Why did Stock market give up promising opening gains?

Stocks and credit markets gave up promising opening gains, and it was only commodities that had a really good day. It seems like the beneficiary of inflation would be indeed real assets, as I had been harping about so often, and that the S&P 500 is starting to run into headwinds. Not on account of taper expectations, which appear to have been indeed pushed to the Nov-Dec time window, but thanks to inflation. Whenever you start seeing heavyweights roll over to the downside, it‘s time to pay attention.

Yes, enter tech behemoths – worthwhile to watch. Stagflation would be a powerful environment to facilitate stock market declines – who could forget the 1974-5 slump? Real assets stand positioned to reap the rewards as the cost-push inflation that I‘ve discussed since early this year is very much intact. Throw in some serious supply chain disruptions that won‘t be resolved this year. All you end up with is waiting for precious metals to catch up in the commodities appreciation – bringing in very nice profits in oil and copper… My total portfolio performance chart is at a fresh high!

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

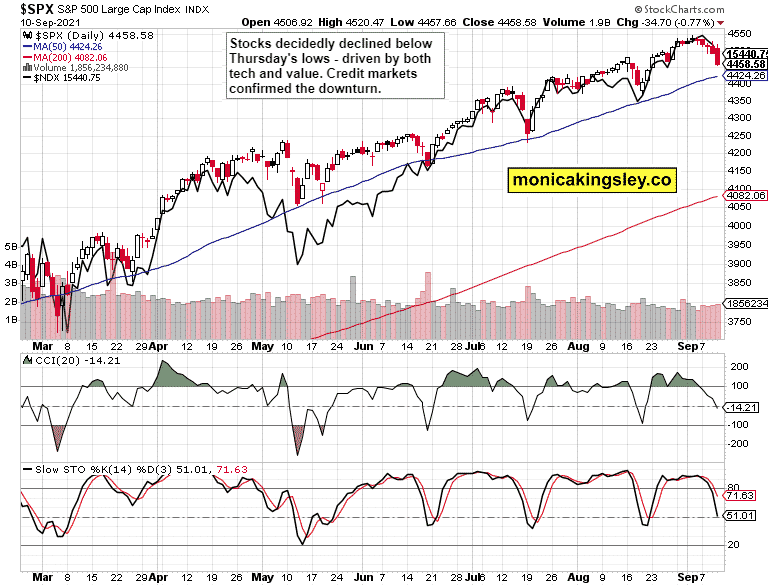

S&P 500 and Nasdaq Outlook

Bears took the opportunity and managed to close quite a few opening gaps on Friday. Would the 50-day moving average again cushion the downswing?

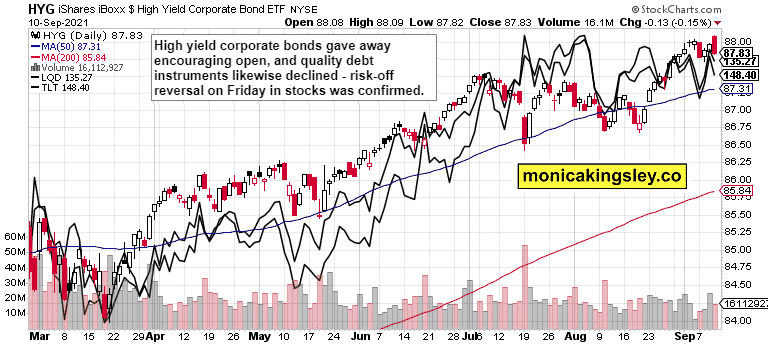

Credit Markets

The credit market turned sharply lower, and the only encouraging sign is the lack of volume compared to the prior upswing.

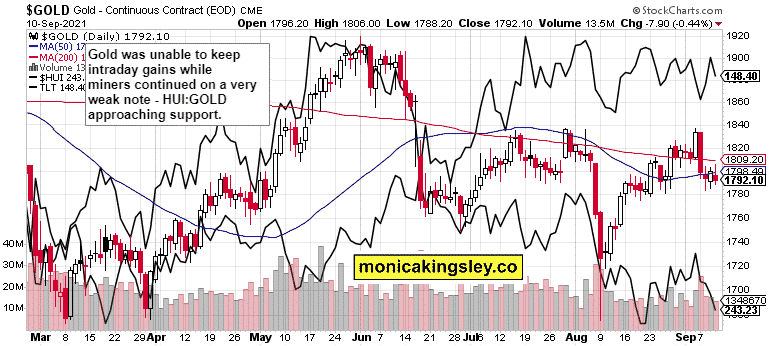

Gold, Silver, and Miners

Gold and silver are stable in the very short run and can still surprise on the upside. However bleak the miners to gold ratio looks like, precious metals are approaching Sep FOMC disappointment as the Fed won‘t taper then – and that equals celebrations in the metals. Meanwhile, inflation keeps biting, and real rates are going ever more negative.

