USD/CAD analysis for April 16, 2021

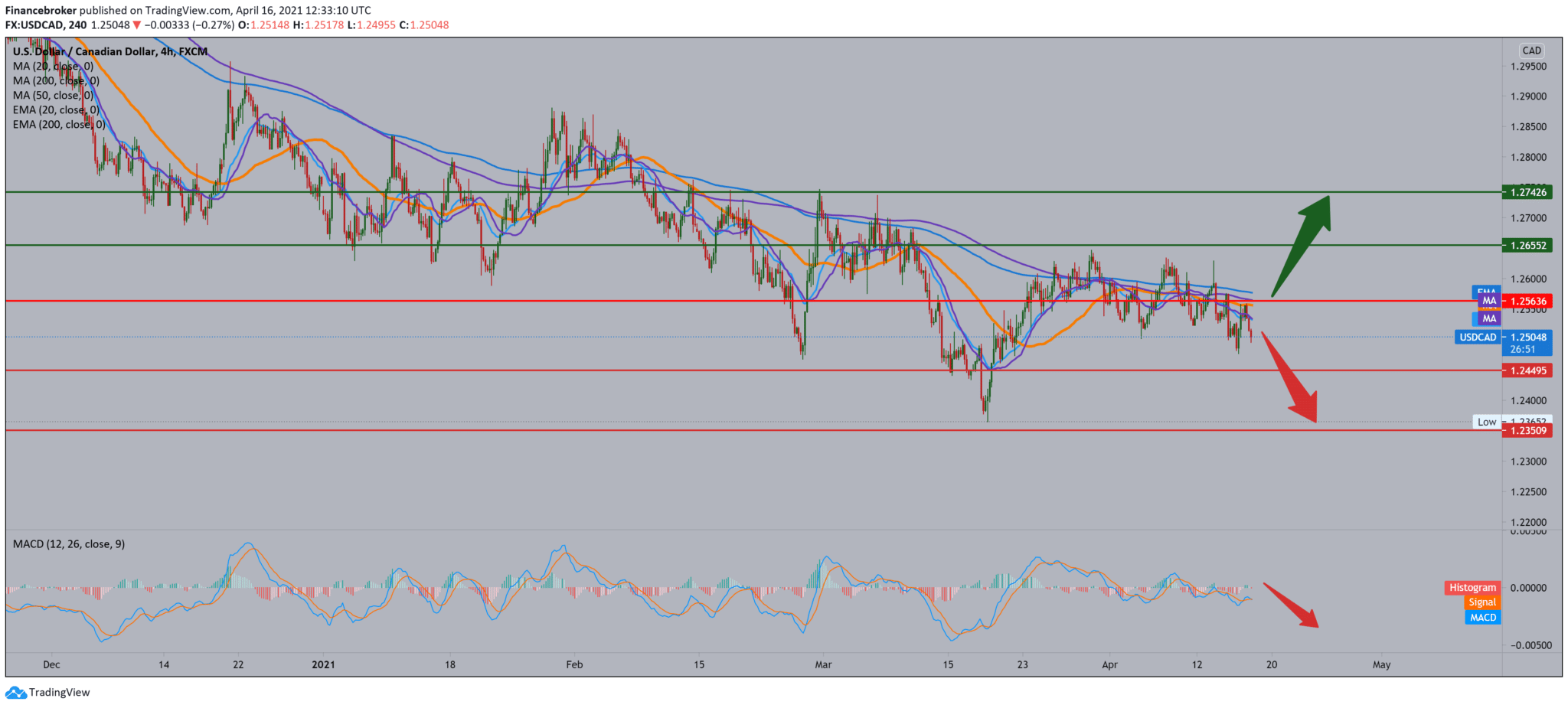

Looking at the chart on the four-hour time frame, we see that the USD/CAD pair is still very bearish with a tendency to continue even lower towards 1.24500, with a view to the previous low at 1.23650. Moving averages are now all on the bearish side, and for now, there is a lot of pressure and resistance to a potential bullish trend. The MACD indicator rotates again and down, giving us also a signal for continuing the bearish trend.

