Ether still under pressure

The expiration of futures and the option on May 28 could be a turning point for Ether. Although the open interest amounts to 6.2 billion dollars, only 16% should expire today because most of the work takes place on indefinite and June contracts. The expiration of options is always taken into account, as this could represent an imbalance of power. This feature does not apply to futures markets, where buyers and sellers coincide at all times. Options are divided into two independent segments: call or path options, which are most commonly used for bullish-neutral strategies, and neutral-to-bearish sales options. The fall started after the maximum of 4,380 dollars on May 12, and the price dropped to 1,730 dollars after about 10 days. However, Ethereum quickly consolidated and established support at $ 2,400. Open interest in futures fell 54% to $ 5.2 billion as leverage was liquidated and short-sellers took part of the stakes (profits).

As for the $ 980 million Ether futures due to expire today, the crypto exchange Huobi is taking the lead with $ 300 million in open interest. CME follows him closely; however, CME traders have traditionally rolled over most positions over the past few trading days, so this number could be significantly reduced as we approach the deadline. As of May 28, there are 189,000 long ether options stacked against 153,900 short options. This initial analysis gives neutral-bull calls a 23% advantage.

However, one must consider that the right to purchase Ethereum at $ 3,200 or more in less than 16 hours is not currently particularly desirable. $ 3,000 is the deciding level for bulls, as there are 30,700 call options stacked there compared to 15,000-way options. This means that if the bears manage to keep Ether below that price, the neutral and call options amount to 54,500 ETH, equivalent to $ 150 million. Futures traders were less than optimistic after the recent major liquidations reported by Cointelegraph on May 24. Huobi, OKEx, and Deribit expire on May 28 at 8:00 AM UTC. CME futures and options happen a little later in the day at 15:00 UTC.

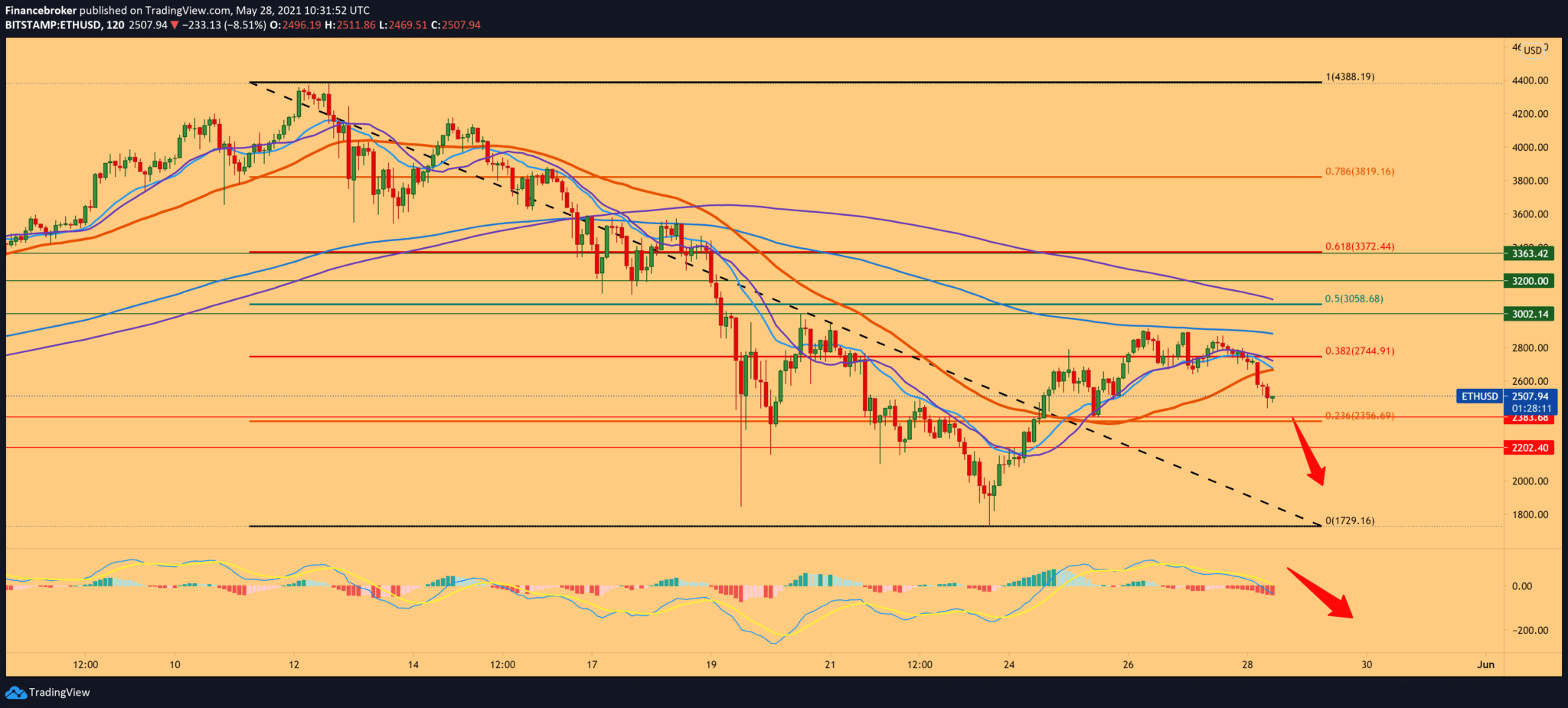

Doing a technical analysis, we see that ETH is still under great bearish pressure and that for now, it cannot climb above 2800$ 38.2% Fibonacci level. Still, we are returning to the 23.6% level, trying again to find support in zone 2356-2385 $. Hoping this will stop the fall in the price of ETH. Following the MACD indicator, we get a clean bearish signal without any weakness, and based on it, and we can expect a further drop in the price of ETH.

-

Support

-

Platform

-

Spread

-

Trading Instrument