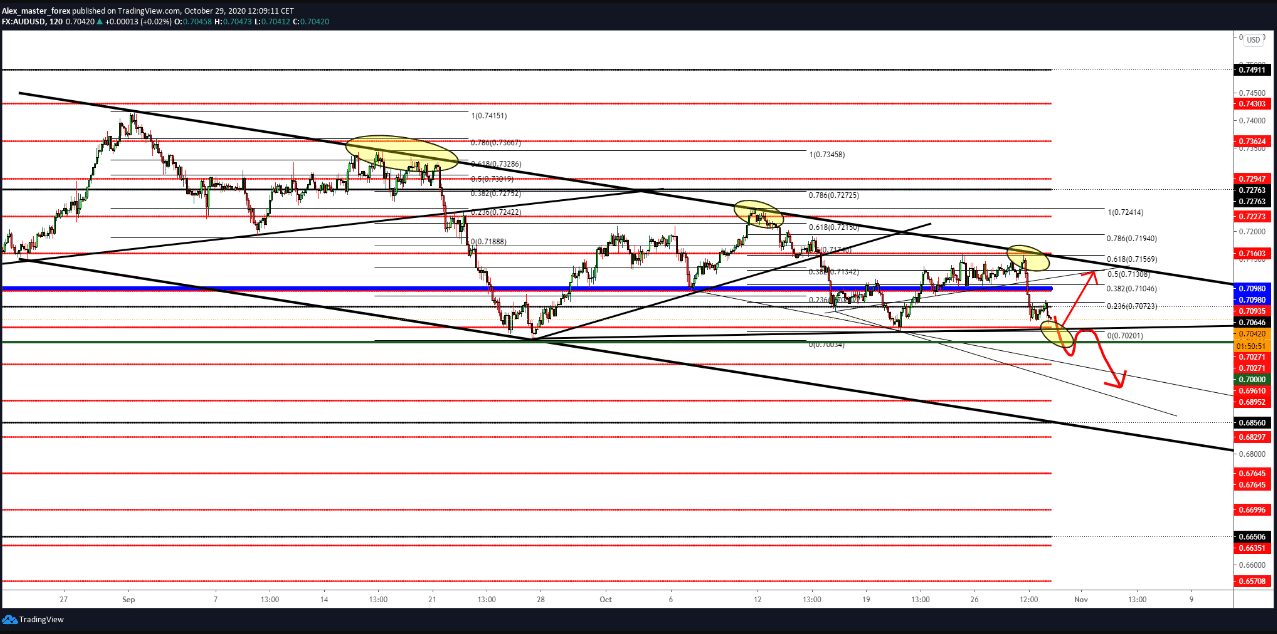

The AUD/USD pair on October 29, 2020

AUD/USD psychological level testing 0.70000. The Reserve Bank of Australia (RBA) will likely introduce additional incentives as early as next month, despite rising inflation in the Australian economy. Australia’s main CPI rose to 1.6% q / k for 3Q20, more than the estimate of 1.5% q / k, and after a record drop of 1.9% q / k in the second quarter, when childcare was temporarily free, and gasoline prices fell by 20%.

The recovery in the third quarter was because childcare benefits, returned to the rate before COVID-19, were free during the June quarter … Compared to the same period a year ago, the CPI advanced by 0.7% to year-on-year, rebounding from 1.9% on an annual basis, a decline in the previous three months and slightly higher than expectations of 0.6% y / y.

While optimistic data is welcome, it is expected that this will not deter the RBA from reducing policy rates. The index managed to regain the area above the key obstacle of 93.00 so far this week. The current dollar recovery comes in response to the impact of the COVID-19 pandemic on the prospects for global growth, as well as the small chances of an agreement between Democrats and Republicans over a new law on incentives.

However, a worsening attitude towards the dollar is predicted if Joe Biden wins the November election. The “lower for longer” position from the Federal Reserve also covers occasional bullish attempts. This afternoon we have the following news Gross Domestic Product (GDP) measures, Initial Jobless Claims measures, and The National Association of Realtors (NAR) Pending Home Sales Report measures.

It will be exciting what the results will be and how this will affect the market, the dollar from October 21 to rise from 92.47 to the current 93.58, greater resistance awaits it at 93.88. The news may push the dollar to that level, and after that, we will see.

-

Support

-

Platform

-

Spread

-

Trading Instrument