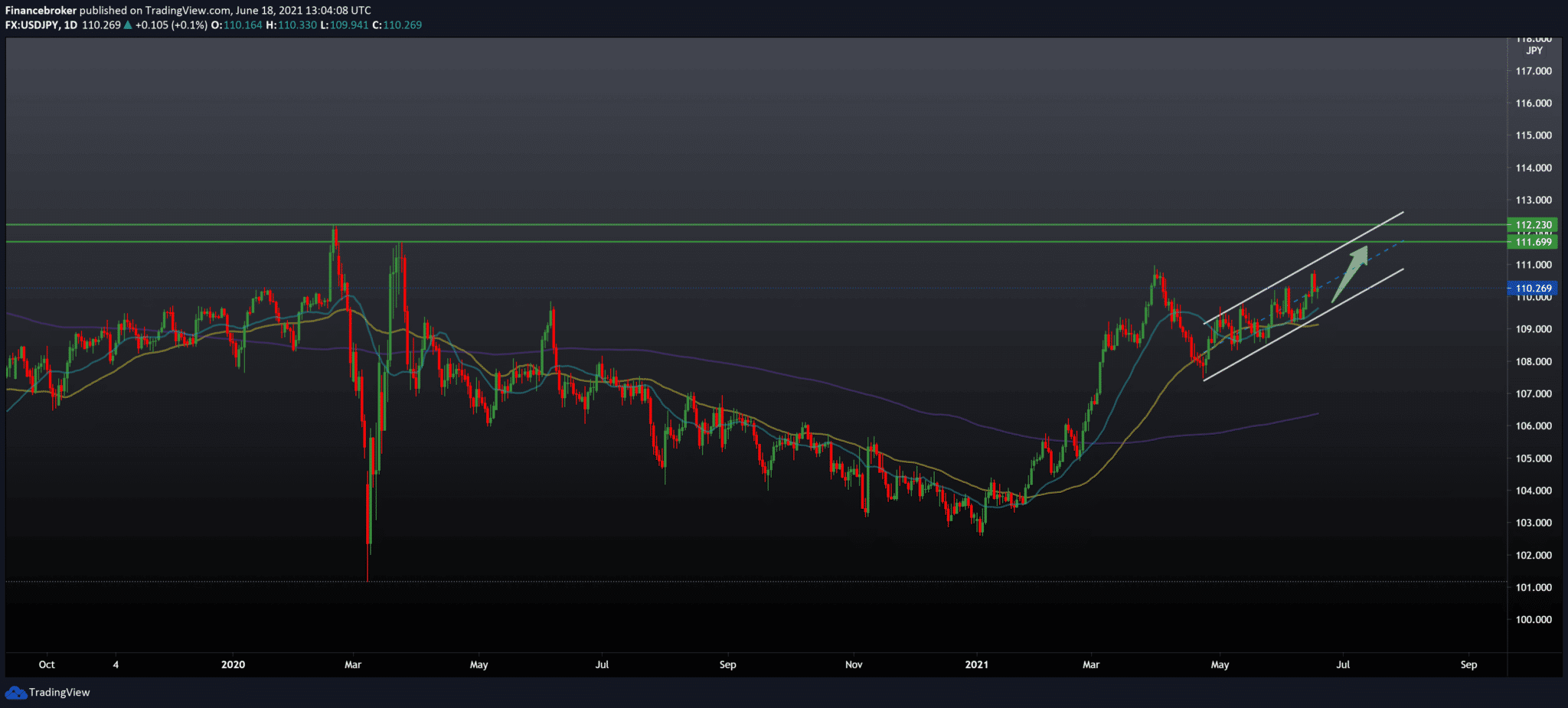

USDJPY 112.00 Next Target

The Bank of Japan has left a large monetary stimulus. It announced the introduction of a new funding program to support efforts on climate change issues. It has also extended the deadline for the Covid support program. However, the board voted 7-1, with 1 abstention. Thus, keeping the interest rate at -0.1 percent on current accounts held by financial institutions in the central bank.

The bank will continue to buy the required amount of Japanese government bonds without setting a ceiling. So the yields of 10 years in JGB will remain at the current, around zero percent. It is expected that BoJ will leave its policy rates. Target yields on ten-year government bonds will remain unchanged in the foreseeable future. The bank decided by a majority of 8: 0, with 1 abstention, to extend the financing support program in response to the new coronavirus.

The BOJ considers it appropriate to introduce a new regulation by providing funds. Accordingly, it provides financial institutions with funds for investments or loans they provide to address climate change.

The bank plans to launch a new stimulus probably in the continuation of 2021. Therefore, the preliminary framework of the provision will be presented at the July meeting of the monetary policy.

This new provision will build on the forthcoming measures to provide funds to support the strengthening of the foundations for economic growth, BoJ said.

Looking at the chart on the daily time frame, we see that the USDJPY pair is moving in a growing channel with support moving averages MA20 and MA50. A stronger dollar, a successful vaccination, and a loose monetary policy of the Bank of Japan managed to climb the pair above 110.00. Based on that, we can expect further growth of this pair towards 112.00. For a possible bearish option, we need a break below the bottom support line and the transition of moving averages to the bearish side. For now, we are only thinking bullish.

-

Support

-

Platform

-

Spread

-

Trading Instrument