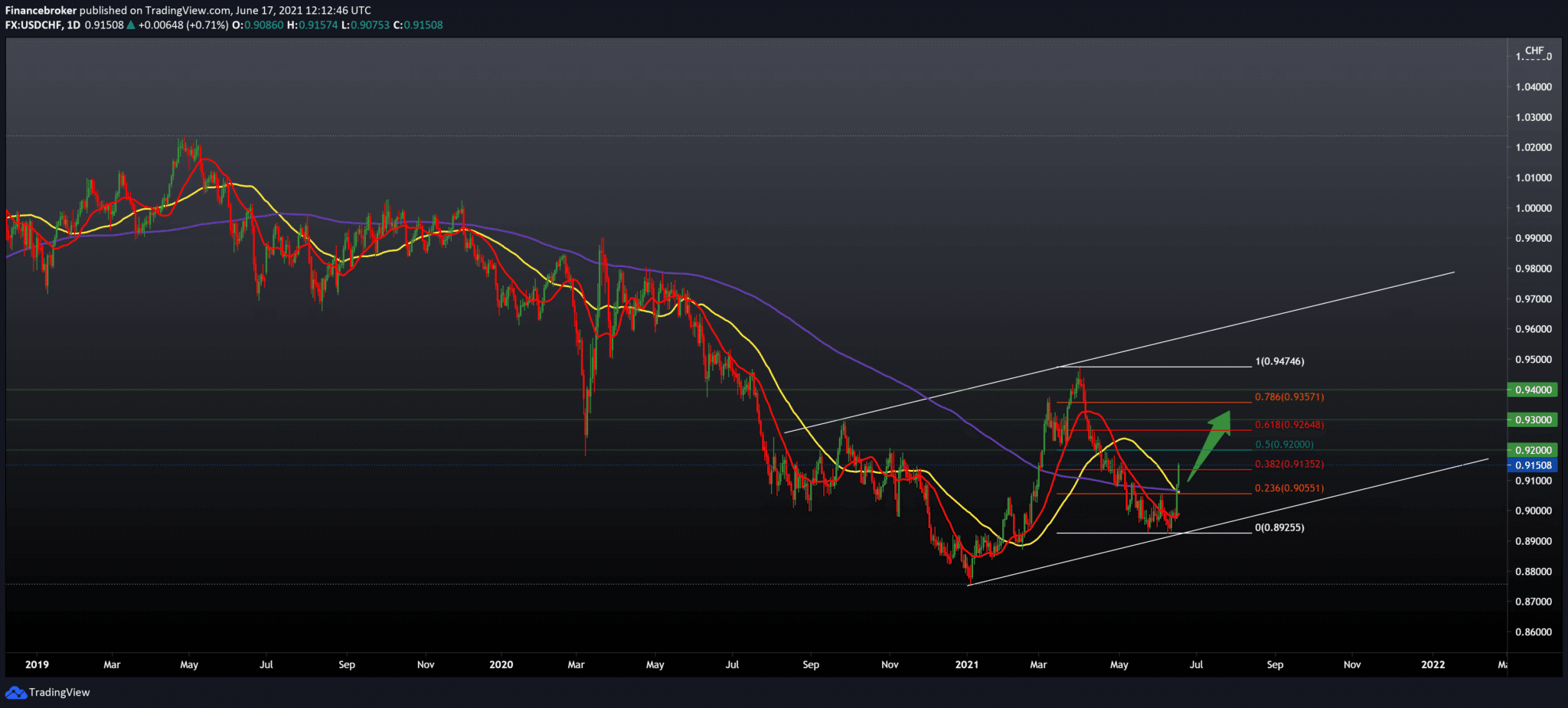

USDCHF Potential for Further Growth

The Swiss National Bank continued its expansive monetary policy to ensure price stability and support the economic recovery in the coming period.

On Thursday, members of the central bank decided to keep the interest rate and the interest rate on demand deposits in the SNB at -0.75 percent. The bank reiterated that it is ready to intervene in the foreign exchange market as needed. This helped take into account the overall currency situation. The bank’s opinion is that the Swiss franc is still highly valued.

With the positive but cautious outlook and inflation remaining below one percent for some time to come, a change in monetary policy does not appear to be needed any time soon, said Peter Vanden Houte, an ING economist.

Central Bank

We do not see the central bank moving before the European Central Bank, the economist said. As in the Eurozone, the change in interest rates is not expected before the second half of 2023. Moreover, the SNB will probably not increase interest rates before 2024.

With higher petroleum products and tourism-related services, the SNB has increased the short-term inflation outlook for some growth.

Consumer prices will increase by 0.4 percent this year, compared to the previous outlook of 0.2 percent. The projection for 2022 increased to 0.6 percent from 0.4 percent. For 2023, inflation recorded at 0.6 percent compared to 0.5 percent projected in March.

As economic indicators improve, projects show GDP to grow strongly in the second quarter. The bank expects the Swiss GDP to return to pre-crisis levels by mid-2022. This year, growth expectations fall at around 3.5 percent. Thus, citing a fall in GDP lower than expected in the first quarter. Earlier, the bank forecast 2.5 to 3 percent economic growth for 2021.

-

Support

-

Platform

-

Spread

-

Trading Instrument