EURUSD and GBPUSD are on a slight rise today

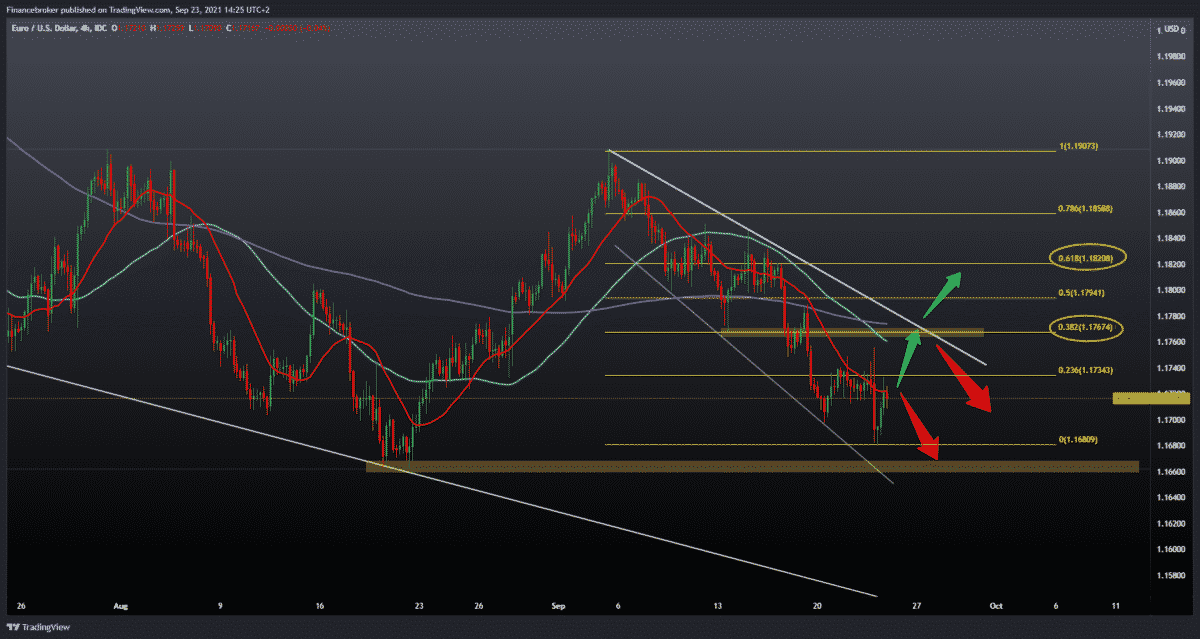

Looking at the chart on the daily time frame, we see that the EURUSD pair made this month’s low to 1.16800 this morning. After that, we have a slight retreat to the current 1.17150. we can say we are testing the MA20 moving average at 23.6% Fibonacci level at 1.17340, and we need a break above to get additional support with the goal of climbing to the MA50 and MA200 moving averages in the zone around 38.2% Fibonacci level at 1.17675. After reaching a high at 1.19100 from September 7, we see that the pair is in a bearish trend, forming a falling channel, and based on that, we can say that we are in a bearish trend and that we can see the continuation if the pair does not break above the upper resistance line.

