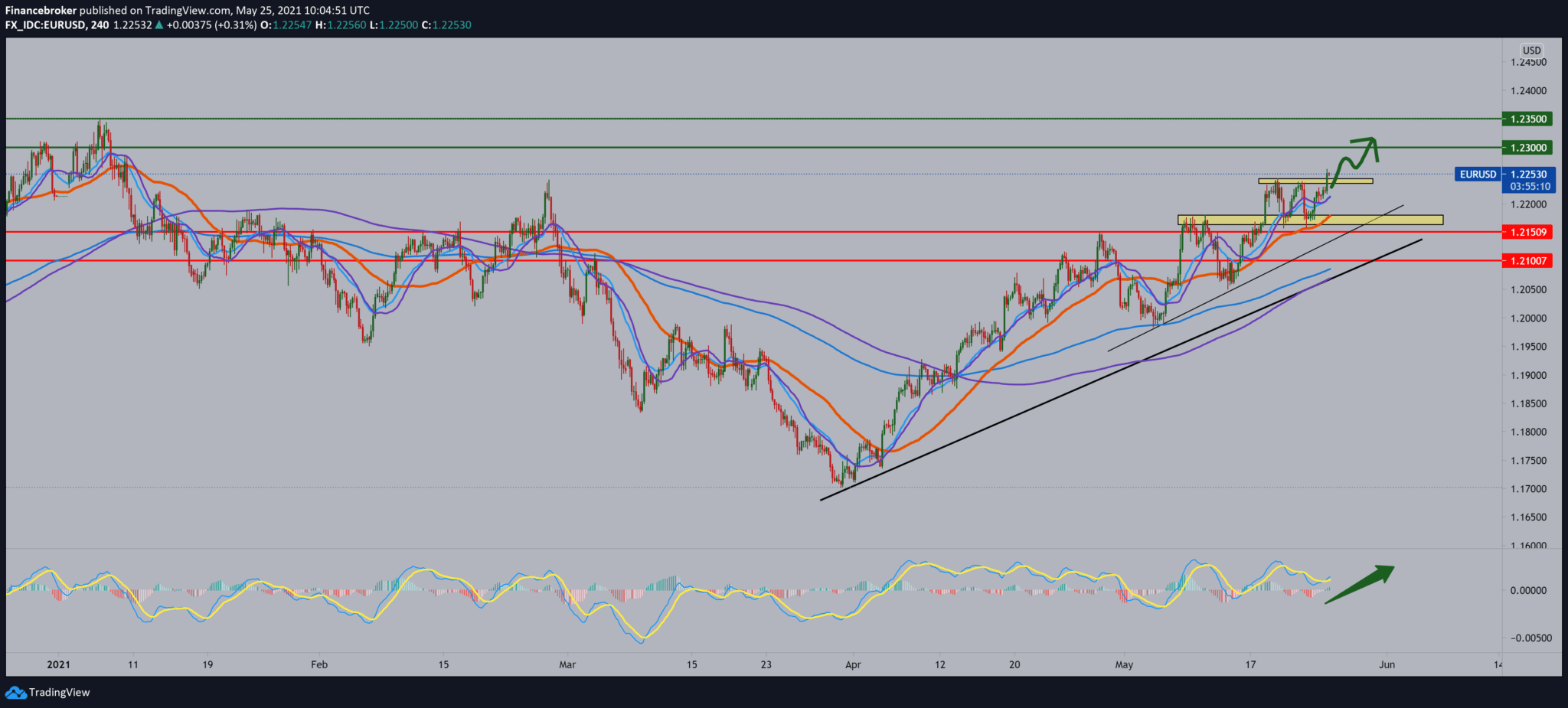

EUR/USD potential for a new high

The US dollar index fell to all multi-month lows, around 89.50, and was further pressured by the prolongation of the recent decline in the yield of US Treasury bonds. It is all successfully using the Euro climbing above the consolidation zone around 1.22000, and we are now at 1.22500, targeting 1.23000. According to a survey by the Ifo Institute on Tuesday, economic growth from Germany also helped this growth: German business sentiment improved more than expected in May. The business confidence index is jump to 99.2 in May from 96.6 in the previous month. The reading was also above the economists’ forecast of 98.2. The current conditions index reached 95.7 versus 94.2 in the previous month and an expected reading of 95.5. The expectation index rose to 102.9 from 99.2 a month ago. This was also better than the 101.4 forecasts.

Gross domestic product fell -1.8 percent in the first quarter, in contrast to the 0.5 percent growth seen in the fourth quarter. In the coming months, the view of transiently higher inflation seems to be gathering market participants, especially following the recent confirmation of this position by FOMC officials. FOMC L. Brainard suggested that the Fed has tools to return inflation to the central bank’s goal if consumer prices jeopardize the impact on long-term inflation expectations.

At the head of the Fed, KC Fed E. George assessed that any narrowing conversation is premature for now. In the US calendar today, the Conference Committee will announce its consumer confidence meter, which was awarded by the housing price index, the S&P Case-Shiller index, the sale of new houses, and the testimony of FOMC R. Quarles.

Following the chart on the four-hour time frame, we see strong growth since the beginning of April, and that for now, I have excellent support in moving averages from the bottom. It is evident that we will soon see the EUR/USD pair at 1.23000 because the dollar still does not show any signs of potential recovery. If a pullback occurs, we seek support at the 1.21500-1.22000 zone.

-

Support

-

Platform

-

Spread

-

Trading Instrument