CHF/JPY forecast for March 8

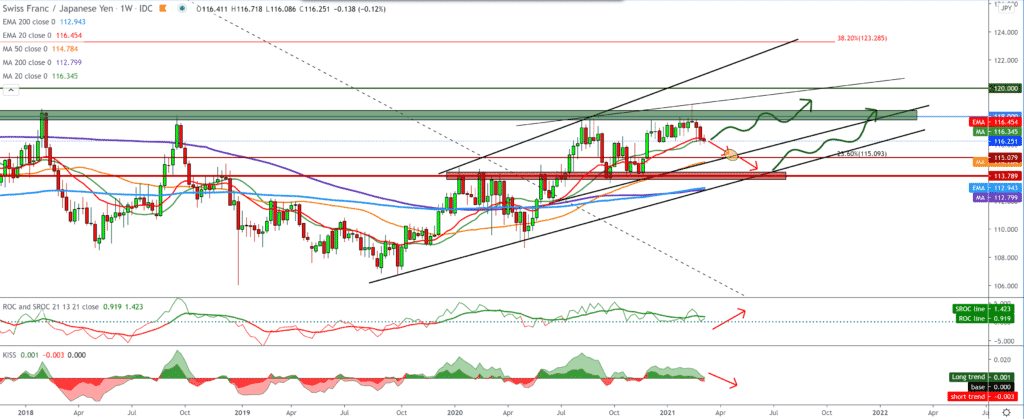

Looking at the chart on the weekly time frame, we see that the pad failed to stay above 118.00 and test 120.00. In contrast, we see a pullback from 118.80 to the current 116.30. We also have a break below MA20 and EMA20, and our target next could be MA50 at 115.00. If the support does not withstand the support, we ask below at 113.70-114.00 with the support of MA200 and EMA200.

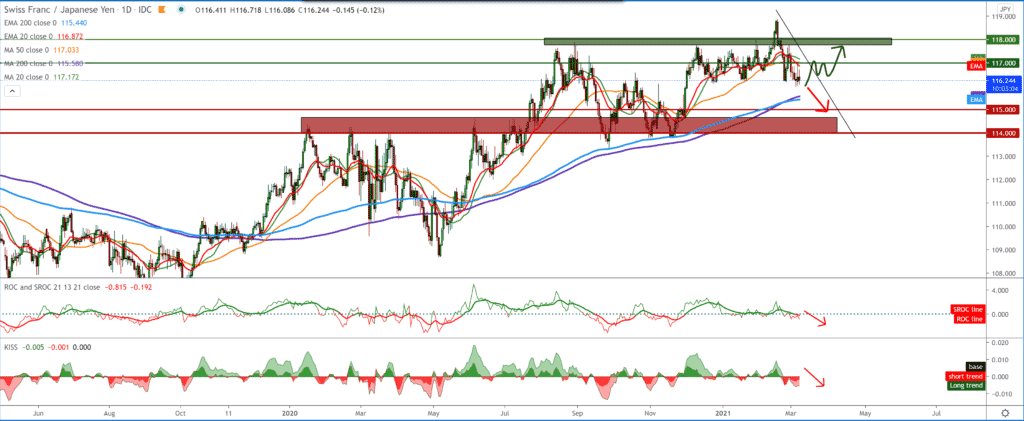

On the daily time frame, we see a pullback from the previous high with a break below MA20 and EMA20 and MA50, with a view to MA200 and EMA200 at 115.50, where it is close again testing the psychological level at 115.00. For the bullish scenario, we need a break above 117.00, with MA20 and EMA20 support.

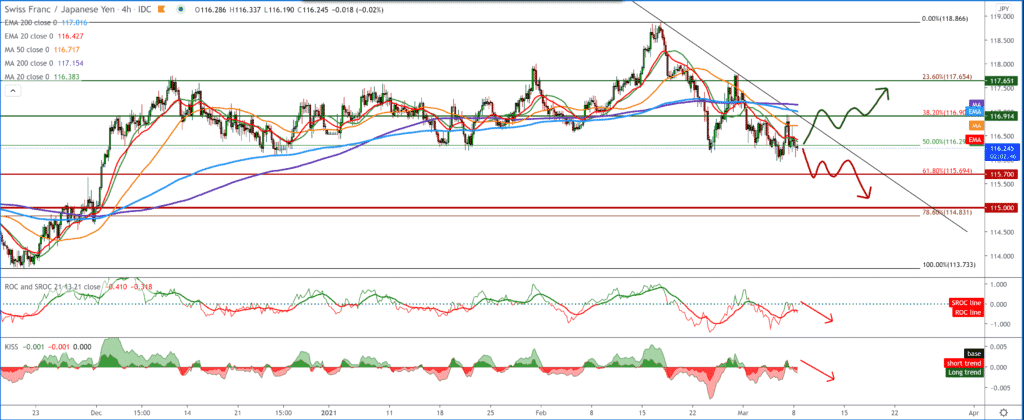

On the four-hour time frame, we see that the pair has made a new lower high, and based on that, we can expect a continuation of the bearish trend with resistance from the top with moving averages. We can use Fibonacci retracement levels on this time frame, and based on that, the pair is currently testing the Fibonacci 50.0% level at 116.30. A break below this level leads us to a 61.8% level to 115.70, while for the bullish scenario, we look at the Fibonacci 38.2% level at 116.90.

From the news for these two currencies, we can single out the following: The measure of public assessment of the Japanese economy increased in February. The data from the survey from the cabinet showed on Monday. The Index of Current Conditions of the Economic Observer Survey, which measures the economy’s current situation, rose to 41.3 in February from 31.2 in January. In December, the reading was 34.3. However, reading under 50 suggests pessimism. Japan’s leading index rose to its highest level in two and a half years in January, and preliminary cabinet data showed on Monday. The leading index, which measures future economic activity, rose to 99.1 in January from 97.7 in December. The most recent reading was the highest since September 2018, when it was 99.2. The randomness index fell to 91.7 in January from 88.2 in the previous month. This was the highest reading since February last year. Switzerland‘s unemployment rate rose seasonally to 3.6 percent in February from 3.7 percent in January. That was in line with economists’ expectations. On an unadjusted basis, the unemployment rate fell to 3.6 percent in February from 3.7 percent in the previous month.

-

Support

-

Platform

-

Spread

-

Trading Instrument