Ethereum consolidation around 2500$

Ether’s futures premium went through the entire cycle, from the April euphoria jumping to the historic high of $ 4380 to the current level of $ 2500. This change shows how investor sentiment depends on performance over several weeks and has nothing to do with longer time frames.

By analyzing the difference in futures market prices and regular spot exchanges, traders better understand how price movements have affected professional traders.

The three-month futures trade trades with an annual premium of 8% to 15%, comparable to a stable interest rate loan. By delaying the settlement, the sellers demand a higher price, which causes a price difference. The net value locked in decentralized finance (DeFi) reached $ 50 billion, and analysts set a target of $ 10,000 for the end of the year. Bull growth was also spurred by the expectations of EIP-1559, which could lead to Ether burning faster than creating a new offer on the market.

On May 19, when Ether fell 45% to $ 1,870, the futures premium finally left its optimistic level and fell below 16%, but remained relatively stable at 17%, even as the price of Ether fell by 30% between 12 and 17 May. According to the data on the chart, most traders do not believe that the trend has reversed and have continued to trade with long positions despite liquidations of 2.8 billion dollars.

Ether futures finally ended the entire cycle, as the futures premium fell below 8% on May 21. We can note that this level was last seen in November 2020. For now, investors are unable to show bullishness due to a recent correction of 56% in the last 12 days. investors should have calmed down instead of blindly believing in short-term market indicators and sentiment.

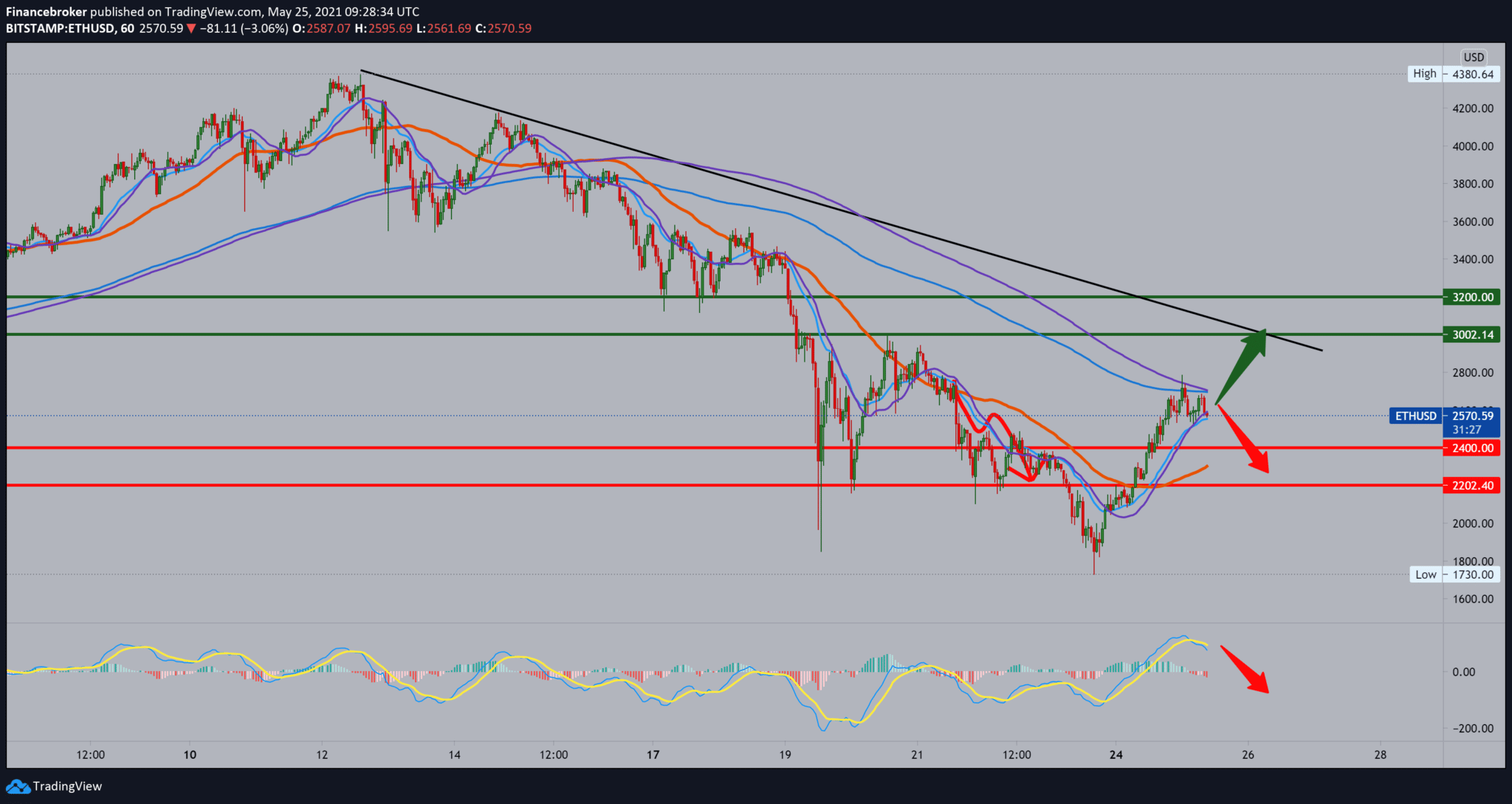

Our brief technical analysis is based on moving averages, and what we can notice is that the price, for now, has MA20 and EMA20 support, while we have resistance in MA200 and EMA200. And to continue towards $ 3000, we need a break above MA200 and EMA200. The opposite bearish signal gives us the MACD indicator showing us that the ETH is not yet ready to climb to higher levels on the chart

-

Support

-

Platform

-

Spread

-

Trading Instrument