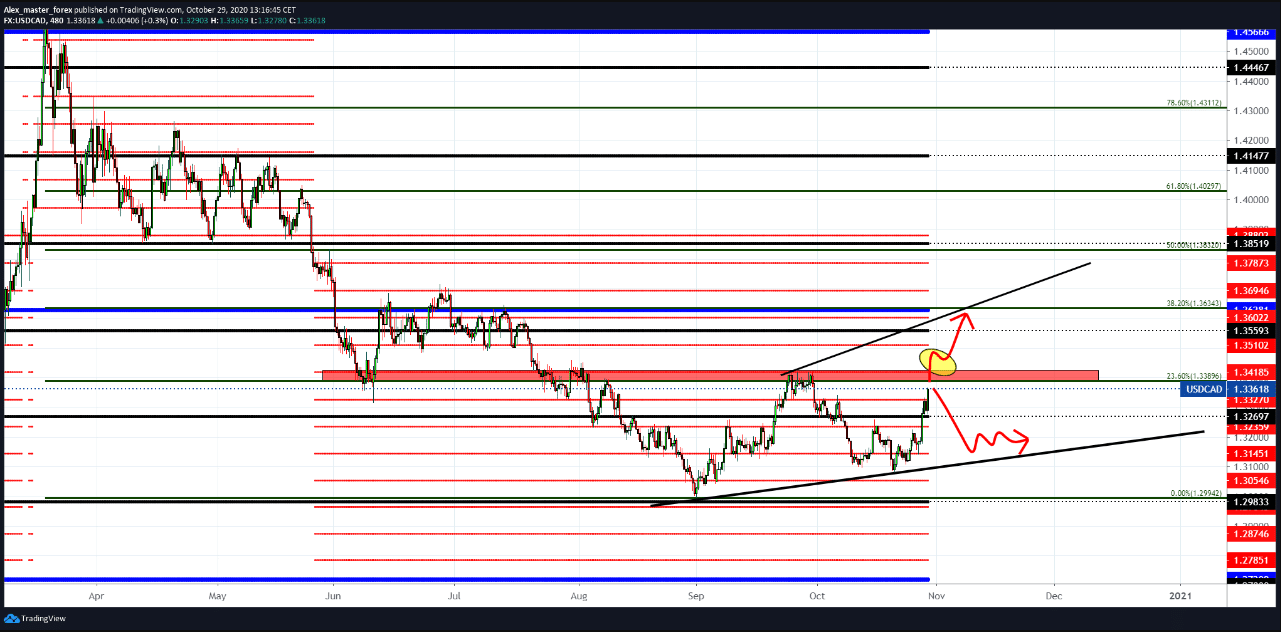

The USD/CAD currency pair on October 29, 2020

The USD/CAD has potential for above 1.34000. Yesterday, the Bank of Canada confirmed an unchanged interest rate of 0.25%, which means that the exchange rate and policy towards the economy are not changing for now.

The Monetary Policy Report revealed an upward revision to GDP growth estimate for 2020 to -5.7% as expected, but the bank maintained a cautious tone. The US dollar index is advancing according to key US data. Markets expect the US economy to show a growth of 31% in K3.

The heavy selling pressure surrounding crude oil seems to be causing the commodity-related CAD to have a tough time attracting investors. Dragged by heightened worries over a dismal energy demand outlook, the barrel of West Texas Intermediate (WTI) lost more than 4% on Wednesday and extended its slide on Thursday.

The current price of oil is $ 35.75 per barrel. Traders will look for quarterly reports on the GDP of major economies such as the US and the eurozone to find indications of the pace of global economic recovery (and oil demand). Pandemic-related updates (number of cases, lock, incentive, vaccine) will continue to affect overall Canadian risk-taking and demand.

Topics closely monitored, such as Brexit and U.S. stimulus negotiations, and the U.S. presidential election can also foster instability among CAD couples. President Donald Trump is expected to get a badly needed positive headline Thursday morning with a report expected to show the economy grew at a record pace in the third quarter, recovering much of the plunge from the worst of the coronavirus-induced national lockdowns in the second quarter.

Even again, as big as 35 percent on an annualized basis in the third-quarter GDP growth – while an all-time high – would not get the U.S. economy back to where it was at the end of the first quarter. And it would take a far bigger jump to get the economy back to where it would have been had Covid-19 not slammed the country at all.

Economists and Wall Street analysts now expect much slower growth in the fourth quarter and early next year than they previously expected, given that the roughly $ 4 trillion in federal stimulus spending that propped up consumers and businesses through the end of the summer has largely faded.

The elections are getting closer, so it is very unpredictable in which direction the US Dollar will move in the future because the difference between Republicans and Democrats in the way they lead the economy is totally different.

-

Support

-

Platform

-

Spread

-

Trading Instrument