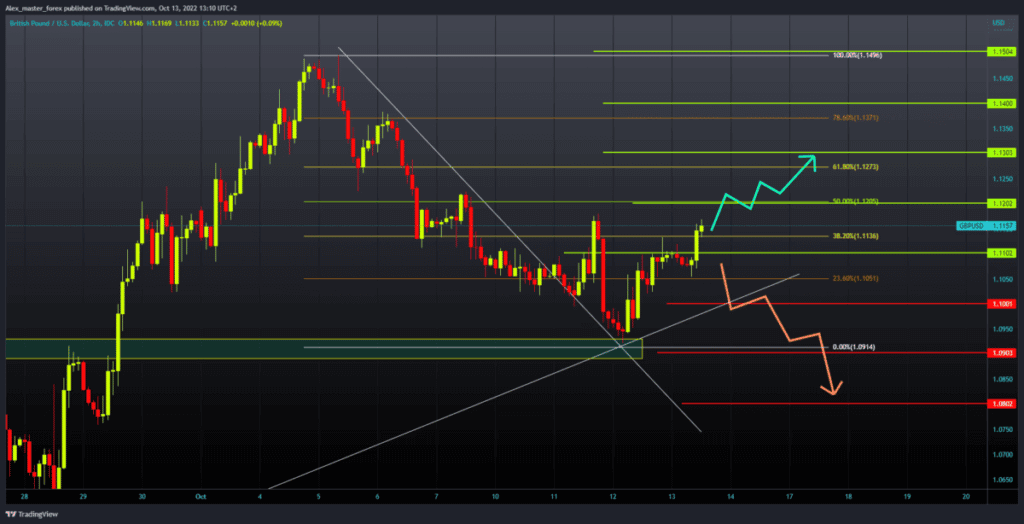

GBPUSD chart analysis

The pound found support at the 1.09000 level yesterday and has been in a bullish recovery since then. During the Asian trading session, we had a consolidation and calm session, while in the European session, the pound continued to grow and made a break above the 1.11000 level. We are already at the 1.11650 level and continue towards the 1.12000 resistance level. In that place, we could expect more resistance.

Potential higher targets are 1.12500 and 1.13000 levels. For the bearish option, we need a new negative consolidation and descent to the 1.10500 level, this morning’s low. A break below the pound could further lower us to the 1.10000 level. Potential lower targets are 1.09500 and 1.09000, this week’s support level.

Market Overview

Consumer price inflation in Germany hit a new record in September; final Destatis data showed on Thursday. Consumer price inflation accelerated to 10.0% in September from 7.9% in August. The inflation rate coincided with the forecast. Energy prices have risen sharply by 43.9% compared to last year due to Russia’s attack on Ukraine and supply shortages. The European Central Bank is expected to raise interest rates by at least 75 basis points at its next meeting in late October.