GBPUSD chart analysis

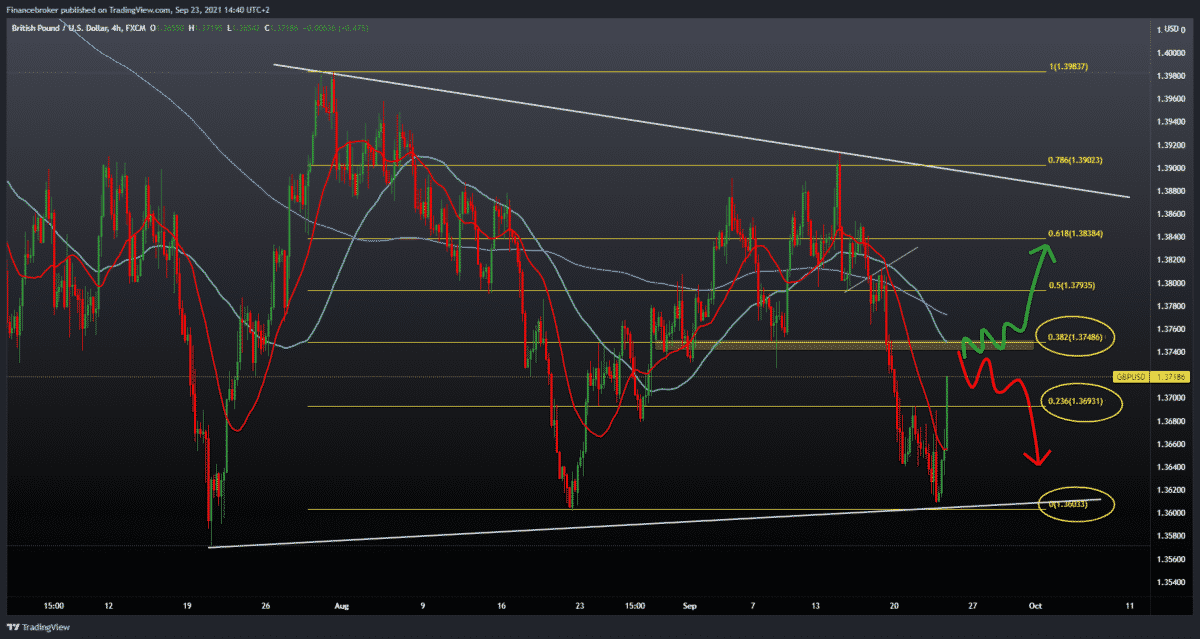

Looking at the GBPUSD chart on the four-hour time frame, we see that the GBPUSD pair found support on the bottom trend line at 1.36100 and then reduced losses by climbing to the current 1.37175 with support for the MA20 moving average. Above, our next resistance is the MA50 moving average and 38.2% Fibonacci level at 1.37500. For further continuation on the bullish side, we definitely need a break above, and as the next target and potential new resistance, we are looking at the zone 50.0-61.8% Fibonacci levels. For the bearish scenario, we expect the pair to encounter resistance at 38.2% Fibonacci level and then revert to the previous low of 1.36100 and try to break below that potential support.

Market overview

An economic situation in EU

Private sector growth in the eurozone fell to its lowest level in five months in September due to supply chain shortcomings, the results of the latest IHS Markit survey showed on Thursday.

The Flash Composite Output Index fell to 56.1 in September from 59.0 in August. The result is predicted to fall to 58.5.

Strong but slow growth was recorded in production and services.

The procurement manager index fell to 56.3 from 59.0 in the previous month. The expected reading is 58.5.

At 58.7, PMI in production fell to a seven-month low from 61.4 in August. The reading is also below the forecast of 60.3.

The German manufacturing sector grew slowly

The German manufacturing sector grew at the slowest pace in eight months in September due to ongoing supply disruptions and rising prices, while service sector growth lost momentum after a strong recovery as economic activity recovered after the COVID-19 pandemic, survey results showed Thursday.

According to the preliminary results of the latest IHS Markit survey on purchasers, the index of procurement managers for the factory sector fell to 58.5 from 62.6 in August. Economists forecast a score of 61.5.

Thanks to supply bottlenecks that reduced demand, the production index fell to a 15-month low of 53.8 in September.

Orders have been growing at the slowest pace since July last year. The lack of semiconductors has led to reduced demand in the automotive sector.

The PMI flash service fell to a four-month low of 56.0 from 60.8 in August. Economists have predicted a reading of 60.2.

BOE keeps interest rates at a record low

The Bank of England on Thursday left its key interest rate at a record low and quantitative easing, which was expected.

The Monetary Policy Committee unanimously decided to leave the key interest rate unchanged at 0.10 percent.

The MOC also kept existing inventories of corporate bond purchases at GBP 20 billion and government bond purchases at GBP 875 billion, with total volume easing reaching GBP 895 billion.

-

Support

-

Platform

-

Spread

-

Trading Instrument