Bitcoin and Ethereum: Stumblin’ in

- The price of Bitcoin has stumbled once again.

- The price of Ethereum this morning failed to maintain the $1100 level, but we saw a steep drop to the $1000 level.

- Federal Reserve Chairman Jerome Powell reiterated the Fed’s commitment to raising interest rates to reduce inflation.

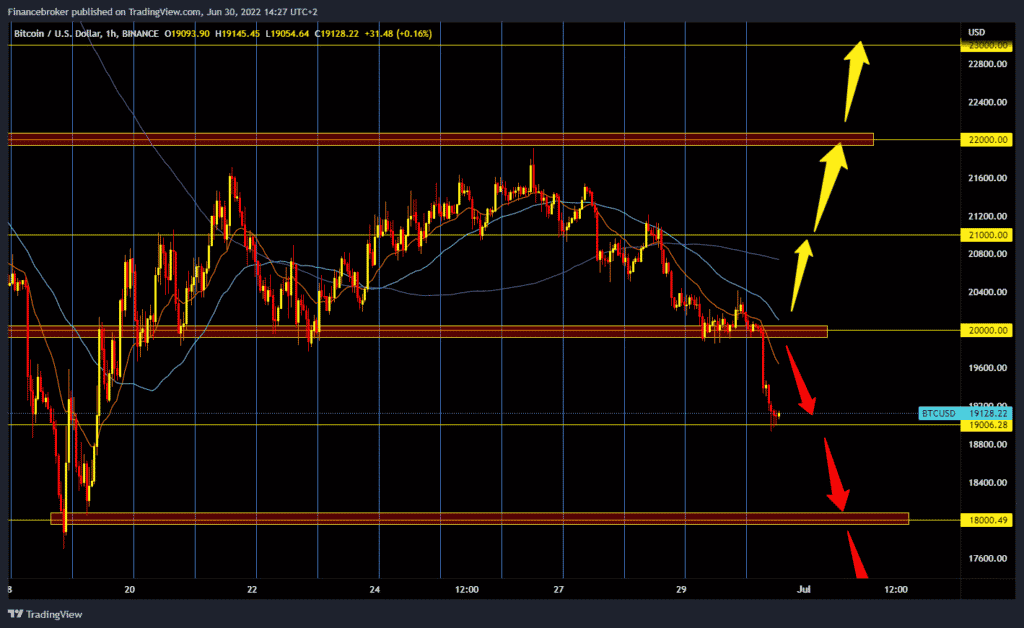

Bitcoin chart analysis

The price of Bitcoin has stumbled once again. It failed to hold above $20,000, and early this morning, we saw a break below and a drop to the $19,000 level. It looks like this bearish impulse is not over yet, and we could expect a continuation towards $18000 unless we find support here. The last time at the $18,000 level was on June 18, not so far away. For a bullish option, we need a positive consolidation that would take us up to the $20,000 level. Only after that could we hope for further price recovery. Potential higher targets are $20400 and $21000 levels.

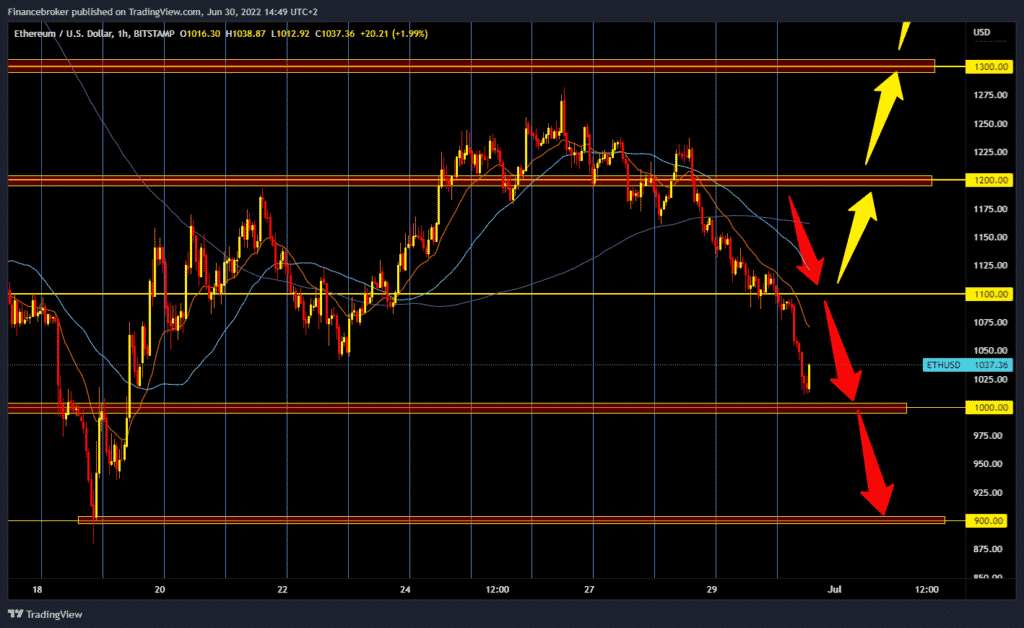

Ethereum chart analysis

The price of Ethereum this morning failed to maintain the $1100 level, but we saw a steep drop to the $1000 level. Currently, the price is managing to consolidate above the $1000 level, but it is still under a lot of pressure. It could very easily happen that we see a break below and a continuation of the decline to the $900 support zone of last week. We need a new positive consolidation and recovery to the $1100 zone for a bullish option. If we stay at that level, then we have a chance for a potential bullish continuation. Potential higher targets are $1150 and $1200, as well as last week’s high at the $1275 level.

Market overview

Federal Reserve Chairman Jerome Powell reiterated the Fed’s commitment to raising interest rates to reduce inflation. Speaking at the ECB meeting, he said he was more concerned about the challenge posed by inflation than the possibility of higher interest rates pushing the US economy into recession. Powell said the Fed must raise rates quickly, Reuters reported, adding that a gradual increase could lead consumers to feel that higher commodity prices will persist. Contagion risks within the crypto industry, such as the possible insolvency of crypto lenders and the implosion of prominent crypto fund Three Arrows, have further put downward pressure on assets that are otherwise intended as potential inflation hedges.