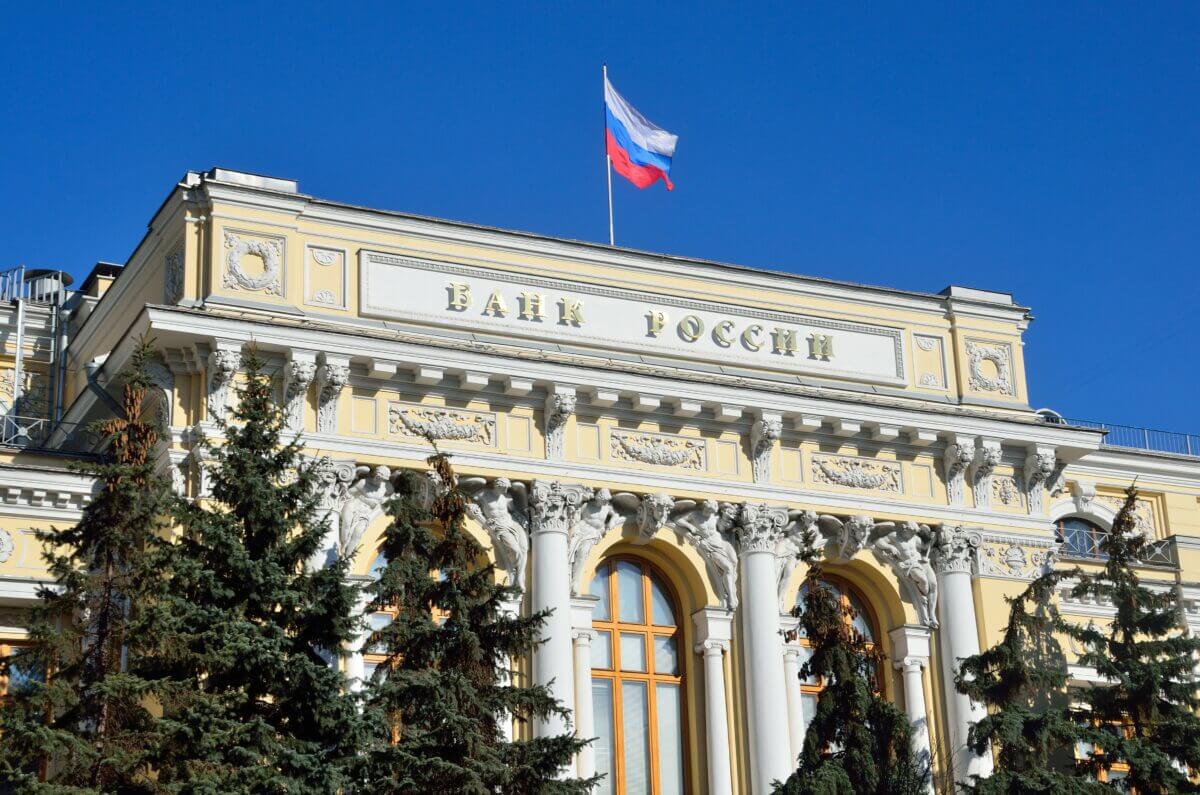

Russia Lowers Interest Rates To 4.5%, its Lowest Point since Post-Soviet Union Era

The Central Bank of Russia announced a 100 basis points cut on interest rates to 4.5% on Friday. This marks the lowest rate since the fall of the Soviet Union. The move is aimed at cushioning the economy from the devastating impacts of the Coronavirus pandemic and preventive measures.

In April, when the Russian GDP contracted by 28%, the CBR cut the interest rates by 50 basis points. Meanwhile, it suggested that it would also reduce lending costs. This was in the wake of low inflation risk and a continuously contracting economy.

According to the official statement, the CBR stated that “disinflationary factors” have been worse than projected. This is due to prolonged restrictive measures in Russian and around the world.

“The effect of short term pro inflationary factors has been largely exhausted. Financial stability risks related to the situation in global financial markets have declined.” This was according to a statement.

The CBR stated that, in 2021, inflation might be lower than the current 4% target. To corroborate this, they mentioned “household” and “business” inflation as some of the areas where inflation is less intense.

“The key rate decision taken by the bank of Russia is aimed at limiting and maintaining inflation close to 4%.” This was according to the same statement.

Actual, Expected Inflation Dynamics to Determine Future Key Rate Decision-Making

The Bank of Russia stated that its future decision-making for a rate reduction will depend on how the “situation develops”. It will behave according to its “baseline forecast.”

“In its key rate decision-making, the Bank of Russia will take into account actual and expected inflation dynamics relative to the target and economic developments over the forecast horizon, as well as risks posed by domestic and external conditions and the reaction of financial markets.”

CBR also expects that inflation dynamics for the rest of 2020 and the first quarter of 2021 will be affected. Namely, by the “steep decline” witnessed in both domestic and foreign demand in the second quarter of 2020.

Russia was one of the emerging markets that was slow to respond to the pandemic. It is the third most affected country by the coronavirus pandemic, with over half a million confirmed cases.

However, Capital Economics’ emerging Europe economist Liam Peach observed that the country has now firmly put in place easing monetary policy to protect its economy. Peach added that the policy rate will likely go down from 4.5% to 4% in the last quarter of 2020.

“Crucially, the statement provided a strong signal that the easing cycle has further to run, with the CBR stating that it will consider the possibility of further interest rates cuts at upcoming meetings.” Stated Peach.

Economic Recovery Support Continues Via Lending and Gradual Lifting Of Restrictions

According to the CBR, May-June easing in monetary conditions was a result of a tightening in March-April. This was despite a drop in OFZ and corporate bonds.

Subsequently, improvement in global markets and the global economy decreased the country’s risk premium. This then combined with reduced interest rates on deposits and housing and mortgage loans.

These factors, in addition to increased credit risks and non-price lending in certain market segments, have paved the way for further reduction in the future.

“Coupled with the Government and other Bank of Russia’s measures, this will support lending, including in the most vulnerable sectors of the economy.” According to the statement.

The Government’s gradual easing of restriction measures between May and June will help consumption-based economic sectors to recover. The CBR also expects economic activity in 2020 to reduce by 4-6%. Positive economic news and recovery will likely occur between 2021 and 2022.

Russia’s Economy Heavily Reliant on Oil Exports and Natural Resources

According to Erik Norland, CME Groups’ senior economist, the confidence portrayed by the CBR in the stability of the Russian economy is based on its “strong economic fundamentals.”

Norland stated that heavy reliance of the Russian economy on natural resources such as oil exports hit the country hard, especially after China’s reduced consumption as its biggest importer. However, this makes them one of the countries in the world with the lowest debt levels.

“Russia’s public and private sector debt totals just 80% of its GDP, compared to 250%+ in China, Europe, Japan and the U.S.,” Norland stated.

This is in addition to the “relatively modest” fiscal support, which amounts to about 2% of its GDP indicates the government’s reliance on monetary policy.