Bitcoin, Ethereum, and Dogecoin in short profits-recovery

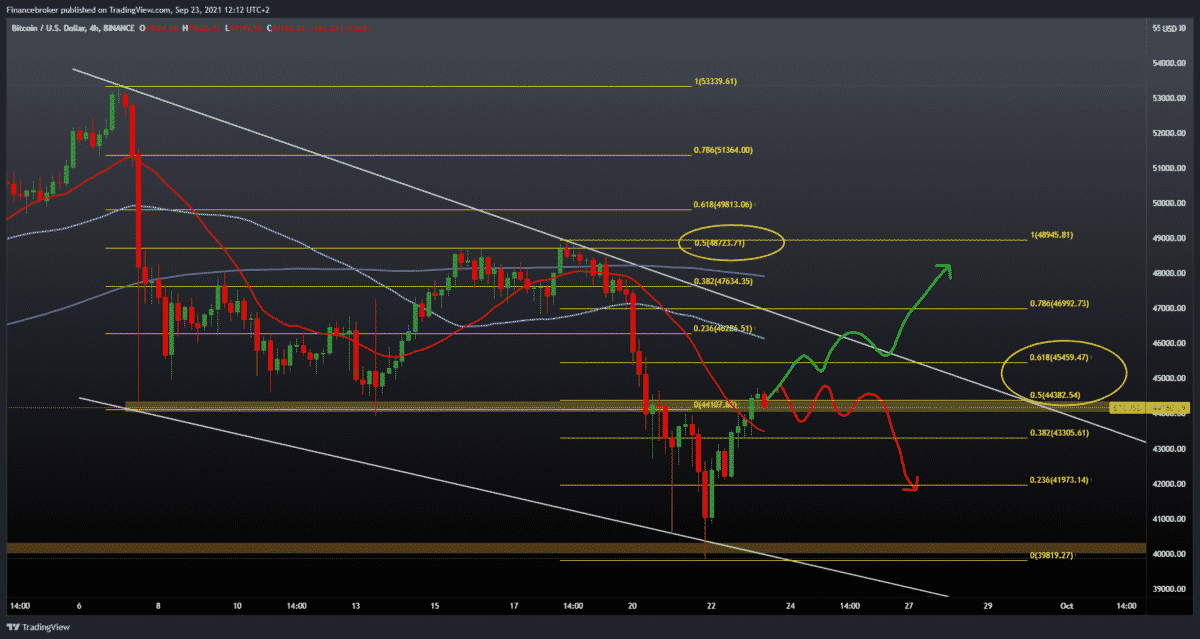

Looking at the chart on the four-hour time frame, we see that the price of Bitcoin managed to recover today, and after yesterday’s fall to $ 40,000, it climbed to the current $ 44,400. To the positive list for Bitcoin, we can add the transition above the MA20 moving average. Our target is the next upper moving average, the MA50 in the zone above 61.8% Fibonacci level around $ 46,000. Additional upward resistance awaits us in a downward trend line, and a break above us may lead us to the previous high zone at $ 48,900. For the bearish scenario, we need a price pullback below the MA20 moving average and 38.2% Fibonacci levels to $ 43305. After that, we can say that we will see the continuation of the lowering of the price on the bearish side and the potential new testing of the previous lows to $ 40,000.

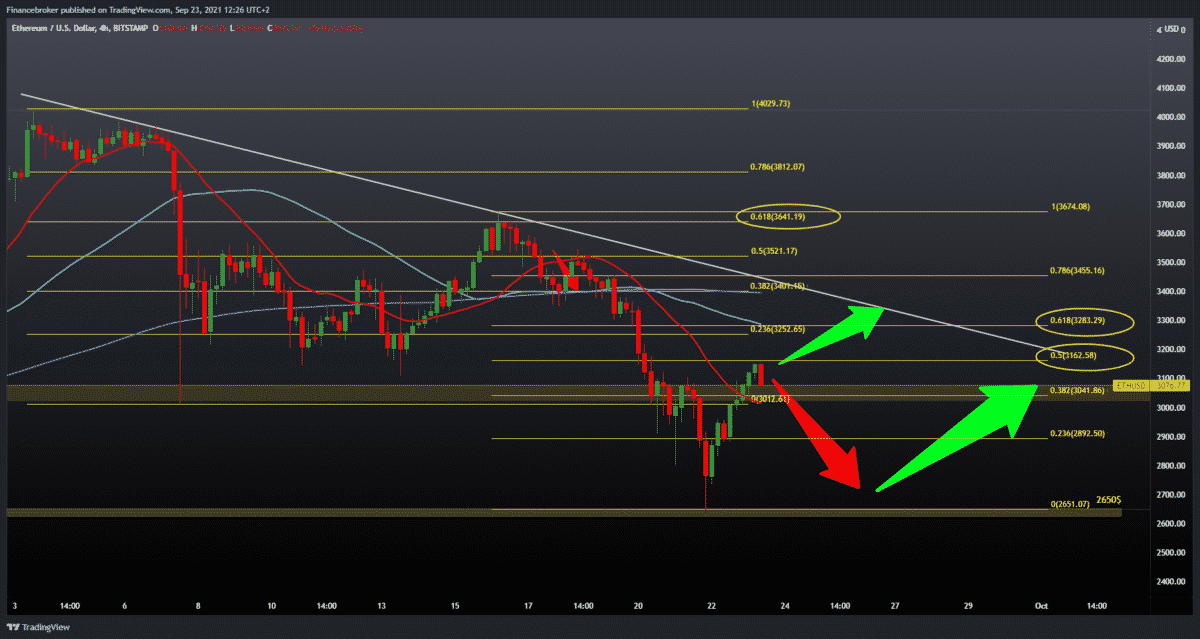

Ethereum chart analysis

Looking at the chart in a four-hour time frame, we see that the Ethereum price has managed to recover from yesterday’s $ 2650 to the current $ 3100. The price made a break above 38.2% Fibonacci level at $ 3040 and MA20 moving average, and our current resistance is at 50.0% Fibonacci level at $ 3160. We are entering a very important zone between 50.0% and 61.8% Fibonacci levels, the place of the previous price drop from the beginning of September. If we do not break that zone, there is a high probability that we will see a new price drop to the previous low, and maybe to the psychological level at 2500 $. If the price breaks that 50.0% -61.8% Fibonacci resistance zone, the MA200 moving average and the upper line of the resistance line are waiting above us. A further break above returns us again to a stronger bullish scenario.

