EUR/AUD forecast for November 30, 2020

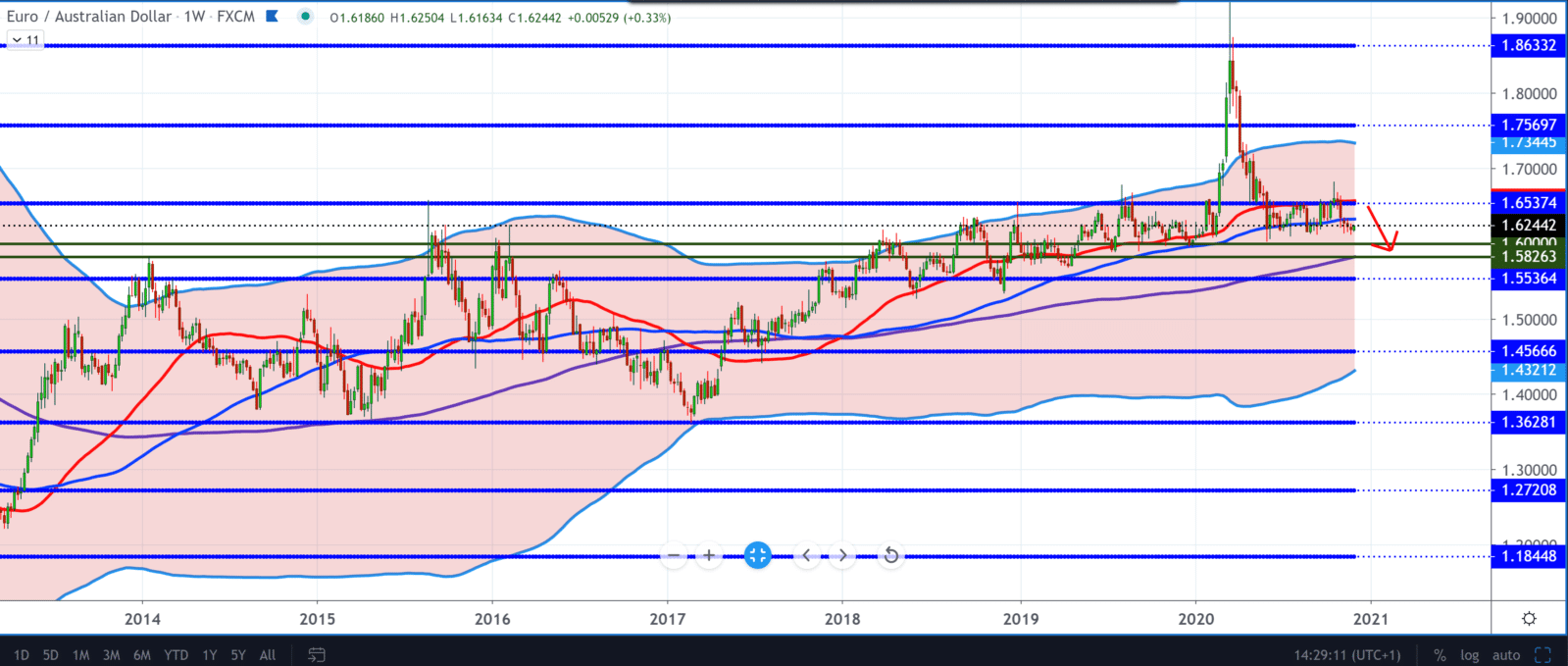

Looking at the EUR/AUD pair chart on the weekly time frame, we will see a big drop in the euro since the beginning of the year against the Australian dollar.

Following the moving sections, we will notice that the EUR/AUD pair has fallen below MA50 and now MA100. They are putting pressure on this pair and pushing it down towards 1.60000.

On the downside, as long-term support, it can be a moving average of the MA200 to 1.58000 currently.

Since mid-October, as Europe began to lockdown due to coronavirus, it has tested the level of 1.65000 and continued to decline towards lower levels. The advent of the vaccine has eased pressure on the euro but not to a significant extent. The continuation of the bearish scenario is more likely.

