Similar Scenario For EURUSD and GBPUSD

- Yesterday we saw the euro fall from the 1.01800 level to the 0.99550 level.

- Yesterday, a similar scenario occurred to the pound. The pound fell from 1.17400 to 1.15000 level.

- Consumer price inflation in the UK slowed in August from a 40-year high, thanks to falling fuel prices.

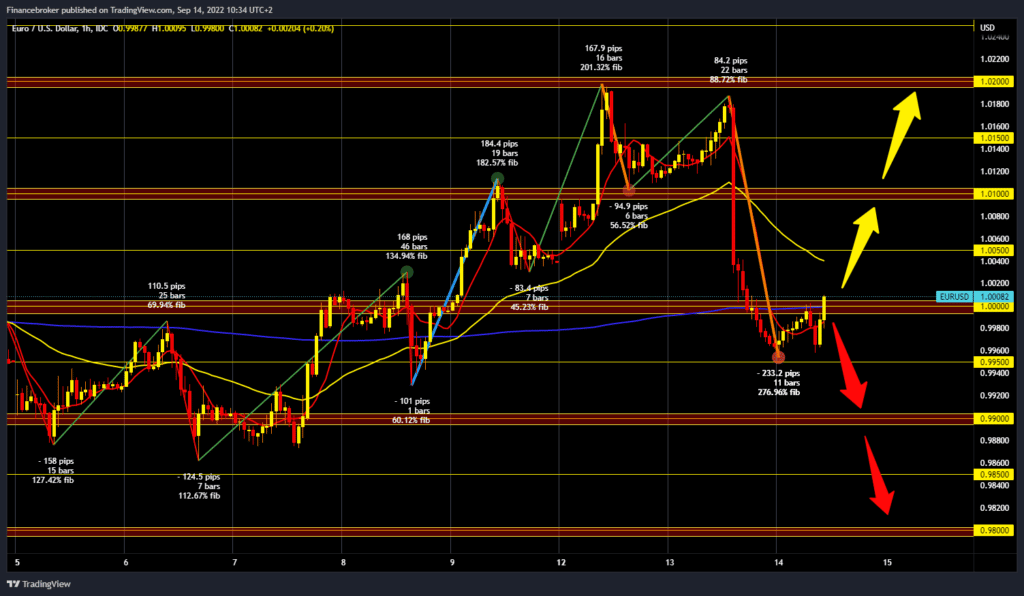

EURUSD chart analysis

Yesterday we saw the euro fall from the 1.01800 level to the 0.99550 level. The reason for the drop is the report on American inflation, which is still at a high level. During the Asian trading session, the euro managed to stop the decline and recover to the 1.00000 level. Additional resistance at that level is the MA200 moving average. We need further positive consolidation to continue the bullish recovery and try to hold above the 1.00000 level. Our next target is the 1.00500 level and the MA50 moving average. If we made a break above, then we would be halfway to erasing yesterday’s losses. Potential higher targets are the 1.01000 and 1.01500 levels. We need a negative consolidation and a retest of support at the 0.99500 level for a bearish option. A break below the euro would signify a further continuation of the pullback. Potential lower targets are 0.99000 and 0.98500 levels.

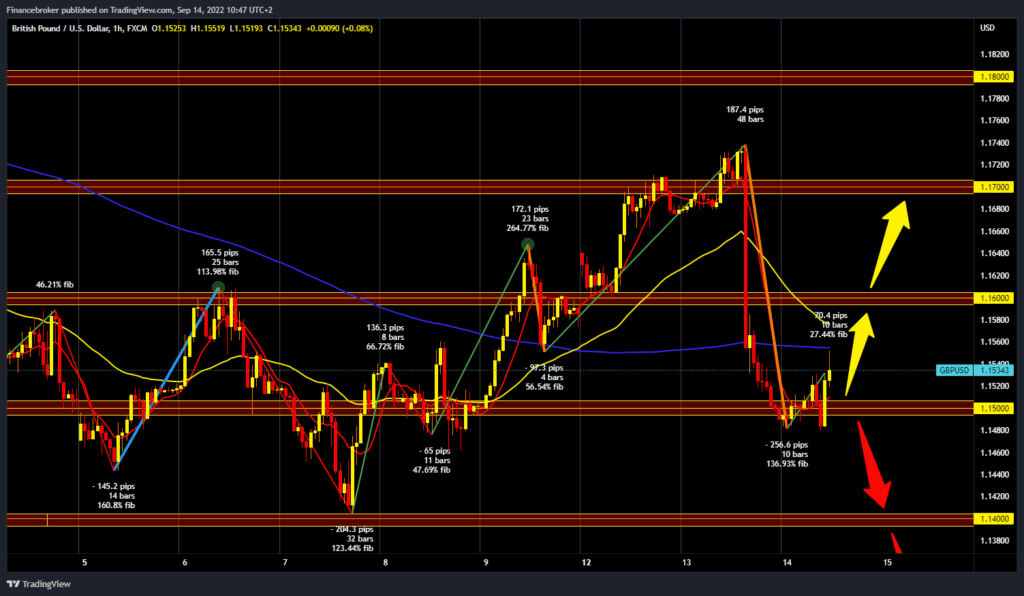

GBPUSD chart analysis

Yesterday, a similar scenario occurred to the pound. The pound fell from 1.17400 to 1.15000 level. During the Asian trading session, the pound managed to stay at that level and recover slightly to the 1.15400 level. At the 1.15500 level, we have resistance in the MA200 moving average. We need a break above and a continuation of positive consolidation towards the 1.16000 level. Then we must try to stay in that zone to start a new bullish impulse. Potential higher targets are 1.16500 and 1.17000 levels. We need a negative consolidation and a new pullback below the 1.15000 level for a bearish option. Potential lower targets are 1.14500 and 1.14000 levels.

Market Overview

Consumer price inflation in the UK slowed in August from a 40-year high, thanks to falling fuel prices. This is according to data from the Office for National Statistics on Wednesday. Consumer price inflation slowed to 9.9% in August from 10.1% in July. On a monthly basis, the CPI rose 0.5%, weaker than the 0.6% increase in July. Despite the slowdown, headline inflation is forecast to remain around 11 % early next year before pulling back more dramatically, ING economist James Smith said.