Bitcoin testing new low at $ 40,000

We all now wonder if Musk, with his tweets, shattered the myth of the indestructible Bitcoin, removing it from the list as a means of payment for his Tesla cars. The question to which we also cannot give another answer is: What kind of currency is it when a tweet can destroy it? Does it make sense to invest in such a currency, in this case, Bitcoin?

The focus was on Tesla and its CEO Elon Musk. After taking the blame for the instability in recent days, Musk felt that his comments cost himself and his company more than most others. With a yield below $ 40,000, Bitcoin traded at almost the same price on Wednesday as the one at which Tesla bought $ 1.5 billion.

Bitcoin (BTC) futures on the CME stock exchange in Chicago slipped for a few days into a state that is sometimes observed in commodity markets where prices on almost monthly contracts exceed prices for further deliveries. The setback began late last week and continued until early Tuesday. The unusual situation could be an indicator that the current demand for cryptocurrency has exceeded the supply. Crypto analysts are not sure if the interpretation applies to bitcoins.

According to Investopedia, the decline is the result of “higher demand for the asset currently than contracts maturing in the coming months through the futures market.” However, this definition is more applicable to oil markets, where demand is a function of economic growth. The market often faces tighter supply conditions due to declining production or a sharp rise in economic activity. The concern among investors and traders is that we may see another crypto winter, and it may take a long time until the price of bitcoin recovers because the bull cycle may be over.

The realistic answer is that no one really knows what will happen next, and the only thing we know is that institutions continue to buy Bitcoin at every drop. Yesterday we saw the news of the company MicroStrategy, which bought Bitcoin for an additional 10 billion. As long as institutions continue to support bitcoin prices, it is unlikely that we will see a crypto winter.

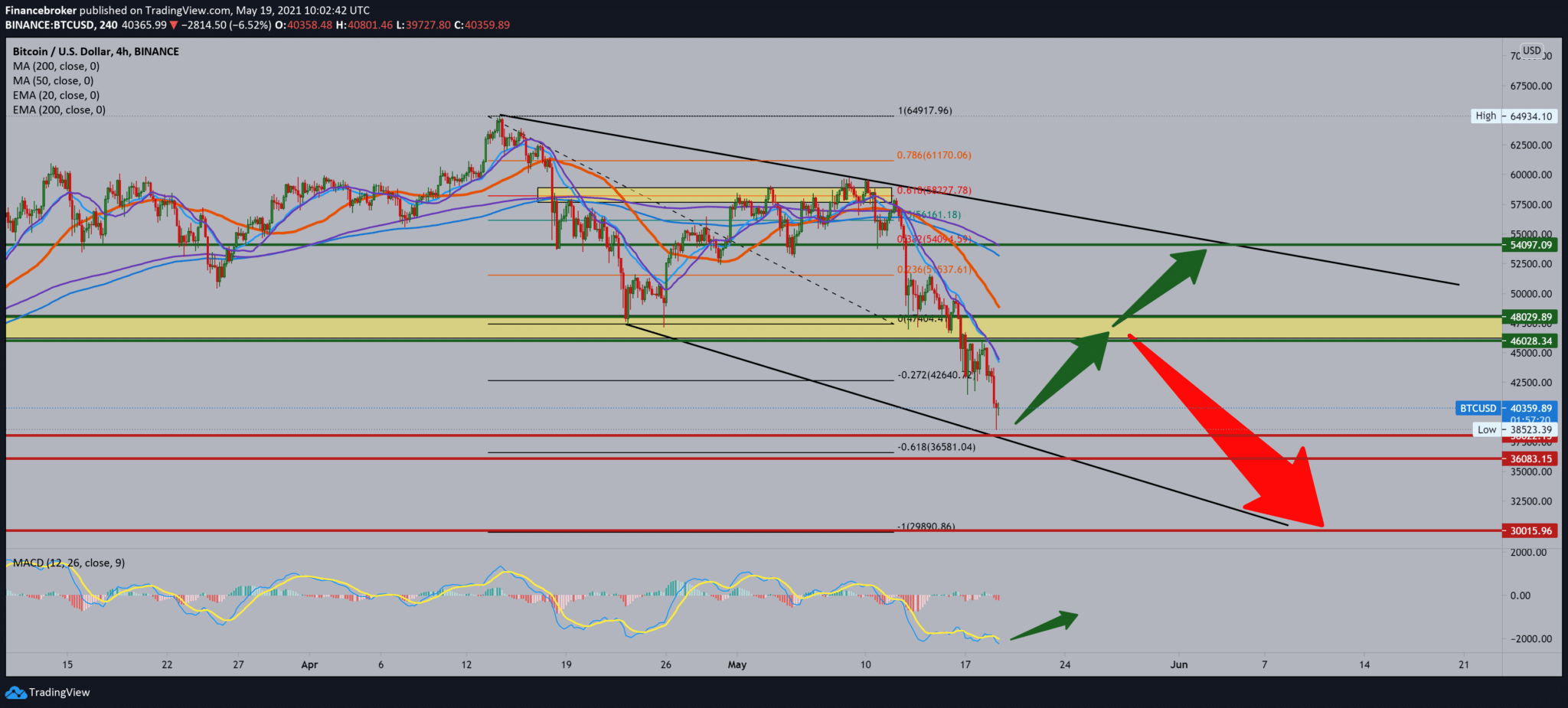

Looking at the chart on the four-hour time frame, we see that the fall in Bitcoin price has been very painful for buyers. The price is currently held in the zone around $ 40,000, with a smaller trend line at the bottom. Now we can expect some pullback that would at least mitigate this decline a bit. If a pullback happens, our target could be the $ 46000-48000 zone. Otherwise, we go down to $ 36,000. Looking at the MACD indicator, it is realistic to expect a smaller pullback upwards, thus creating a bullish signal.

-

Support

-

Platform

-

Spread

-

Trading Instrument