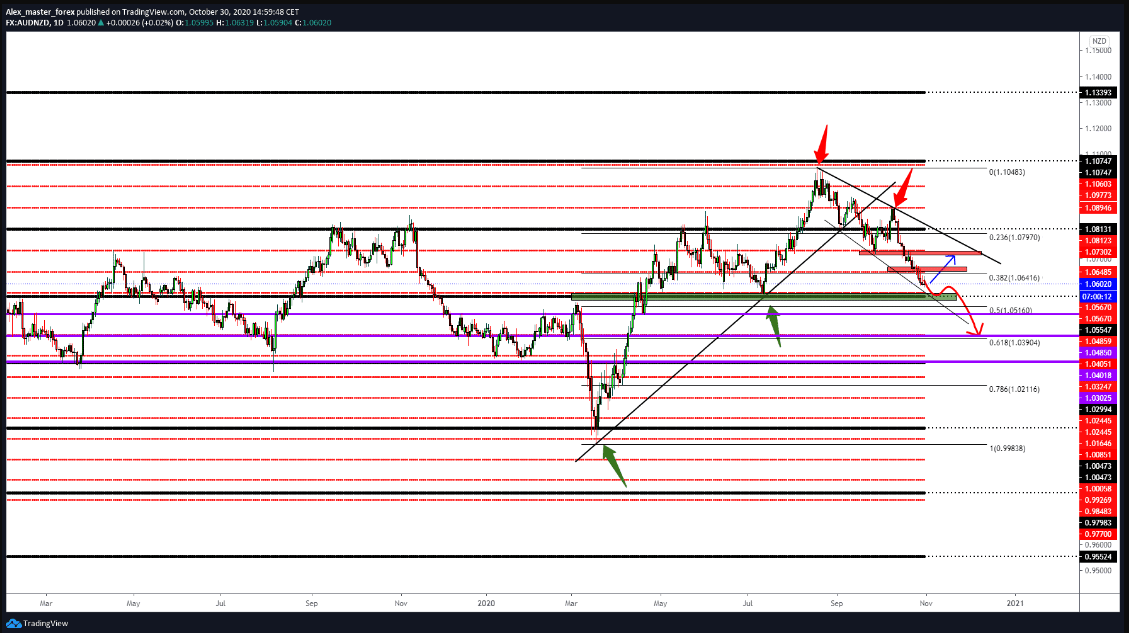

AUD/NZD support around 1.05500-1.05700

If AUD / NZD falls below 1.05500, the next support below is at 1.04850. It may open and target at 1.04000. The cross AUD/NZD represents two almost identical Australasian currencies, which are often traded similarly to other currencies due to their geographical locations and high rollover rates.

Therefore, the cross moves with real changes in local economies and is not affected by strong risk trends or global factors.

Exports of goods represent a significant segment of both economies with Australia, which supplies energy products and ferrous metals. At the same time, New Zealand is better known for exporting wool, meat, and milk. Next week will be full of economic news from both Australia and New Zealand.

The Reserve Bank of Australia has a report on the change in the interest rate on Tuesday. According to the forecasts, it should reduce its interest rate by 15 points to 0.10%, which will be the historical minimum. This decision of the RBA will weaken the Australian dollar.

We will have important news from New Zealand, Employment Change measures, The Unemployment Rate measures, and Inflation Expectations measures on Wednesday. For AUD on Wednesday, we have the Retail Sales measure.

A very turbulent week for both currencies. In general, if the RBA reduces the interest rate, we can expect the RBNZ to make the same interest rate reduction at the next meeting on November 11, without any announcement, to match the Australian dollar.

Both currencies are risky and not so attractive to investors during this Coronavirus crisis. Even if there are global locks, the state will gain strength in CHF, JPY, and USD, while other currencies are in the background. Coronavirus updates (number of cases, incentives, lock, vaccine) will continue to affect intra-weekly high-yield currency trends.

-

Support

-

Platform

-

Spread

-

Trading Instrument