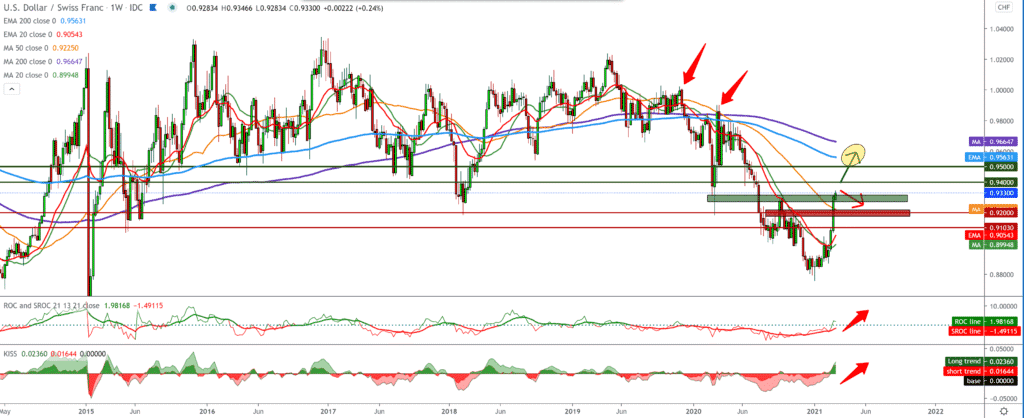

USD/CHF forecast for March 8

Looking at the chart on the weekly time frame, we see that the dollar is taking advantage of this period to reduce global vaccination risk and make gains against the Swiss franc. Based on that, we can conclude that we will see the pair in the coming period near MA200 and EMA200, the zone between 0.95600-0.96600. Our first next bullish target is 0.94000. We find support in moving averages MA20, EMA, and almost with MA50.

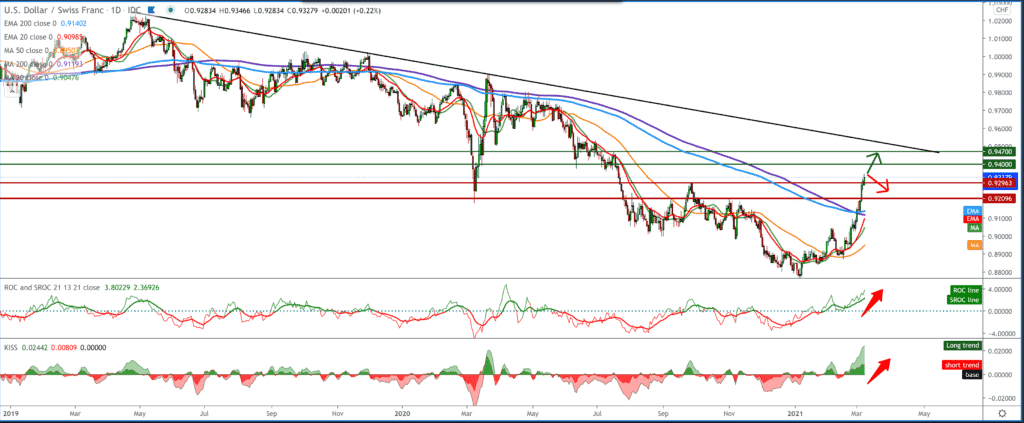

On the daily time frame, we see that the bullish momentum is very strong and that based on that, we can look at the previous high at 0.94700. The moving averages of the MA20 and EMA 20 will soon cross the MA200 and EMA200 lines, giving the pair even stronger support, directing it towards higher targets on the chart. From the top, we can draw one line connecting the previous higher high, and we can use it as a potential trend line of resistance. The pullback is always possible, especially because the bullish impulse is powerful and the pullback is a logical sequence. If we see pullback support, we are looking for the first one at 0.92900, and below that, we will have even stronger support at 0.92000.

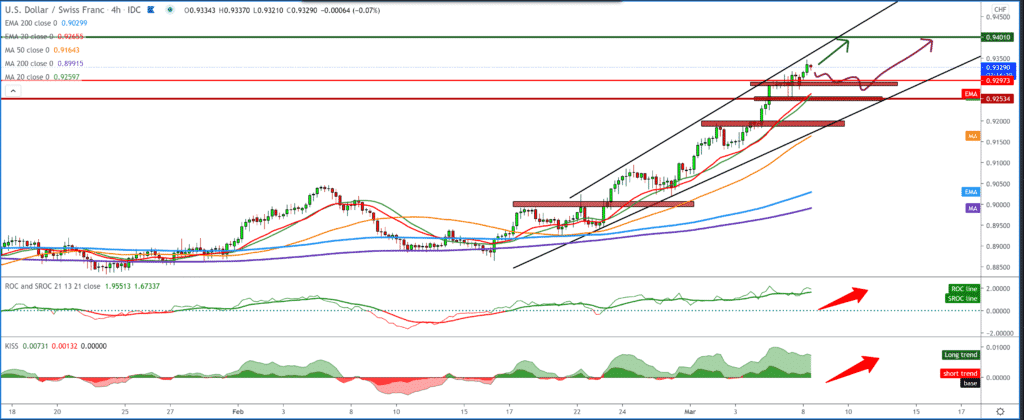

On the four-hour time frame, we see that the pair finds support in the MA20 and EMA20, giving us signals for a strong bullish scenario. Based on this image on the chart, we can expect a smaller pullback within that rising channel to the bottom support line at 0.92500-0.92900.

From the news for this currency pair, we can single out the following: With the growth of imports by slightly more than exports, a report released by the Commerce Department on Friday showed that the US trade deficit widened in January. The trade ministry said the trade deficit widened to $ 68.2 billion in January from a revised $ 67.0 billion in December. The unemployment rate in Switzerland rose in February, data from the State Secretariat for Economic Affairs showed on Monday. The unemployment rate rose seasonally to 3.6 percent in February from 3.7 percent in January. That was in line with economists’ expectations. On an unadjusted basis, the unemployment rate fell to 3.6 percent in February from 3.7 percent in the previous month.

-

Support

-

Platform

-

Spread

-

Trading Instrument