| General Information | |

|---|---|

| Broker Name: | Tickmill |

| Broker Type: | Forex |

| Country: | Seychelles |

| Operating since year: | 2015 |

| Regulation: | CySEC, FSA SC, FCA UK |

| Address: | 3, F28-F29 Eden Plaza, Eden Island, Mahe, Seychelles |

| Broker status: | Regulated |

| Customer Service |

|

| Phone: | +852 5808 2921 |

| Email: | [email protected] |

| Languages: | English, Russian, Chinese, Indonesian, Spanish, Polish, Thai, Italian, Malay, Korean, Vietnamese, Portuguese, German, Arabic |

| Availability: | 24/5 |

| Trading | |

| Trading platforms: | MT4 |

| Trading platform Time zone: | GMT +2 |

| Demo account: | YES |

| Mobile trading: | YES |

| Web-based trading: | YES |

| Bonuses: | YES |

| Other trading instruments: | YES |

| Account | |

| Minimum deposit ($): | N/A |

| Maximal leverage: | 1:500 |

| Spread: | NO |

| Scalping allowed: | YES |

Tickmill Review (2021 Update)

Review Contents:

- General Information – Introduction to Tickmill Review;

- Funds Trading and Security;

- Trading Accounts at Tickmill;

- The Tickmill Conditions;

- Trading Platform;

- Tickmill’sTrading Products;

- Customer Service;

- Tickmill Review Conclusion;

General Information – Introduction

forex. It was established in 2015. It has been providing quality brokerage services ever since.

The broker is based in Seychelles. The firm’s address is 3, F28-F29 Eden Plaza, Eden Island, Mahe.

When changing brokers, experienced traders have become quite cautious. Why wouldn’t they, after all, when it seems like every other company is a scam these days. However, the good news is that Tickmill doesn’t belong in the same basket as those shady brokers. They do business is straight-forward and transparent, so there aren’t any tricks to worry about.

Us saying “don’t worry,” however, isn’t proof enough for most people to flock onto Tickmill. Rightfully, they want to find out about further details, which we are happy to provide:

Tickmill aids newer users with a series of webinars, seminars, videos, and other learning resources. The information on the website goes quite deep, helping beginners’ trading experience. Furthermore, even experienced traders could certainly learn something if they went through it all.

-

TIGHT SPREADS

With spreads as low as 0 on some account types, they provide the best possible offer to their customers.

-

500:1 LEVERAGE

The firm allows users to trade with a 500:1 leverage that makes it easier to turn a profit. Traders should grab any small advantage that they can, and this solid leverage allows exactly that.

-

RIGOROUS REGULATION

Many modern brokers circumvent the complicated process of getting licensed by a strict regulator. They usually take the easy route of lax regulation, which, in actuality, doesn’t mean anything. That makes it even more impressive that the Tickmill group secured not one but five licenses.

-

DEPOSIT AND WITHDRAWAL

TickMill offers three diverse depositing and withdrawing methods. They are bank transfer, Visa / Mastercard, and Skrill.

Transfers can be done in the following currencies: USD, EUR, GBP. The minimum deposit size is 100 units for all options. And withdrawal is only 25 units. Processing is done within one working day, and no commissions are applied.

In this Tickmill review, we will closely analyze what Tickmill offers and its conditions.

Funds Trading and Security

As we’ve already mentioned, we think quite highly of the security that Tickmill provides, and it’s time to elaborate why. First of all, they hold a substantial five regulator licenses, which is more than nearly all other online brokers. Tickmill UK is regulated by the Financial Conduct Authority (FCA). Tickmill Europe holds a CySEC license, while the ltd branch is under the Financial Service Authority (FSA). The Asian and South African sections work under the Labuan FSA and FSCA, respectively.

All of these licensers are respected institutions, and even if the firm were regulated by only one of them, they’d be in good hands. However, since they are covered by all five of these watchdogs, there’s nearly no chance of them tricking their customers. Even if the broker wished to do so, it’d face hefty fines and a possible shutdown. Additionally, they’ve been quite diligent in resolving any issues that customers might have. You can see them responding to both positive and negative reviews online, showing that they genuinely care about user experience.

To add to all of that, they haven’t had any part in any scandals. They also enjoy a positive reputation around the internet. Most of the few complaints express user dissatisfaction with the experience and not any malicious behavior.

Overall, the reputation score is as good as it can get for an online broker. The way they operate seems spotless, and your funds are undoubtedly safe with Tickmill.

