What Is a Bearish Engulfing Candle – All Details

A bearish engulfing candle pattern is a significant and widely recognized technical analysis tool used by traders and investors in the financial markets, particularly in the context of stock trading and foreign exchange (Forex) markets.

What is a bearish engulfing candle?

This pattern is essential for understanding market sentiment, making informed trading decisions, and managing risk effectively. In this comprehensive guide, we will delve deep into the bearish engulfing candle, exploring its definition, purpose, formation, interpretation, and its significance in trading strategies.

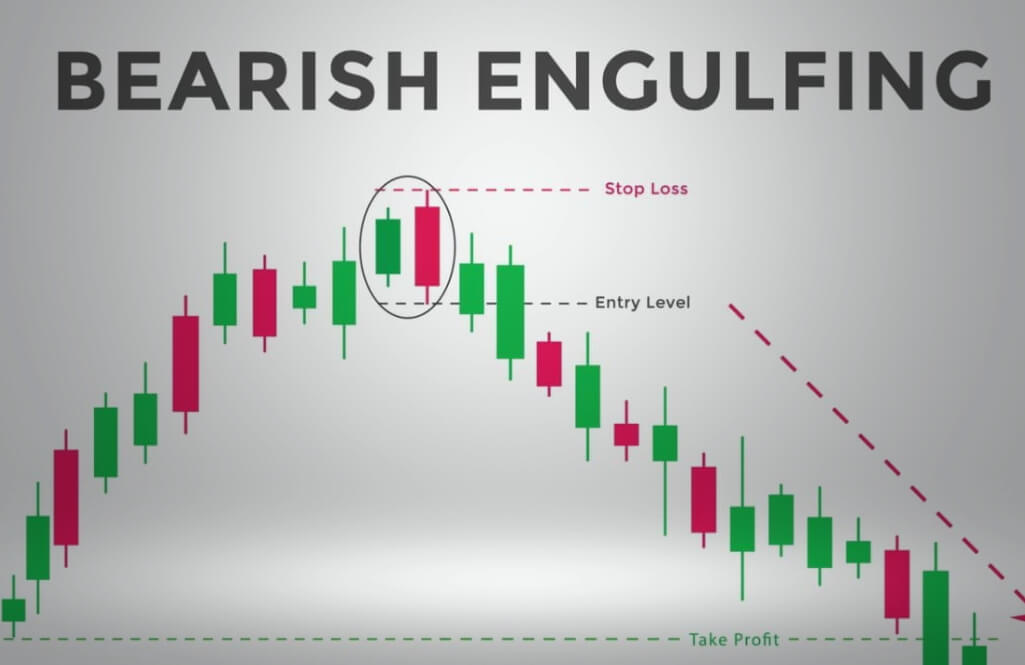

A bearish engulfing candle pattern occurs when a bearish (downward) candle completely engulfs the preceding bullish (upward) candle. In simpler terms, the body of the bearish candle completely covers or “engulfs” the body of the preceding bullish candle.

This reversal pattern suggests a shift in market sentiment from bullishness to bearishness and often signals a potential trend reversal or a downward price movement.

Key characteristics of a bearish engulfing candle pattern:

Two candles: This pattern consists of two bullish candles followed by a bearish candle.

Size matters: The bearish candle (the second candle) should be larger and have a longer real body compared to the preceding bullish candle (the first candle). The real body represents the difference between the opening and closing prices during the candle’s time frame.

Complete engulfing: The bearish candle must fully cover the real body of the preceding bullish candle. It should open below the previous candle’s low and close above its high.

Volume confirmation: Although not a strict requirement, many traders prefer to see higher trading volume accompanying the bearish engulfing pattern as it adds more conviction to the reversal signal.

Purpose of a bearish engulfing candle:

As we already covered what is a bearish engulfing candle, let’s focus on other important details.

The primary purpose of the bearish engulfing candle pattern is to provide traders and investors with a visual representation of a potential trend reversal from bullish to bearish. It serves several important purposes:

Identifying reversals: A bearish engulfing pattern is a valuable tool for recognizing potential trend reversals in the market. It signals that the previous bullish momentum may weaken, and bears are gaining control.