.

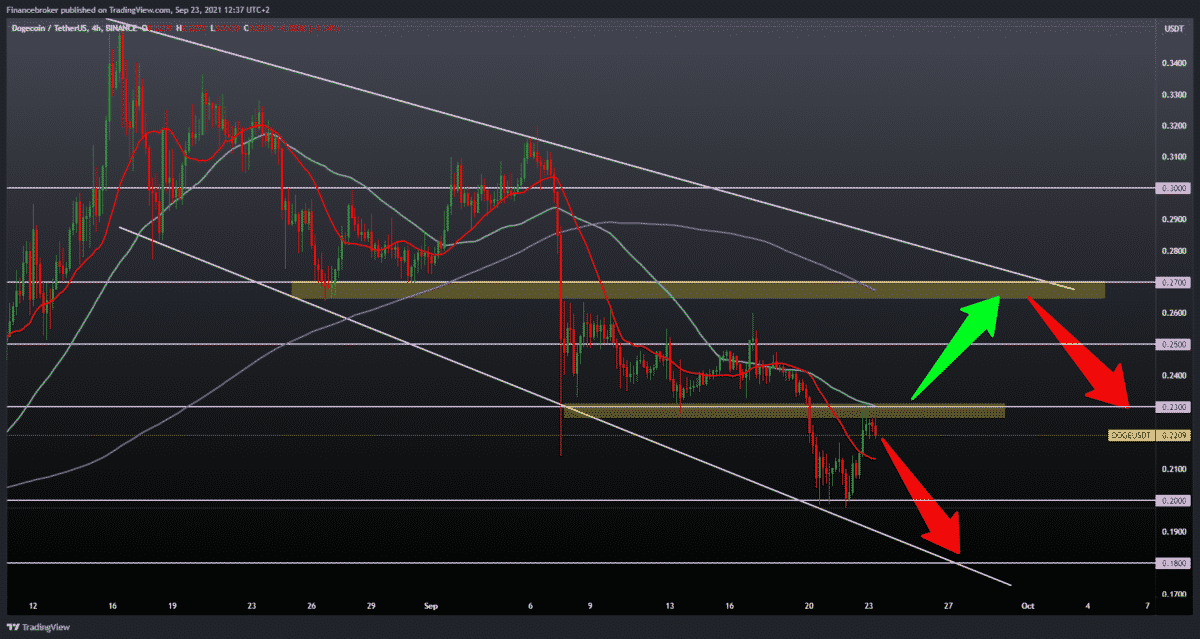

Dogecoin chart analysis

Looking at the chart on the four-hour time frame, we see that the price of Dogecoin, after yesterday’s fall to 0.19500, managed to climb to 0.23000 today. We currently have a resistance of 0.23000, and we need a break above to continue on the bullish side; for that, we need a new break above the MA50 moving average. The broader picture is that we are still moving in a large falling channel, with falling consolidation at the bottom line of this channel. For the bullish target on this time frame, our upper channel line and zone around the MA200 moving average is 0.26000-0.27000. For the bearish scenario, we need to continue the negative consolidation along the lower edge of the channel, with the goal of testing the previous low again at 0.19500 and then the next potential support on the chart.

Market overview

Ethereum’s network activity has jumped significantly since the beginning of this week due to the volatility of ETH prices. Whale Alert, a major platform for tracking blocks and crypto analytics, recently highlighted a $ 215 million transaction involving the transfer of 71,191 Ethereum from an unknown wallet.

The mentioned transfer was made on September 22. The crypto whale account moved 21,587 Ethereum from the Binance digital exchange to an unknown wallet in a separate transaction. Since London’s Hard Fork, the overall activity of whales in Ethereum has increased sharply.

Ethereum’s supply to exchange ratio has jumped recently, but the overall trend has remained negative. The latest data from Santiment show that some owners of ETH rejected the second-largest digital currency in the world during this week’s market instability.

During the recent downturn, there was an influx of ETH on exchanges, indicating that some people sold out during this downturn. Overall, ETH’s stock market offer continues the downward trend, which is good as it alleviates sales pressure. ETH’s daily active addresses have remained fairly active in the last six months, indicating that the network’s health is still strong.

Chinese real estate giant Evergrande has breathed a sigh of relief after the National Bank of China injected nearly $ 19 billion into the banking system yesterday in an attempt to save the debt of the indebted real estate giant. Evergrande has more than $ 300 billion in liabilities, making it the most indebted real estate company, and many believe its decline could lead to 2008 like a market crisis. Therefore, the rescue from China came as no big surprise to many Wall Street experts.

The fall of Evergrande and the possibility of default in the past week have led to the fall of the global market, including the crypto market. Bitcoin and Ethereum (lost vital support levels on Monday, but the rise of Evergrande helped the crypto market make some profits. The total market capitalization of cryptocurrencies rose to close to $ 2 trillion, gaining 7% in the last 24 hours.

-

Support

-

Platform

-

Spread

-

Trading Instrument