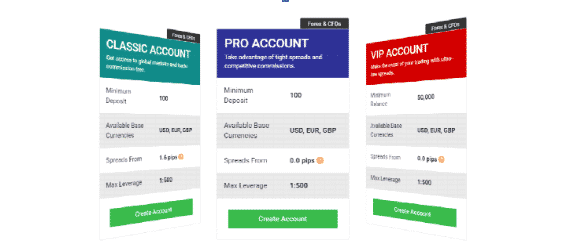

Trading Accounts at Tickmill

Tickmill offers three different live account options to their customers. There’s the classic account, pro account, and VIP account, the last one accommodating users willing to invest serious funds. However, each of the reports has an exceptional investment-service ratio, so you can’t go wrong with any of them. There are also swap-free Islamic accounts, which is a nice inclusion that lets even more traders enjoy their services.

Lastly, there’s a demo account option for users who want to test out the service before actually investing money. Demo accounts are a meaningful tool since they’re the best way to judge a broker’s service in practice.

However, since there’s not much else to be said about the different account variations, here are some of their specifications:

-

CLASSIC

Minimum deposit: $100

Minimum balance: N/A

Spread: 1.6 pips

Maximum leverage: 1:500

Commissions: Zero Commissions

-

PRO

Minimum deposit: $100

Minimum balance: N/A

Spread: 0.0 pips

Maximum leverage: 1:500

Commissions: 2 per side per 100,000 traded

-

VIP

Minimum deposit: N/A

Minimum balance: $50000

Spread: 0.0 pips

Maximum leverage: 1:500

Commissions: 1 per side per 100,000 traded

As you can tell, not many changes take place when you switch accounts. That means users don’t need to feel bad about not investing a ton of money. At the same time, however, loyalty does yield some nice rewards. Tickmill’s account setup strikes an excellent balance between being accommodating to budget users and high spenders.

The Tickmill Conditions

make it easier for their users to turn a profit. The leverage is at 1:500, which is, as far as many are concerned, the sweet spot. At that level, it’s just high enough to help but not high enough for users to get ahead of themselves.

The spread is also great for users, as two of their three account types have none at all. That’s a feature you’ll rarely see an honest broker provide, and it makes earning money significantly easier. The accounts also aren’t too expensive, meaning the barrier to entry isn’t high.

We should also mention their copy trading feature here, as many brokers have recently incorporated it. The broker cooperates with MyForexBook to bring the function to its users. With copy trading, you can follow expert traders, which makes it easier to turn a profit. It also automates a large part of the trading process, making it more convenient for some.

Lastly, we can’t speak about trading conditions without circling back to the excellent security. Unfortunately, we live in a world where many brokerage companies aim to lure users into a false sense of security. The goal here is to steal their money via malicious tactics, like refusing withdrawals or straight-up draining their accounts. As such, we view the certainty that you won’t get scammed out of your money as a significant trading advantage. At Tickmill, you have that security, which is in no way a small deal.

Tickmill provides near-perfect trading conditions, and we’re confident that both veterans and newer traders will enjoy the experience.

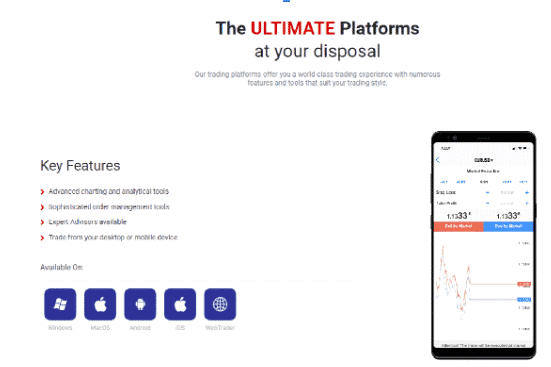

Trading Platform

Tickmill provides only one trading platform to its users, but one, in this case, is more than enough. Namely, they went with MetaTrader4, the most popular and widely-used platform in the brokerage world. MT4 earned that spot for a reason, with its easy-to-navigate interface allowing novices to jump into trading instantly. However, experts aren’t left out either, as the analytical tools MT4 provides can help you no matter your skill level.

To add to that, there’s a web app you can use if you’re unable to download the actual client. It loses very little in terms of functionality and can provide a lot in the form of convenience. You can use any device and trade instantly.

Lastly, there’s also a mobile client that lets you trade on the go. All you need is mobile data and a stable connection. You can get it for free on the Google Play and Apple App stores. Another great thing about it is that it’s synced with all your other instances of MT4.

