Market: Turning the Screws

S&P 500 duly paused yesterday but the (beyond very short-term) outlook remains as bearish as before. Bonds agree, but in the interests of real assets, I would have preferred to see stronger performance by miners and oil stocks. This suggests the next downleg in the stock market would affect precious metals and commodities as well. Some relative resilience (especially in gold) is there but won‘t be enough to change the neutral to bearish outlook in the least. As always in this tightening period (Treasuries keep the pressure and USD is rising), copper (with silver) are to suffer the most. Cryptos – that‘s the same story. It‘s only in oil where I expect the bulls to put up a good fight – the spike didn‘t happen yet, and once oil stocks decouple again from the general stock market, it would be easier. For today, I look for a strong day in the red across the board – good for open profits in stocks and cryptos.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

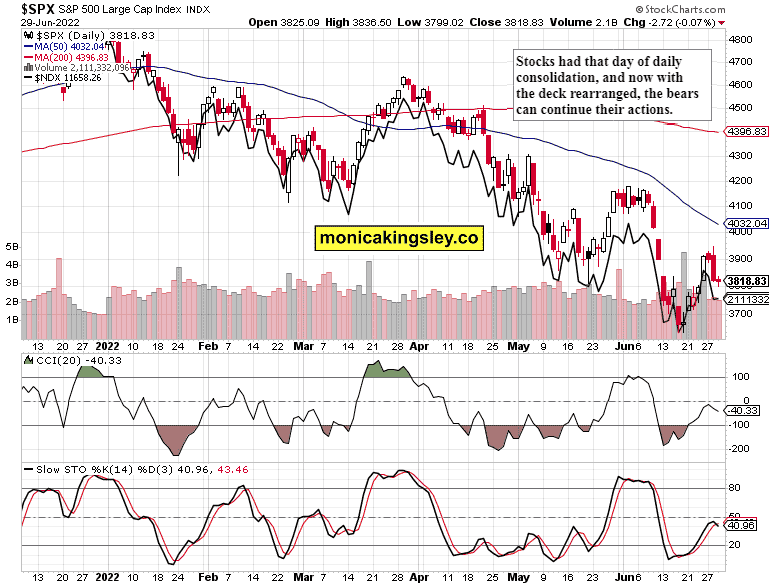

S&P 500 and Nasdaq Outlook

The caption says it all – S&P 500 is primed to decline some more, and unlike yesterday when I was looking for a little counter trend move first, today‘s expectations are of a day in red with insufficient buying into the close, creating a lower knot.

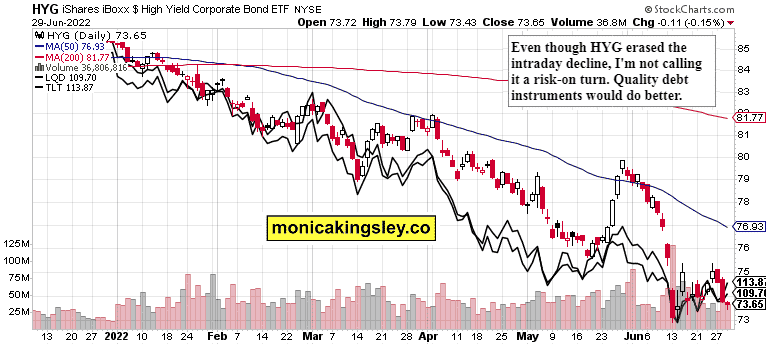

Credit Markets

Bonds are very risk-off, and the disconnect between quality debt instruments and junk bonds can be counted on to persist, even increase until stocks bottom.

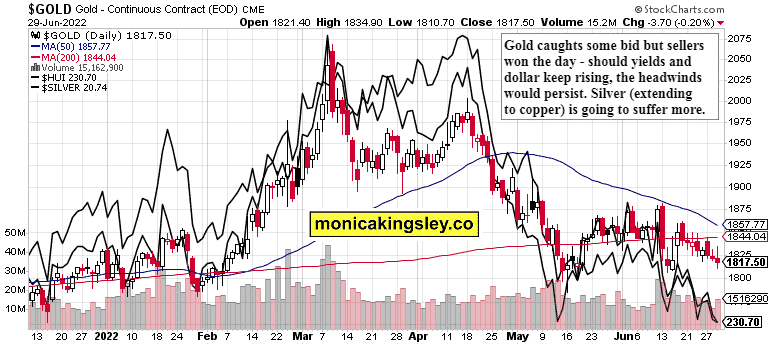

Gold and Silver

Precious metals haven‘t formed the bottom yet – miners keep acting weak, which is concerning. The prospects of two 75bp rate hikes are biting but if there‘s anything worth holding alongside paper and crypto shorts, it‘s namely gold and crude oil.

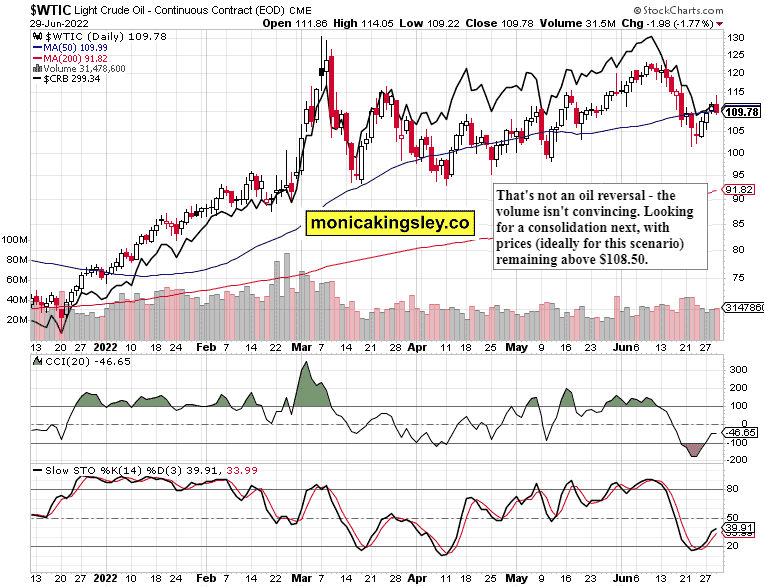

Crude Oil

Setback for a couple of days, that‘s the most likely conclusion. Another upleg is on the way unless we break convincingly below $108.50 – the most optimistic scenario is that the bulls keep defending it.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

www.monicakingsley.co

[email protected]

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.