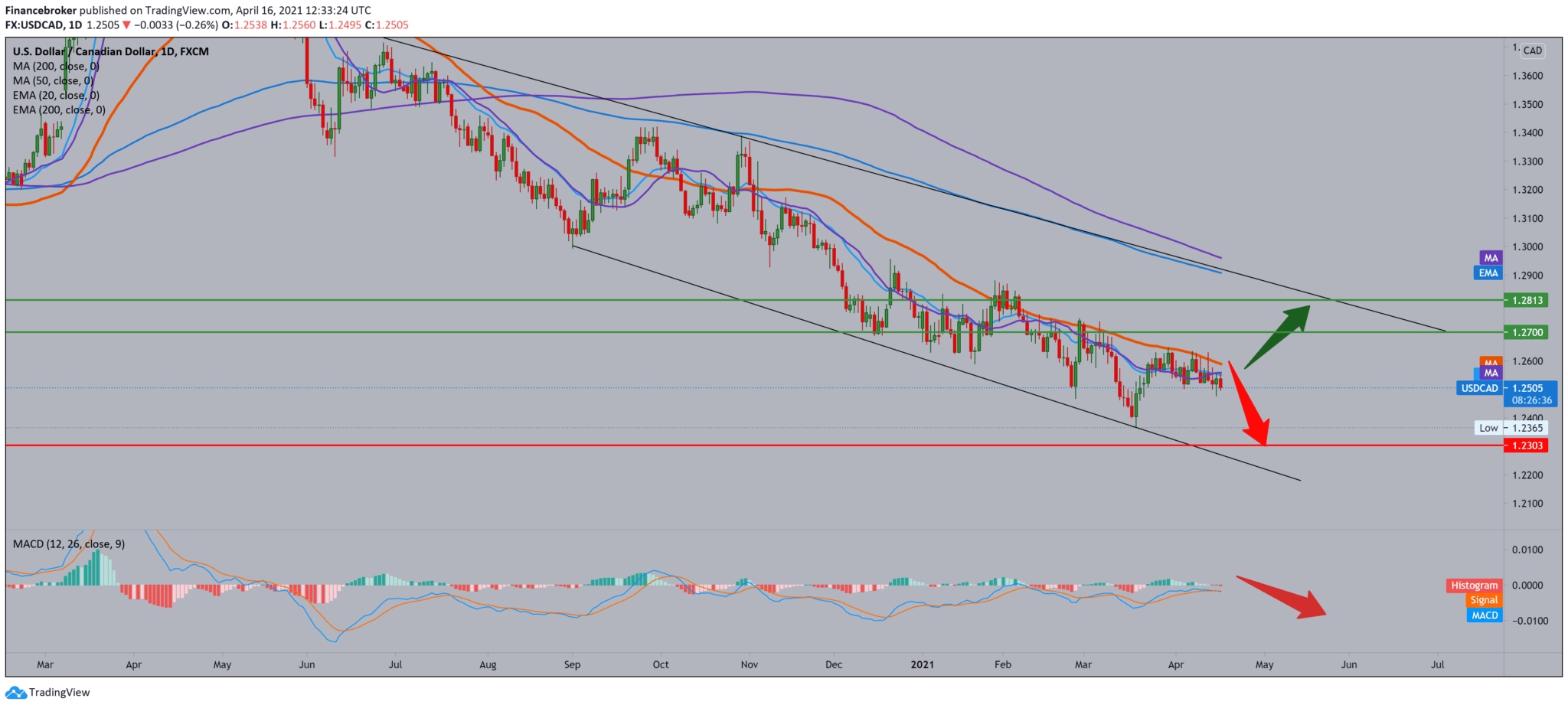

On the daily time frame, we see a big downward trend with a large pressure of moving averages from above; MA50 is, for now, a big obstacle to a possible reversal of the trend. The MACD indicator also gives a bearish signal. With moving averages, rounds out the overall picture that we will see below the continuation of the decline towards the lower levels on the chart. The bearish trend’s target is our previous low at 1.2365, and here we can ask for the next support.

