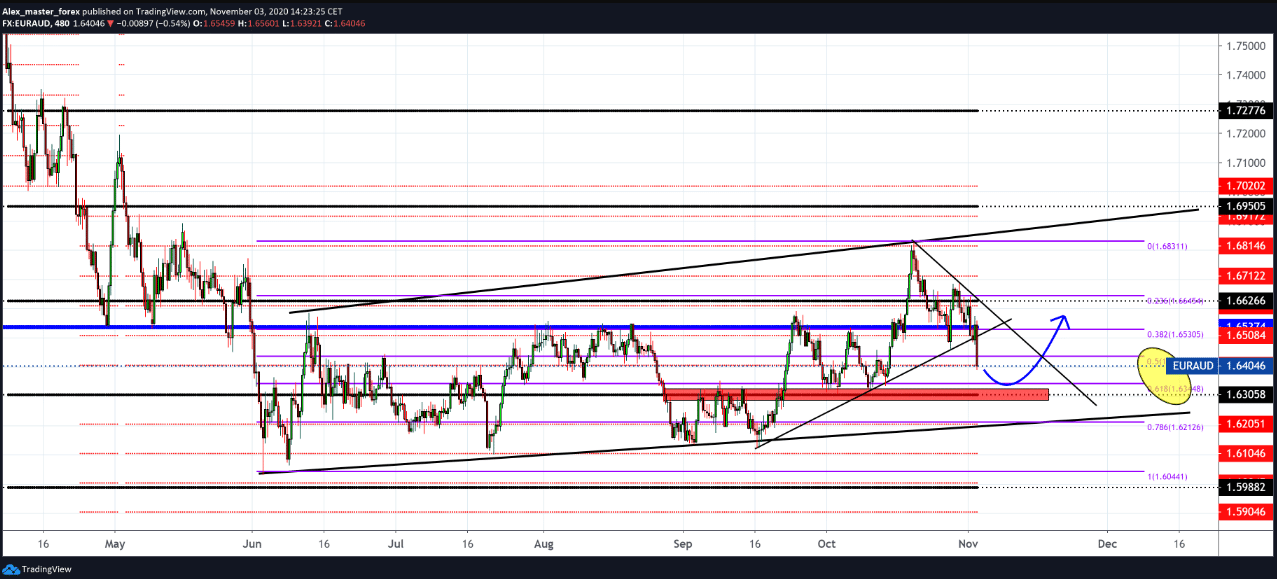

The EUR/AUD pair on November 3, 2020

EUR/AUD short-term bearish moves towards better support

This morning we had news from the Reserve Bank of Australia, which reduced its interest rate to a historic low of 0.10%. Expectations were that the Australian dollar would weaken after that event. Still, the opposite happened, and it gained strength due to the world’s global current situation due to the coronavirus.

In Europe, many countries are lockdown, and rigorous coronavirus protection measures have been introduced, as the number of new infections has increased dramatically in the last month. Australia was locked much earlier, the borders were closed, and many measures were introduced to combat the crown.

The central bank has also announced an expansion of its asset purchase program. The package includes $ 100 billion in government bonds with a maturity of about 5 to 10 years in the next six months. Whether the bank will provide additional incentives will depend on the outlook for unemployment and the functioning of the market over the next six months.

Looking at the chart, if the pair breaks 1.64000, we may then see it 100 pips lower at 1.63000, where there is more support for the euro. Today, the market is prolonged because everyone is following the American elections and its outcome. This uncertainty of the market will probably last until the end of the week when we will get the election results.

All this is closely monitored by investors, which is why there are no changes in the market. Tomorrow, we single out the Retail Sales measure from the Australian news, which is expected to be better than the previous ones, but it isn’t very pleasant in general. We are just waiting for the moment when the Australian dollar will start to lose strength.

-

Support

-

Platform

-

Spread

-

Trading Instrument