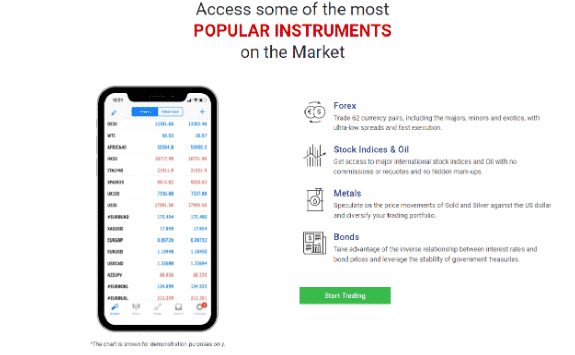

Tickmill’s Trading Products

Tickmill provides excellent variety as far as trading assets are concerned, with only one possible missing feature. To be specific, there are no options to trade cryptocurrencies, which might deter some users. However, we don’t consider the lack of digital currencies enough of a reason to neglect the rest of Tickmill’s service. Here’s a shortlist of what you can expect to see in the broker’s selection:

- Over sixty currencies/pairs – Currencies and their pairs are some of the most common assets to be traded. There’s quite a selection at Tickmill, so it’s pretty confident you’ll find what you’re looking for.

- Spot energies – The broker also provides the most common energy trading option in oil.

- Spot metals – They also let you trade with precious metals, like gold, silver, and others. Metals are quite a stable market and are perfect for traders that don’t want too much fluctuation.

- Spot shares – There are various shares from many of the world’s largest companies to pick from at Tickmill. However, there’s also a selection of smaller firms, for those that believe that that’s the better route to earning money.

Customer Service

As per usual, there are three ways you can contact the Tickmill customer support team. You’ll be able to use an email address, phone line, and, lastly, a live chat option. They work 24/5, as is usual in the brokerage world, and respond to emails within a business day.

What we found impressive was that their support team was active even outside their own website. They are quick to respond to many different review websites and eager to help users with their issues.

Phone number: +852 5808 2921

Email: [email protected]

Tickmill Review Conclusion

Even then, many wouldn’t consider that a mistake at all, as they avoid the digital currency market. However, whether you think it’s a flaw or not doesn’t even matter. We say that because there are a ton of positives that overshadow this minor negative.

They use an excellent platform, MT4, which is familiar to many users and lets them start trading without delay. The buying and selling specifications, such as the spread and leverage, are equal or better to the industry standard. That means you’ll have an easier time achieving financial success. The customer support is quick and attentive, eliminating extended waiting periods before your issues get resolved.

To top it all off, they have no apparent trust issues and enjoy an excellent reputation. That covers one of the primary concerns with online brokerages.

After all, in this Tickmill review, we can conclude that it is a good broker. We certainly recommend trying out the service for yourself and expect that you won’t be disappointed.

-

Support

-

Platform

-

Spread

-

Trading Instrument

Good profit

Happy with my trading results. I gain good profit from my trades.

Did you find this review helpful? Yes No

Excellent broker signals

Excellent broker signals. I am getting 10percent profit on average. Been using this broker service for more than a year and they’re consistently good.

Did you find this review helpful? Yes No

Fully satisfied

The best broker among the ones I have tried. They have very good signals and a smooth withdrawal process. I never encounter any single problem and I am fully satisfied with the services.

Did you find this review helpful? Yes No

Reliable services

Reliable signals and services. Customer service serves happily.

Did you find this review helpful? Yes No

Good services

Good broker. They have been my broker for over a year and by far services are good.

Did you find this review helpful? Yes No

Non conventional brokers

Non-conventional brokers. They are very creative.

Did you find this review helpful? Yes No

Fast and easy withdrawals

I got my withdrawal earlier than expected. Easy and fast withdrawal process.

Did you find this review helpful? Yes No

Happy with the services

I have been using this broker for a long time and I am satisfied. No plans for switching. I am more than happy with the services.

Did you find this review helpful? Yes No

Good profit

I am trading with this broker for over a year now. I am making good money out of their trading signals and instruments. Every withdrawal is approximately 15 percent of my initial deposit and I am making around 5 withdrawals on a monthly basis.

Did you find this review helpful? Yes No

Competent broker

Competent broker services. I have never dealt with a broker as well as them. Always delivers good results.

Did you find this review helpful? Yes No

Helpful and accommodating

Helpful and accomodating customer service. I’ve got no complaints at all.

Did you find this review helpful? Yes No

Good profit

I am thankful to have them as my forex trading partner. No regrets, they have helped me gain good profit.

Did you find this review helpful? Yes No

Good broker

Good overall. Recommended broker.

Did you find this review helpful? Yes No

Amazing

They have excellent customer support. Services are truly amazing.

Did you find this review helpful? Yes No