Coverage Ratio Definition and Examples

A coverage ratio is a financial metric that assesses a company’s ability to cover its financial obligations or expenses using its income or cash flow. Investors, lenders, and analysts use it to evaluate a company’s solvency, financial health, and ability to meet its financial commitments. Coverage rate can vary depending on the specific financial obligations.

Understanding a Coverage Ratio

There are various forms of coverage ratios that can be used to identify companies that may be struggling financially. However, it is important to note that low ratios do not necessarily mean a company is in trouble.

These ratios are determined by multiple factors, and it is recommended to examine a company’s financial statements to determine its overall health. Some of the financial statement items that should be analyzed include net income, interest expense, outstanding debt, and total assets. To determine if a company is still viable, one should evaluate its liquidity and solvency ratios, which evaluate its ability to pay short-term debts by converting assets into cash. Taking a closer look at these ratios can provide a more accurate understanding of a company’s financial situation.

Investors have two ways of utilizing coverage ratios. Firstly, they can monitor changes in a company’s debt situation over time. If the debt-service coverage rate is close to being outside the acceptable range, it’s advisable to examine the company’s recent past. If the ratio is gradually decreasing, it’s likely that it will soon fall below the recommended level. Secondly, coverage rates are useful when comparing a company to its competitors. It’s essential to evaluate similar businesses since a coverage rate that appears acceptable in one industry may be deemed hazardous in another. If the company you’re analyzing appears out of sync with its major competitors, it’s typically a warning sign.

Here are three common types of coverage ratios:

- the interest coverage ratio,

- asset coverage rate

- debt coverage ratio

- The EBITDA-to-interest coverage rate.

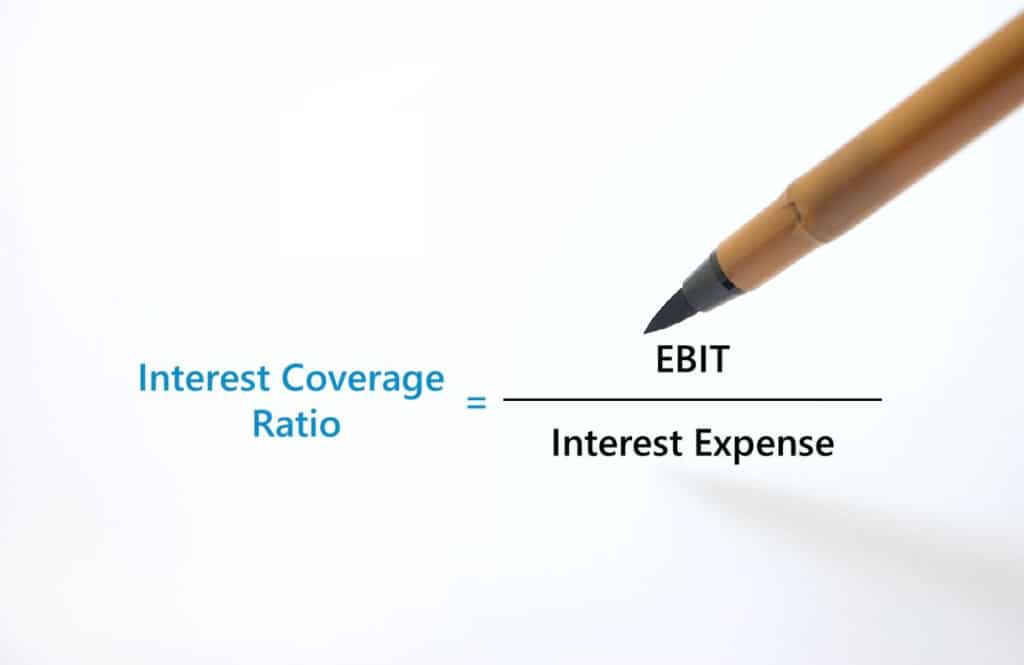

Interest Coverage Ratio

The interest coverage rate measures a company’s ability to meet its interest expenses with its operating income or earnings before interest and taxes (EBIT). It indicates how well a company can fulfill its interest payment obligations. The formula for calculating the interest coverage ratio is:

Interest Coverage Ratio = EBIT / Interest Expense

A higher interest coverage ratio indicates that the company has a larger margin of safety and can more easily cover its interest payments.

Debt Coverage Ratio

The debt service coverage ratio evaluates a company’s ability to service its debt, including principal and interest payments. It measures the cash flow available to cover debt obligations. The formula for calculating the debt service coverage ratio is:

Debt Service Coverage Ratio = Operating Income / Total Debt Service (Principal + Interest)

A debt service coverage rate above 1 indicates that the company generates sufficient cash flow to cover its debt obligations. A ratio below 1 suggests potential difficulty in meeting debt payments.

Earnings Coverage Rate: The earnings coverage rate assesses a company’s ability to cover its fixed charges, which include interest expenses, lease payments, and other fixed obligations. It provides a broader view of a company’s ability to meet all its fixed financial obligations. The formula for calculating the earnings coverage ratio is:

Earnings Coverage Ratio = (Net Income + Fixed Charges) / Fixed Charges

A higher earnings coverage rate signifies a stronger ability to cover fixed charges.

