Bitcoin and Ethereum: Great jump

- Bitcoin made a great jump over $ 32,000 yesterday.

- The price of Ethereum follows bitcoin in its bullish ecstasy, and this morning we had a jump to the $ 2,000 level.

- Argentina is becoming a more and more pro-Bitcoin country, turning to BTC to protect itself from inflation.

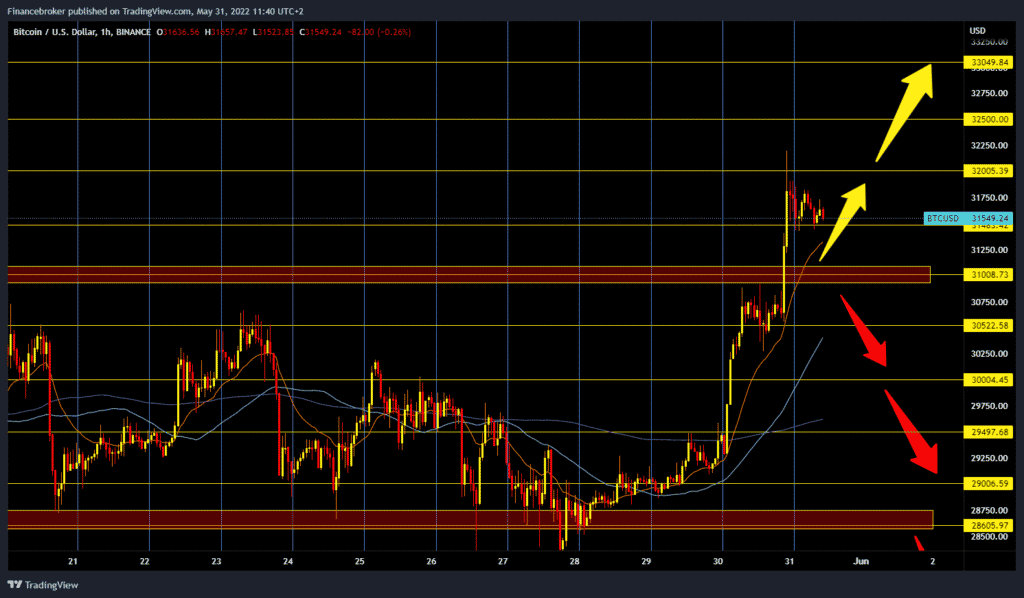

Bitcoin chart analysis

Bitcoin made a great jump over $ 32,000 yesterday. The price consolidated around $ 30,750 for a long time during the middle of yesterday, and it seemed that it would not hold on to that level. Opinions were that we would see a new pullback to the support zone at $ 29,000. In contrast, there was a jump in prices to $ 32,200. Withdrawal soon followed, and we are now consolidating above $ 31,500.

For the bullish option, we need to continue the positive consolidation and keep the price above the $ 31,000 price. That price was an obstacle to our bullish attempts in the previous period. Now the price could advance to $ 32,500 and a $ 33,000 level. For the bearish option, we need a negative consolidation and a pullback of up to a $ 31,000 support zone. A break below would bring us back to the May range of $ 29,000-31,000.

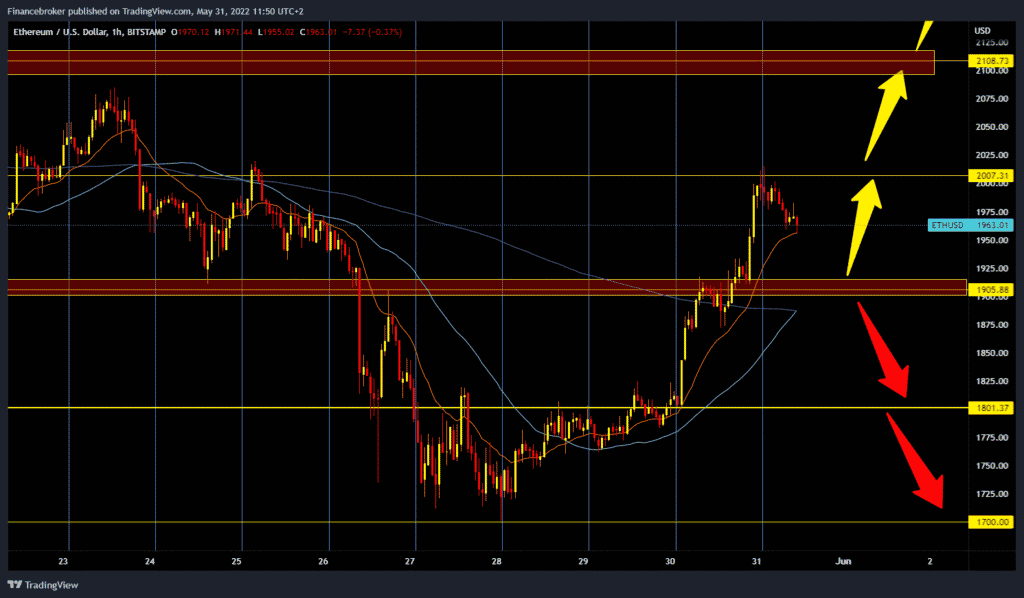

Ethereum chart analysis

The price of Ethereum follows bitcoin in its bullish ecstasy, and this morning we had a jump to the $ 2,000 level. Soon after that, the price made a new pullback and dropped to the current 1965 dollars. We may see a retest of the lower support at $ 1,900. If the price of Ethereum declines above, then it could make a longer bullish boost to the $ 2100 zone. And if we see a break below this support zone, we target a $ 1,800 level. It all depends on the way of consolidation that will take place in the $ 1900 zone.

Market overview

Argentina is becoming a more and more pro-Bitcoin country, turning to BTC to protect itself from inflation. Argentina is in a constant war against inflation in its country. The Argentine peso is declining, which negatively affects the purchasing power of citizens. The fall in the peso was caused by a lack of confidence in the central bank and excessive government spending.

Data on the chain, hints of technical analysis and macroeconomic trends are turning in favor of the bull price of bitcoin. Argentina relies heavily on Bitcoin to fight inflation and the depreciation of the Argentine peso. Long-term bitcoin owners have accumulated funds through a recent drop below $ 30,000. The data on the chain predicts the accumulation of bitcoin and the bullish outlook of investors on BTC.

The report predicts that investing in bitcoin will remain synonymous with volatility and continue to lure investors in Argentina and Latin America, as BTC remains a hedge against inflation.

Ki Yang Yu, CEO of CryptoQuant.com, believes that it is evident that Bitcoin is in the accumulation phase. In a recent downturn, the CEO of CryptoQuant noted that institutional investors who launched the bull bitcoin race in 2021 bought BTC in the range of $ 25,000 to $ 30,000.