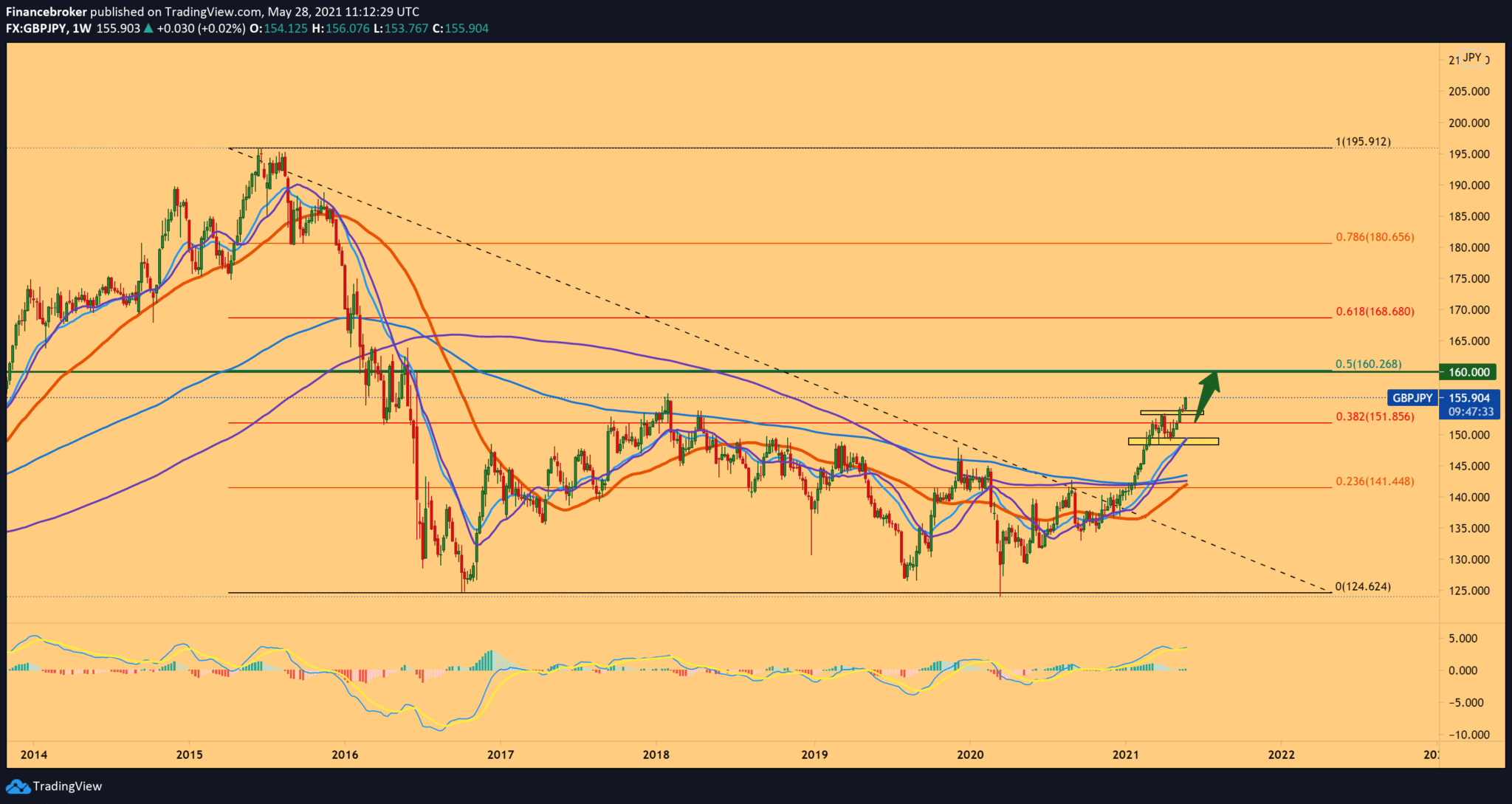

The pound dominates the Japanese yen

The British pound rose sharply on Thursday after Bank of England Governor Gertjan Vlieghe said the central bank was likely to raise rates next year. Vlieghe also noted that the increase could occur earlier if there is a smooth transition from the market and the economy recovers faster than expected.

This comes based on an optimistic outlook for the UK’s economic recovery from the pandemic amid an impressive pace of vaccinations and a gradual easing of lock-in measures. And the Prime Minister of the United Kingdom, Boris Johnson, said that there is currently no data that would delay the plan for the complete lifting of the restrictions on June 21.

Japan is lagging behind global reflation, keeping the yen under downward pressure. Although negative news in Japan lowers inflation expectations, they can support the yen. In contrast, the monetary position of the Justice Council during the previous period, together with expectations of extended fiscal support and a general strong appetite for risk, all combine to make the yen weak.

Japan may embark on another technical recession with the government ready to announce an extension of the current state of emergency until June 20 – just 5 weeks before the start of the Olympics. That means the BoJ is responding by expanding its pandemic assistance program beyond the current September, according to Nikkei newspaper reports. So the global topic of ongoing reflation in the US, Europe, and the UK is likely to exclude Japan, which is likely to lag behind as it adopts caution to ensure the continuation of the Olympics. The speculative market quickly put itself in a position to make the yen worse.

We expect cross-border outflows from Japan to increase. In three of the last four weeks, net sales of foreign bonds were recorded, and the total purchase this fiscal year is only 1.4 trillion. Is on. Given that long-term yields in the US are now more stable, we see that conditions are ripe for growth over the coming weeks.

-

Support

-

Platform

-

Spread

-

Trading Instrument