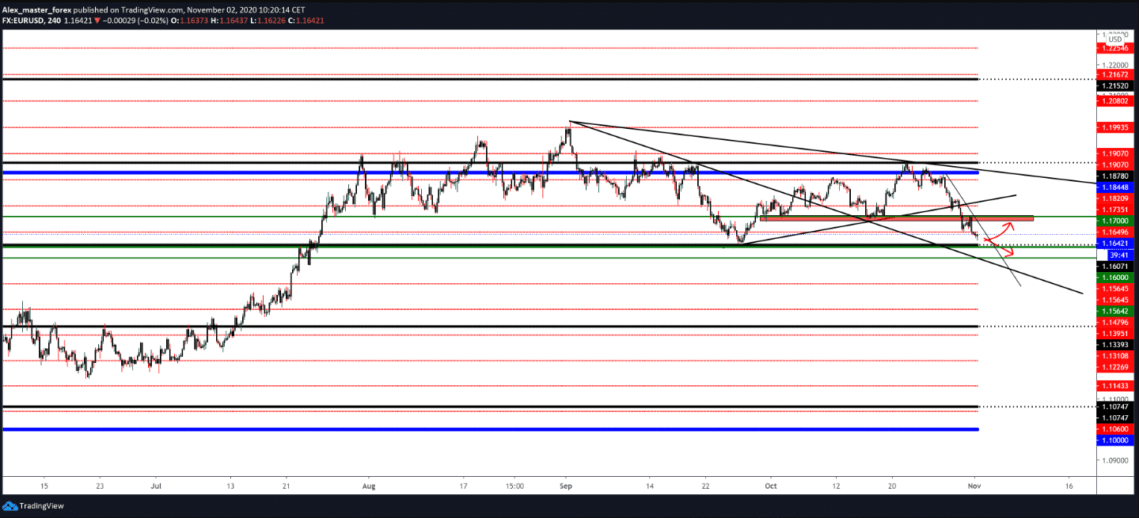

EUR/USD bearish scenario

Germany’s closure and the announcement by other European countries to do the same put pressure on the euro and push it down. On Thursday, the Spanish government decided to extend the emergency state for six months and allowed its regions to impose their restrictions.

As a result, some provinces have introduced night curfews and closed restaurants, bars, and cultural venues. From the news today, we have The Manufacturing Purchasing Managers’ Index from Europe and Britain, and America.

In general, whatever the reports were, and they were positive from all over Europe, the impact of COVID-19 is too significant on the global economy. The number of newly infected cases is only growing day by day.

The European Central Bank held a meeting on monetary policy on Thursday, October 29, and President Christine Lagarde said that although GDP data for the third quarter may surprise upwards, as it was, Q4 growth is down. This paved the way for additional incentives in December from the European Central Bank.

The end of the American race for president ends on Tuesday. Concerns that riots and civil unrest will escalate at that time and after the elections are growing amid the current heated mood that has divided the country.

Regardless of the election outcome, turmoil is expected in the financial markets with the risk they are likely to take. Later in the day, ISM Manufacturing PMI should show steady growth in the sector, with over 55 points. This issue is a hint of non-agricultural payrolls in a week that consists of the Federal Reserve’s rate decision.

The Fed’s report on the interest rate is waiting for us on Thursday, there are no indications that there will be changes, and it will probably remain at the same level of 0.25%.

On Friday, we have a report on Nonfarm Payrolls measures and The Unemployment Rate measures to be very turbulent for the US dollar this week.

-

Support

-

Platform

-

Spread

-

Trading Instrument