Gold and Silver prices retreat

- During the Asian session, the price of gold was in retreat and stopped at 1845 dollars.

- The price of silver is in retreat for the third day in a row after it formed a two-week higher high on Friday at $ 22.48.

- The precious metal weakened sharply after the US dollar index showed a stronger response from market participants to the hawk’s comment from the Federal Reserve.

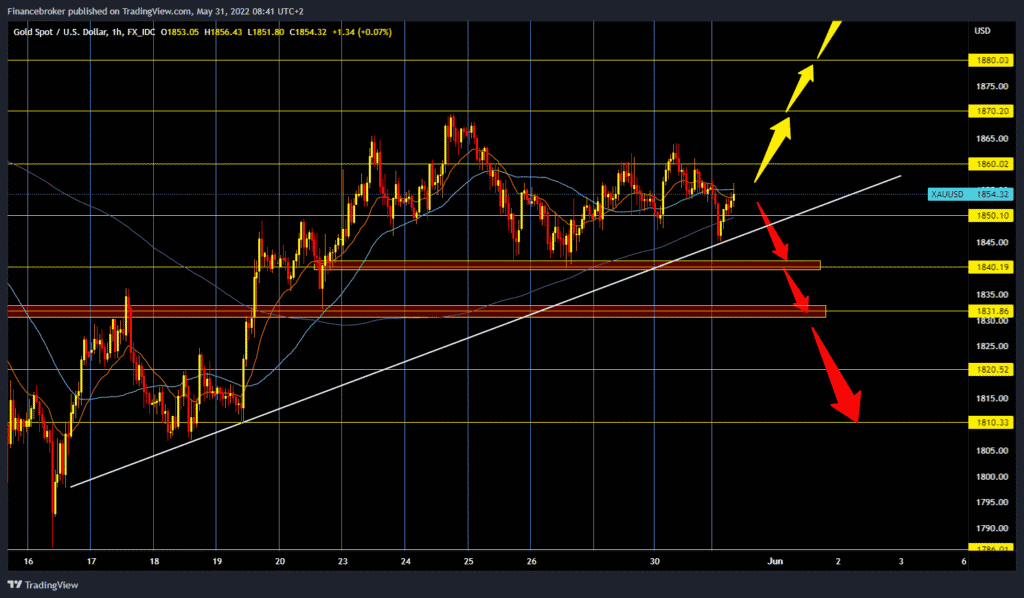

Gold chart analysis

During the Asian session, the price of gold was in retreat and stopped at 1845 dollars. At that place, the gold found support and quickly returned above 1850 dollars. New European sanctions on Russian oil have further shaken world stock markets, and this has resulted in redirecting investors’ funds to safer havens such as gold metal. The current price of gold is already at 1855 dollars, and it could soon test the $ 1860 level again. A price break above this resistance zone could take us to test last week’s high at $ 1,870. The potential next targets above are $ 1880 and $ 1890. For the bearish option, we need a negative consolidation and a new price withdrawal below $ 1,850. After that, our target zone is at $ 1840 and the price break below the bottom line of support. Potential next lower targets are $ 1830, $ 1820 and $ 1810 levels.

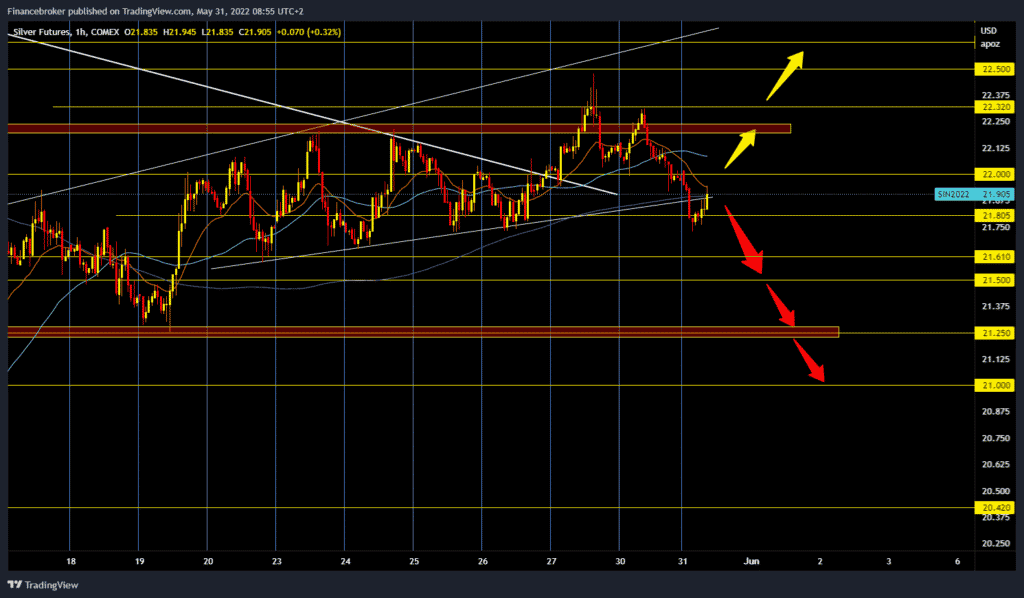

Silver chart analysis

The price of silver is in retreat for the third day in a row after it formed a two-week higher high on Friday at $ 22.48. Since then, the price of silver has been in decline. During this morning’s Asian session, the price dropped to $ 21.72. After that, we have instant recovery of up to $ 21.90. We now need to monitor whether the price will form a new higher high compared to the previous one at $ 22.32 or will form a lower high on the chart. That would be a sign for us to continue retreating to lower levels of support. Potential next bearish targets are $ 21.60, $ 21.50 and $ 21.25 level. We must first return above the $ 22.00 price for the bullish option. With the continuation of bullish consolidation, the price could try again to climb to the previous high at $ 22.32 and then test last week’s high at $ 2.48.

Market overview

Stronger dollar index and NFP report

The precious metal weakened sharply after the US dollar index showed a stronger response from market participants to the hawk’s comment from the Federal Reserve. Fed Governor Christopher Waller supported uncertainty in the domain of the exchange rate after he dictated an extremely hawkish comment, which should be above the investment community’s expectations. Advocating is for increased interest rates by 0.50% by the Fed until inflation is significantly reduced at an appropriate level.

When it comes to the dollar, the US dollar index oscillates around 101.60 while investors wait for payrolls for the NFP in the US. Investors expect the issuance of the US NFP of 320,000 compared to the previous report of 428,000.