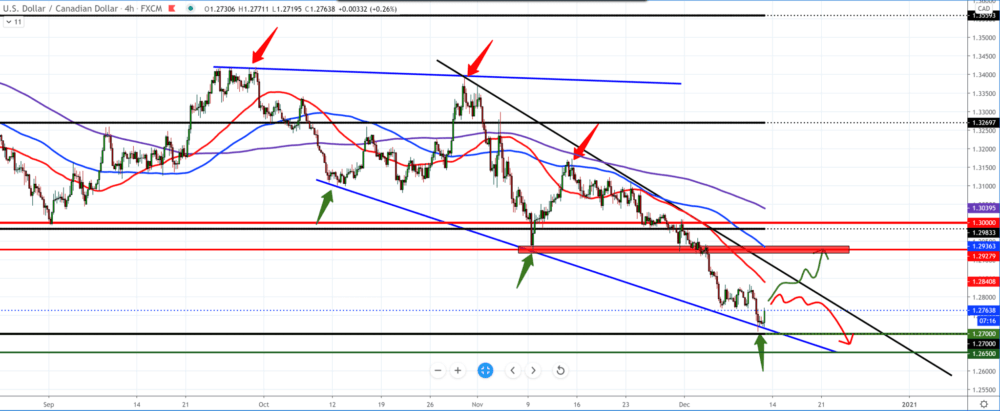

USD/CAD forecast for December 11, 2020

Looking at the chart on the weekly time frame, we see that the bearish scenario dominates and has good potential to continue down to lower levels. The USD/CAD pair falls below all moving averages and the psychological barrier of 1.30000. The USD/CAD pair finds support at 1.27000, which coincides with the Fibonacci level of 38.2%. We can now expect consolidation around that level in a shorter period. The continuation of the bearish scenario is very likely with a smaller pullback.

And on the daily time frame, we see that the The USD/CAD pair falls below all moving averages and the psychological barrier of 1.30000. The pair found current support at 1.27000. If we look at the graph, the dollar index has also found support, which does not give the USD/CAD pair to go down. The price is currently at the level of May 2018, and if we look at the chart that way, we can expect to see a pair at 1.26000 soon. Moving averages tell us that the bearish momentum is strong and that there are no signs of a trend change for now.

On the four-hour time frame, we see that we get a trend line as potential support when we connect all the previous lows. Smaller consolidation is likely to the upper resistance line where the USD/CAD pair will encounter another obstacle: the moving average of MA50. If the pair manages to climb to the previous low of 1.29300, it will be a great success for the dollar.

A report released by the Department of Labor on Thursday shows modest growth in consumer prices in the United States in November. The labor department said its consumer price index rose 0.2 percent in November after coming unchanged in October.

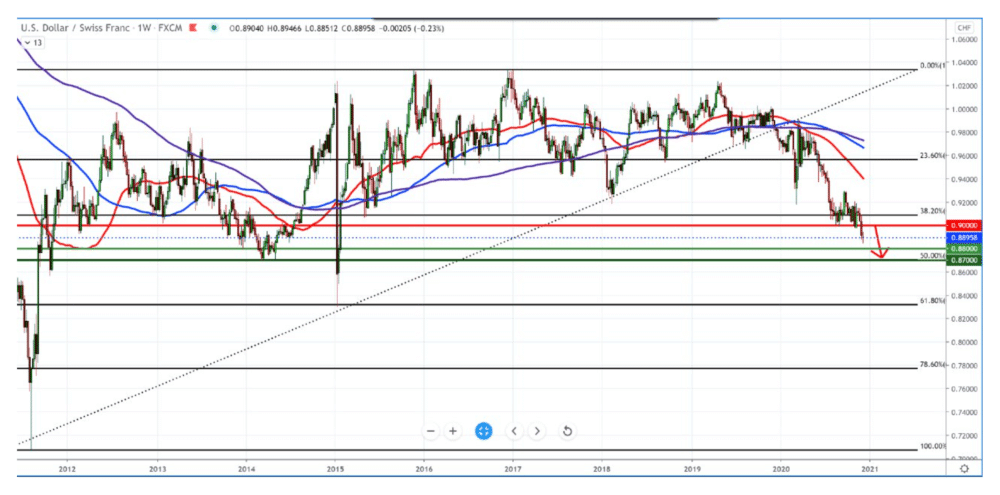

USD/CHF forecast for December 11, 2020

The increase in consumer prices coincided with economists’ estimates. Today, the Department of Labor should publish a separate report on producer price inflation in November. The rise in oil prices to above $ 47 a barrel helped the Canadian dollar strengthen, as did the Bank of Canada’s report to keep interest rates on the new level.

-

Support

-

Platform

-

Spread

-

Trading Instrument