Risk management: Traders can use the bearish engulfing pattern to set stop-loss orders or exit long positions to limit potential losses. It helps traders manage risk by acting as a warning sign of a possible downturn.

Entry point for short trades: For traders looking to profit from a bearish move, the bearish engulfing pattern provides an entry point for short-selling or opening bearish positions.

Confirmation tool: When combined with other technical indicators or patterns, a bearish engulfing candle can provide confirmation of a potential reversal, increasing traders’ confidence in their trading decisions.

Market sentiment analysis: Beyond its immediate signaling function, this pattern can also provide insights into market sentiment. A strong bearish engulfing pattern suggests a significant shift in sentiment toward pessimism.

Formation of a bearish engulfing candle:

Understanding how a bearish engulfing pattern forms is crucial for correctly identifying and interpreting it. Here’s a step-by-step breakdown of the formation:

Bullish candle (day 1): The pattern starts with a bullish candle, representing a period in which buyers dominated the market. This candle typically has a smaller real body.

Bearish candle (day 2): On the following day or candle, there is a bearish reversal. The bearish candle opens lower than the previous bullish candle’s low.

Complete engulfing: The bearish candle closes higher than the previous bullish candle’s high, completely covering its real body. This is the critical characteristic that defines the bearish engulfing pattern.

Volume analysis: Some traders pay attention to trading volume on the day of the bearish engulfing pattern. Increasing trading volume on the bearish day can add more validity to the reversal signal.

How to interpret a bearish engulfing pattern

Interpreting a bearish engulfing candlestick pattern involves considering its implications and potential outcomes. Here’s how traders typically interpret this pattern:

Reversal signal: The primary interpretation is that the bearish engulfing pattern signals a reversal of the previous bullish trend. It suggests that the momentum has shifted from buyers to sellers, and a bearish trend may follow.

Weakness in bulls: The bearish engulfing pattern indicates that the bulls (buyers) who were in control are losing their grip on the market. The strong bearish candle suggests that sellers have taken control.

Bearish bias: Traders often view this pattern with a bearish bias, expecting prices to decline in the near future. However, it’s essential to consider other factors, such as overall market conditions and additional technical analysis, before making trading decisions.

Confirmation: It’s important to use the bearish engulfing pattern as part of a broader trading strategy. Traders often wait for confirmation from other technical indicators or patterns before taking action.

Significance in trading strategies:

The bearish engulfing candle pattern is a powerful tool when incorporated into trading strategies.

Here are some ways traders use it in their trading approaches:

Bearish reversal entry: Traders looking to capitalize on bearish reversals use the bearish engulfing pattern as an entry signal for short trades or as a cue to exit long positions.

Stop-loss placement: When traders identify a bearish engulfing pattern, they can place stop-loss orders above the high of the engulfing candle to limit potential losses if the market goes against their position.

Risk-reward assessment: Traders assess the risk-reward ratio when using this pattern. They calculate potential profit targets based on the size of the bearish candle and set stop-loss levels accordingly.

Combination with other indicators: Many traders combine the bearish engulfing pattern with other technical indicators such as moving averages, RSI (Relative Strength Index), or trendlines to increase the accuracy of their trading signals.

Part two

Timeframe consideration: The effectiveness of the bearish engulfing pattern can vary depending on the timeframe being analyzed. Short-term traders may use it on shorter timeframes, while long-term investors may apply it on daily or weekly charts.

Risk management: Besides being a signal for potential entries or exits, the bearish engulfing pattern plays a crucial role in managing risk. It helps traders set appropriate position sizes and determine when to adjust their trading strategies.

Limitations and considerations:

While the bearish engulfing pattern is a valuable tool in technical analysis, it’s essential to be aware of its limitations and consider other factors when making trading decisions:

False signals: Like all technical patterns, bearish engulfing patterns are not foolproof. They can occasionally produce false signals, leading to losses if not used in conjunction with other analysis techniques.

Market context: Isolating a bearish engulfing pattern without considering the broader market context can be risky. It’s crucial to assess factors like overall market trends, news events, and economic data.

To sum up, it is important to remember what is a bearish engulfing candle and what makes it useful to traders. It is a good idea to gather more information about a bearish engulfing candle.