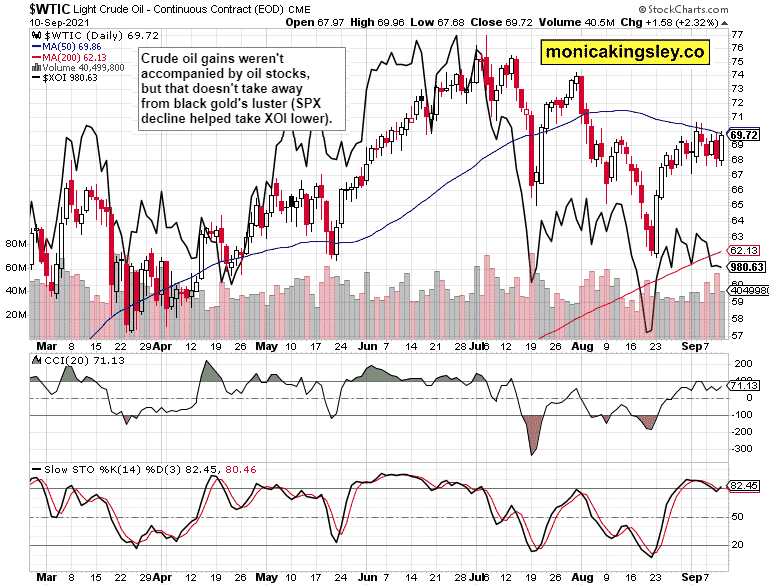

Crude Oil

Crude oil predictably rose, erasing the poor U.S. inventories‘ effect. Oil stocks performance is actually reasonably strong given the broad stock market slide – black gold can keep on surprising on the upside.

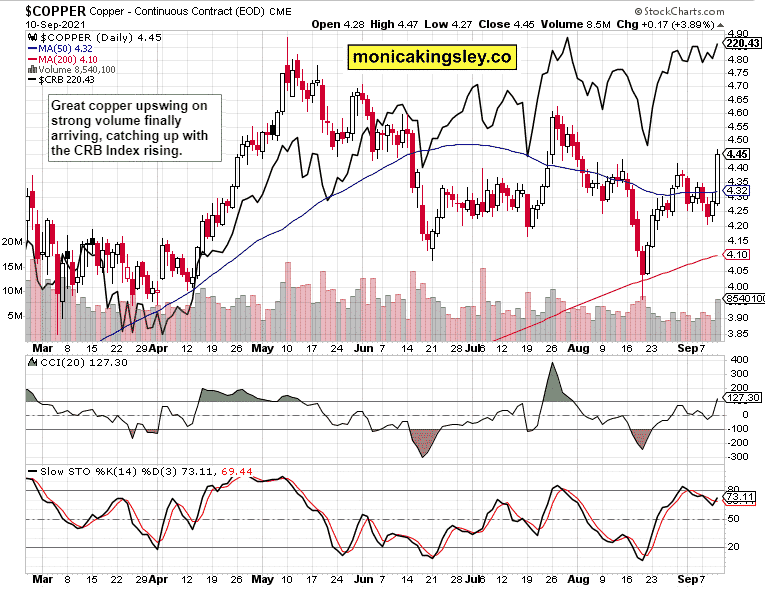

Copper

Copper played strong to catch up to the CRB Index and on heavy volume. This is as bullish short-term as it gets.

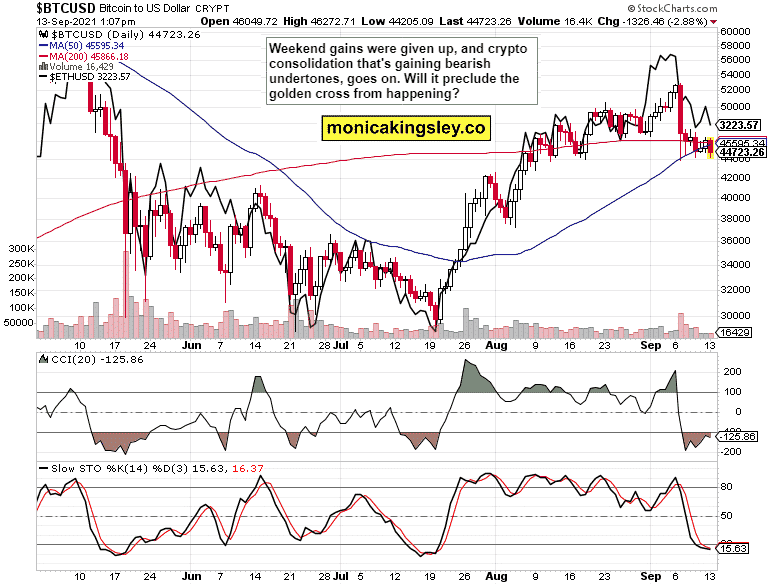

Bitcoin and Ethereum

Bitcoin and Ethereum downswing is approaching juncture – will it break below the Sep lows? The 44,000 level is once again key, but I‘m looking for any bearish move to be invalidated and for the golden cross to happen.

Summary

Risk-on was, in the end, selective on Friday, with real assets outperforming paper ones strongly. Such a dynamic is likely to carry over to the week just starting as a crucial test awaits S&P 500 – and it appears the stock market dip would be bought once again.

Thank you for reading today‘s free analysis, which is available in full at my home site. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals, and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

www.monicakingsley.co

[email protected]

* * * * *

All essays, research, and information represent analyses and opinions of Monica Kingsley that are based on availability and the latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks, and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading, and speculating in financial markets may involve a high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

-

Support

-

Platform

-

Spread

-

Trading Instrument