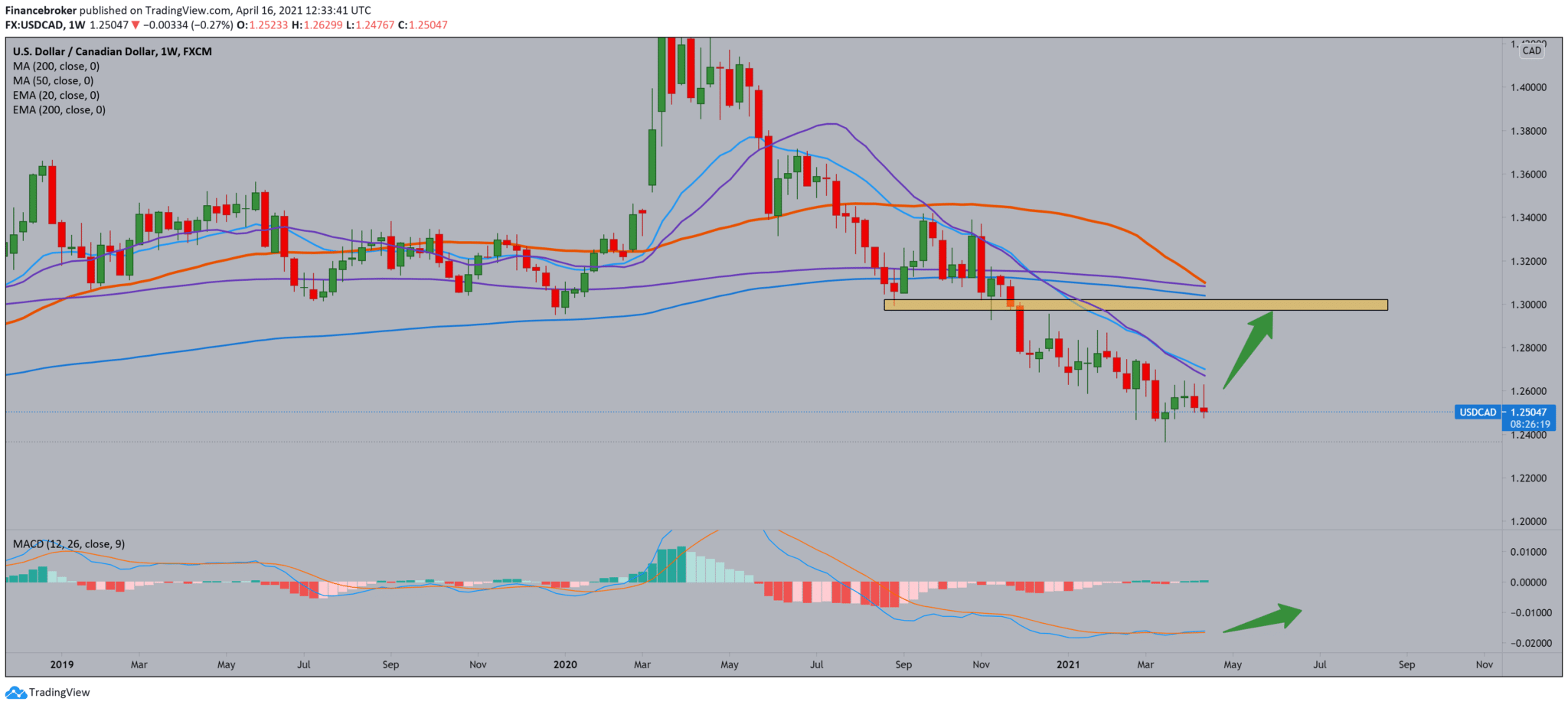

On a weekly time frame, the USD/CAD pair fails to break the MA20 and EMA20 moving average lines, and for now, these are a big obstacle to a potential bullish trend. We are looking again at a low to below 1.24000, with the door open to 1.22000. The MACD indicator tells us that the USD/CAD pair has found some support by consolidating around 1.25000. The MACD indicator movement is lateral and is not of much importance to us as a safer indicator of the trend.

From the news for the USD/CAD currency pair, we can single out the following:

The Canadian economy is expected to grow by 5.6% in the first quarter of the year, a recent Reuters poll showed on Friday. Economists saw economic growth of 3.6%, 6%, and 5.5% in the second, third, and fourth quarters. The publication further revealed that 16 out of 21 economists think that the new wave of COVID-19 and tighter borders will not drive in negativeCanada’s economic recovery.

-

Support

-

Platform

-

Spread

-

Trading Instrument