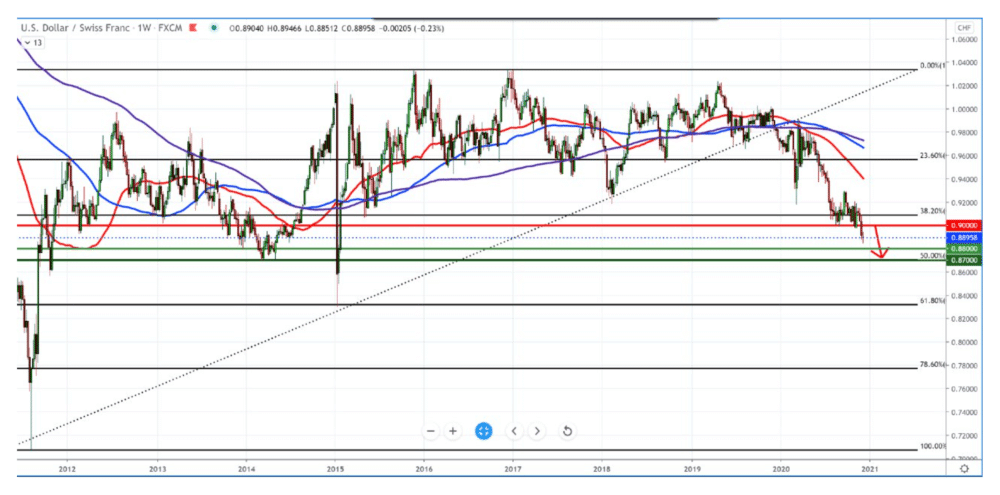

USD/CHF forecast for December 11, 2020

Looking at the chart on the weekly time frame, we will see that the bearish momentum is very strong and that the USD/CHF pair has fallen below the psychological level of 0.90000. By setting the Fibonacci on the chart, we see that the pair consolidated about 38.2% of the level.

The dollar has remained under great pressure since the global coronavirus pandemic, especially now that the vaccine has been found. Technically we can expect the decline to fall to 0.87000 previous support levels.

We have a falling channel that found support at the bottom trend line on the daily time frame, so that we can expect a smaller pullback up to the resistance zone at 0.90000. Today is Friday, so we can expect lower volatility, which may give the dollar a certain advantage over the Swiss franc. The bearish scenario is still in force but with little respite.

The graph on the four-hour time frame shows us that we had support at 0.88500 and that there is now the possibility of a smaller pullback to the resistance zone 0.89500-0.90000. Some potential sign for our bullish scenario is if the pair goes above the lowest moving average of MA50, we should also be careful to trade this pullback.

The global picture is still very bearish. The disappointing announcement of U.S. initial unemployment claims on Thursday added concerns in the market about the potential economic consequences due to the continuous onset of new coronavirus cases.

That, along with uncertainty over the latest U.S. fiscal stimulus measures, has diminished investor confidence. Later in the day, we have the following news: The Core Producer Price Index (PPI), The Producer Price Index (PPI), The Michigan sentiment index, as well as a statement by the Federal Reserve Governor Randal Quarles on potential actions regarding the economy’s recovery from coronavirus.

-

Support

-

Platform

-

Spread

-

Trading Instrument