Coverage rates vary across industries and can be influenced by company-specific factors, such as the level of debt, revenue stability, and industry conditions. It’s important to consider the specific requirements and benchmarks applicable to the industry when interpreting coverage rates. Additionally, comparing a company’s coverage rate to its peers or industry averages can provide further insight into its financial position and performance.

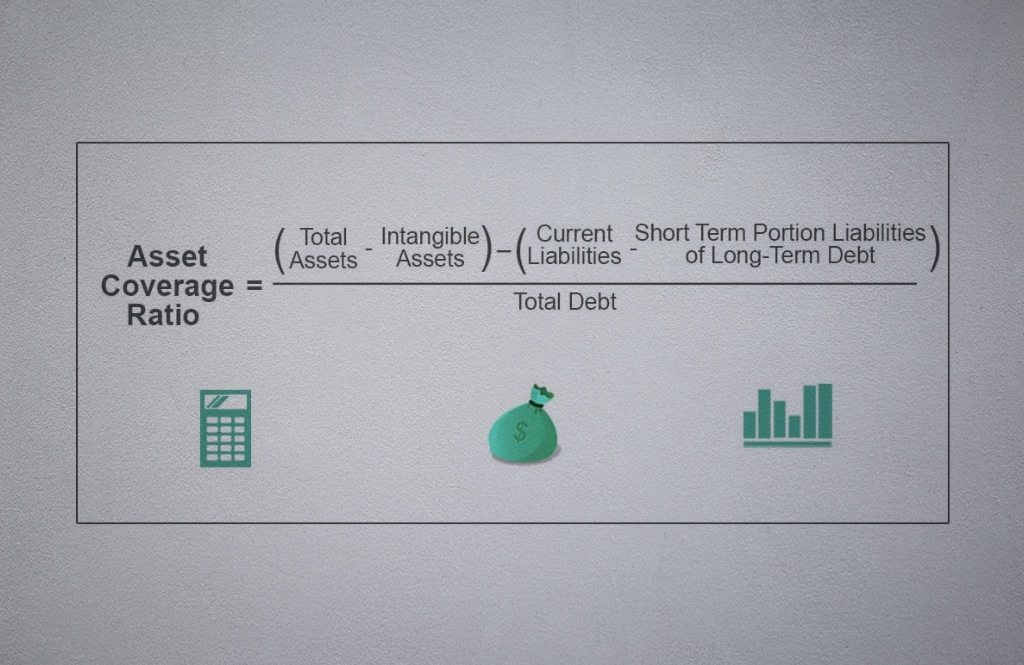

Asset coverage ratio

The asset coverage ratio is a financial metric that measures the extent to which a company’s assets can cover its long-term debt obligations. It provides an indication of the company’s ability to meet its debt obligations by assessing the value of its assets relative to its outstanding debt.

The asset coverage ratio is calculated by dividing the total value of a company’s tangible assets by its total long-term debt. Tangible assets typically include items such as property, plant, and equipment, inventory, and other physical assets.

The formula for calculating the asset coverage rate is as follows:

Asset Coverage Ratio = Total Tangible Assets / Total Long-Term Debt

A higher asset coverage rate indicates a greater ability of the company to repay its long-term debt using its tangible assets. It suggests a lower level of risk for lenders and investors since the company has more assets available to cover its debt obligations. On the other hand, a lower asset coverage rate implies a higher level of risk, as the company may have limited assets to rely on for debt repayment.

The asset coverage ratio is particularly relevant for creditors and bondholders who want assurance that a company has sufficient assets to support its debt payments. It helps assess the collateral available in case of default and the overall financial strength of the company. Lenders often have specific requirements for the minimum asset coverage rate they deem acceptable for extending credit.

It’s important to note that the asset coverage rate only considers tangible assets and does not account for intangible assets or future earnings potential. Therefore, it provides a limited view of the company’s overall financial health and should be used in conjunction with other financial ratios and analyses for a comprehensive assessment.

The EBITDA-to-interest coverage ratio

The EBITDA-to-interest coverage ratio is a financial metric used to assess a company’s ability to cover its interest expenses with its earnings before interest, taxes, depreciation, and amortization (EBITDA). It provides insight into the company’s ability to service its interest obligations using its operating income.

The EBITDA-to-interest coverage rate is calculated by dividing the EBITDA by the interest expenses. The formula is as follows:

EBITDA-to-Interest Coverage Ratio = EBITDA / Interest Expenses

Example of Coverage rate

Let’s examine the contrast in coverage ratios using Cedar Valley Brewing, a hypothetical company. This firm earns a quarterly profit of $200,000, with $300,000 in earnings before interest and taxes (EBIT), while its debt interest payments amount to $50,000. Cedar Valley Brewing borrowed most of its funds during a low-interest period, resulting in a highly favorable interest coverage rate.

Interest Coverage Ratio=$300,000$50,000=6.0

The debt-service coverage ratio reveals that the company pays a substantial sum of $140,000 toward the principal every quarter. With a resulting figure of 1.05, the company has very little margin for error if its sales unexpectedly decline.

DSCR=$200,000$190,000=1.05

DSCR=$190,000/$200,000=1.05

The company’s cash flow is positive, but considering debt-service coverage, it appears more hazardous from a debt standpoint.