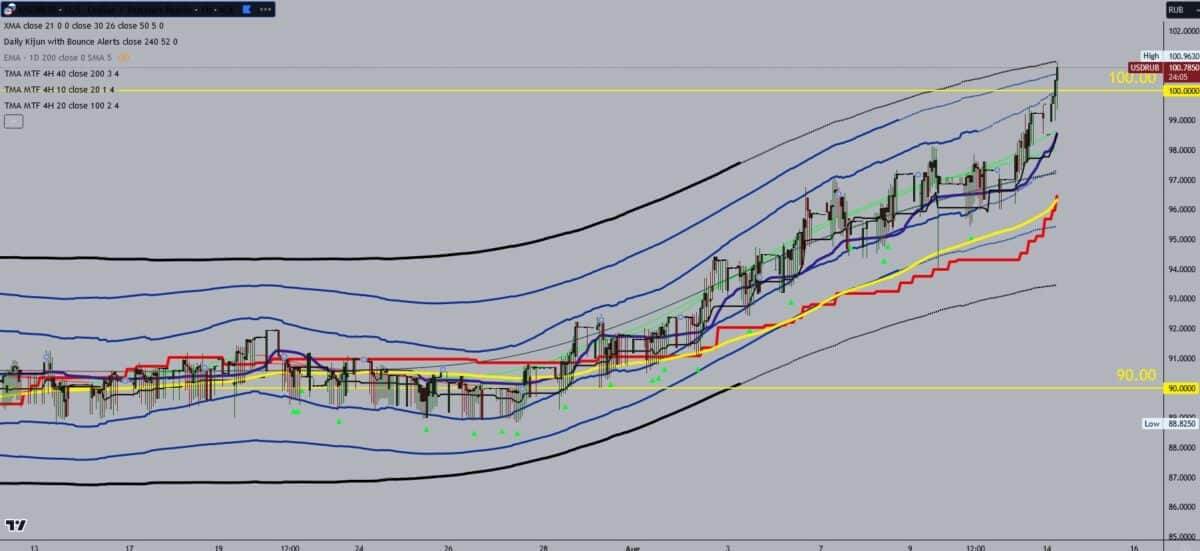

Russian Ruble Collapses Beyond 100 per US Dollar

In a tumultuous turn of events in the global currency markets, the Russian Ruble has crossed a historic and psychologically significant threshold, falling below the 100-to-1 mark against the US dollar. For comparison, six months ago exchange rate was circa 70-74 rubles per USD. This drastic depreciation of the Ruble comes amidst various geopolitical and economic challenges, with the ongoing Russian invasion of Ukraine, and western sanctions imposed on Russia, standing out as the most conspicuous.

The current military conflict, which has drawn widespread international condemnation, has substantially impacted the Russian economy. As a result of the invasion, Russia faces a barrage of international sanctions, which have been rapidly imposed by the US, EU, and other major global powers. These measures target key sectors of the Russian economy, including its vital energy industry, banking sector, and leading oligarchs. These punitive actions have drastically reduced foreign investment and halted many international transactions involving Russia.

Furthermore, there’s a growing apprehension about the fiscal and economic sustainability of Russia’s actions. War is expensive, and with revenues cut off due to sanctions and declining oil prices, Russia’s foreign exchange reserves might be under stress. The possibility of Russia defaulting on its international debt obligations, though still distant, has added to the bearish sentiment on the Ruble.

Apart from the direct economic implications of the invasion, investor sentiment has also been negatively affected. The increasing unpredictability of Russian foreign policy is making global investors jittery, leading to a pull-out of investments from Russia and causing a sharp decrease in the inflow of foreign currency.

Russian Ruble Collapse – further outlook

As for the outlook, there are numerous factors that suggest the Ruble could face even more downward pressure in the near term:

- Sustained Sanctions: If the conflict continues and Russia remains intransigent, we can expect more sanctions to be imposed, deepening the economic isolation.

- Oil Price Fluctuations: Russia’s economy is heavily reliant on energy exports. Any decline in global oil prices, due to either reduced demand or increased supply, will negatively impact Russia’s revenue streams.

- Domestic Pressures: As the Ruble falls, the cost of imports rises, leading to potential inflationary pressures at home. If this spirals, it could lead to civil discontent, further destabilizing the domestic situation.

- Global Economic Climate: A global downturn or recession could lead to reduced demand for Russian exports, putting further pressure on its foreign exchange earnings.

- Potential Military Expenditures: If the conflict escalates, Russia’s military spending might soar, putting additional strain on its national budget.

While the international community continues to push for a peaceful resolution to the Ukraine conflict, the ongoing situation casts a shadow of uncertainty over the Russian Ruble’s future trajectory. Investors and global markets will be keenly watching the developments in the region and assessing their implications on the world economy.