XRP’s Skyrocketing Potential: Unlimited Heights or Just Hype?

Recently, XRP clinched consecutive legal victories, positioning it as an investor’s darling in the crypto arena. As the sole regulated asset in the crypto sphere, its appeal is undeniable. Ethereum’s early advisor and XRP enthusiast, Steven Nerayoff, painted a rosy picture for XRP’s trajectory.

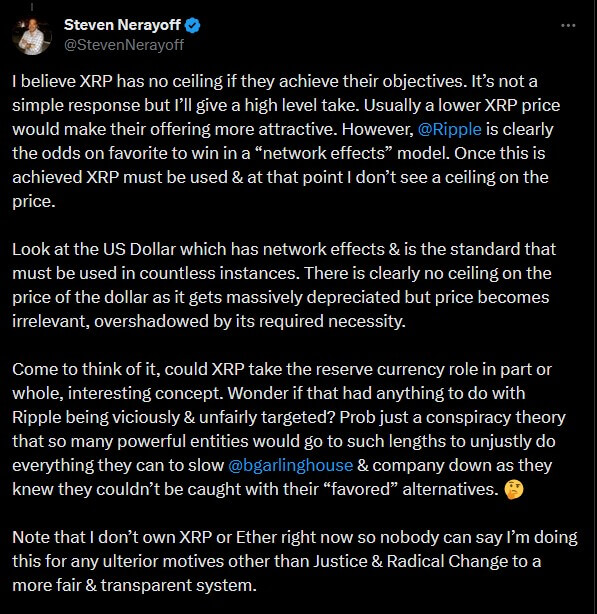

During a discussion, when quizzed about XRP possibly hitting benchmarks like $10 or even a staggering $100, Nerayoff shared an intriguing viewpoint. He postulates that XRP’s price trajectory might just be limitless, given the right circumstances. So, what’s the formula for this possible explosion?

Could XRP Surge by a Whopping 1,000%?

Nerayoff’s confidence in XRP’s prospective heights is rooted in the cryptocurrency’s fluid potential. He emphasizes that as XRP continues to evolve, particularly in international payments, its value could scale unimaginably. This potential surge relies heavily on the “network effects” phenomenon, where XRP’s mass adoption could trigger a mammoth demand surge.

Highlighting Ripple’s pivotal role, Nerayoff asserts that Ripple’s current strategic alignment is primed to usher in the early adoption phase, propelling XRP’s demand. With XRP becoming a cornerstone of Ripple’s framework, he believes that the idea of a capped price might become obsolete. Drawing parallels to the US Dollar, which despite its incremental devaluation retains its crucial global financial role, he remarked, “I believe XRP has no ceiling if they achieve their objectives. It’s not a simple response but I’ll give a high level take.“

Elaborating further, Nerayoff envisions XRP evolving into a reserve currency. He even speculates that the intense scrutiny Ripple faces from powerful quarters might be linked to the disruptive potential XRP presents to traditional financial systems.

Is this Surge Just Pie in the Sky?

The recent uptick in XRP’s price has spurred audacious predictions. While Oaksacorn anticipates a meteoric rise to $43 drawing parallels with 2015-2017 market cycles, EGRAG CRYPTO believes XRP’s legal triumphs might catapult it to $27. However, the most eyebrow-raising projection is Shannon Thorp’s: a whopping $500 for XRP. For context, this would mean a market cap of $250 trillion, dwarfing the industry’s current value. Remember, this speculation is set against the backdrop of Bitcoin’s $70,000 peak in 2021 with its $3 trillion market cap.

But Wait, Is a Storm Brewing for XRP?

The legal tussle between Ripple and the U.S. Securities and Exchange Commission (SEC) has taken another twist. The SEC has tabled a hefty $770 million settlement proposal against Ripple. Anchored in claims that Ripple sidestepped Federal Securities Laws during its XRP institutional sales, this development introduces yet another layer of drama to their ongoing legal saga.