NZD/USD forecast for November 30, 2020

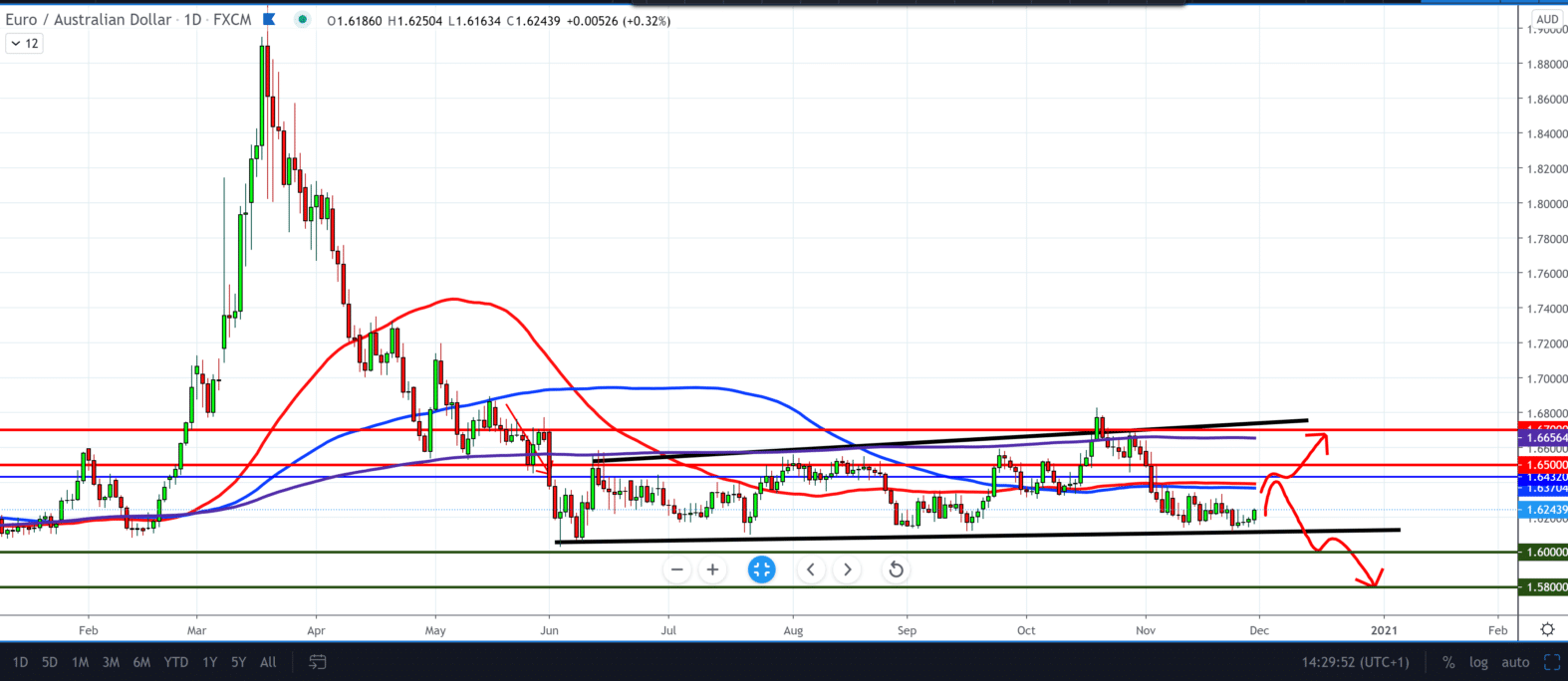

On the daily time frame, the picture is a bit different. The EUR/AUD pair has been consolidating for a long time in the range of 1.6000-1.6800 in the last seven months. Announcing the news that the vaccine was found in early November stabilized the euro and stopped the euro’s rapid decline, which is currently slightly above the bottom trend line. On the upper side, we have the resistance of moving averages MA50 and MA100, and we can expect EUR/AUD to rise again to MA at 1.63500-1.64000.

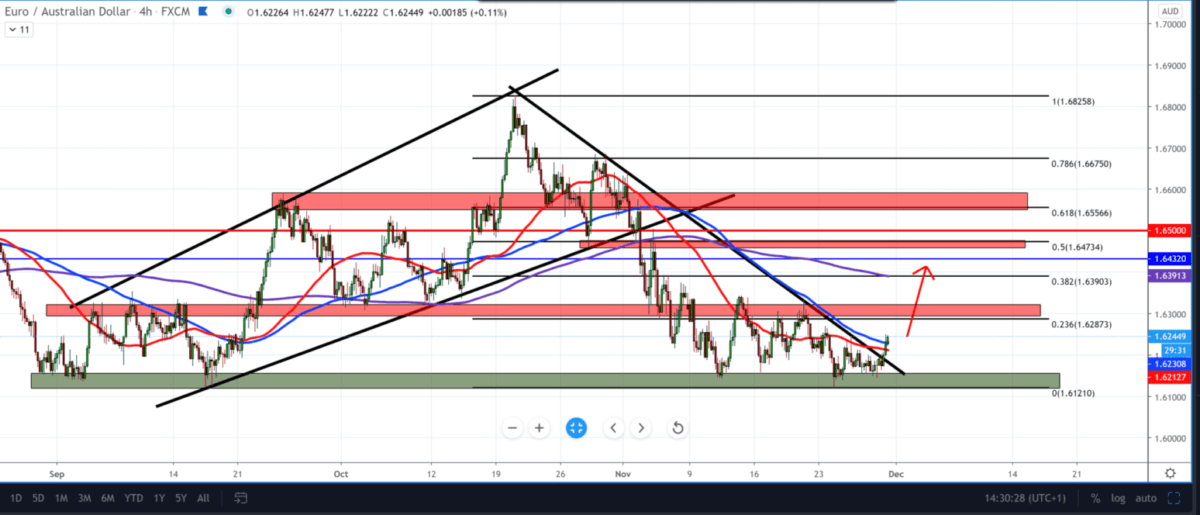

On the four-hour time frame, we have a break of moving averages MA50 and MA100, and that there is a probability that the EUR/AUDpair will climb to higher levels. When we adjust the Fibonacci levels, we see that the levels coincide with certain supports and resistance, bullish momentum on an H4 time frame with a target to Fibonacci level 38.2% and moving average MA200.

Higher psychological resistance is even above at 1.65000. There is a lot of economic news for both currencies this week. As early as tomorrow, we will have a meeting of the Reserve Bank of Australia on the change of the interest rate; according to the forecasts, it should stay at the same level. Also, we will have for AUD Retail sales and GDP for the third quarter.

For the euro, we will have the statements of the President of the European Central Bank, Christine Lagarde, today and tomorrow, as well as the European Consumer Price Index CPI for November. We can expect more volatility this week on this currency pair.

-

Support

-

Platform

-

Spread

-

Trading Instrument