Power Indicator in Forex And Other Examples You Should Know

Have you ever seriously thought about using a Power indicator in the Forex market that would benefit you? Do you want to improve your previous knowledge and results with the help of this type of tool? What does the Power Indicator represent, and are there more examples of power indicators?

As a serious professional in the volatile Forex market, which is still considered the largest and most dynamic financial market with a daily turnover of around 6.6 trillion, it is unsurprising where the craze for technical indicators comes from.

Today, the best trading assistant you could wish for is a quality Forex indicator that has gained users’ trust. The exchange of foreign currencies for profit has become many people’s main activity and business.

But what exactly is the Powerful Indicator of the Forex market? And is he the only one considered so “powerful,” or are there quite a few more that we can consider? Let’s find out everything!

What is the Power Indicator in Forex?

The famous Forex Power Indicator is one of the most reliable tools in the industry, specially designed to assist traders in saving their time and energy, effectively increasing their chances of profits. These chances are increased thanks to identifying present trends and potential opportunities for trading.

This tool determines the comparative level of power or potency of huge currencies such as EUR, USD, GBP, CAD, and others, based on the following periods:

- Monthly

- Weekly

- Daily

- Four-hour

- One-hour

- Fifteen minutes

The “relative currency strength” is decided upon by an advanced formula. It’s crucial to note that the respective currency weights are pre-defined by a formula that evaluates past connections among different currencies, identifying their comparative currency potencies.

The top five currency pairs exhibiting the most significant trading potential are then identified based on these currency weights.

If you are interested in using this instrument, select the desired time interval from the top of the Indicator: Monthly, Weekly, Daily, 4-hour, 1-hour, or 15 minutes. You will immediately get two refreshed charts that form the foundation of this Power tool.

What does the Forex Indicator show you?

This particular Power indicator is beneficial because it shows you strong currencies, weak currencies, and those in between. The software automatically calculates and updates it and is suitable for every trader who wishes to rank the top currencies from strongest to weakest.

To understand the chart in the Power Indicator, it’s crucial to remember that any number of figures above 0 represents relative strength, while any figure beneath it equals “relative weakness.” By recognizing strong and weak currencies, every Forex trader could achieve a huge advantage in the market.

With this Power indicator, traders are also able to identify the currency pair that includes the biggest leverage, meaning that both the weakest and strongest will be paired together.

Why are rapid-moving pairs more attractive?

Rapid moving pairs in the Forex market are more attractive than the slower ones because a trade could hit the target sooner, leave the risk more quickly, and potentially experience windfall profits when the trail stop loss is being utilized.

The main benefits of the Forex Power Indicator

In addition to all this information from above, where we have included some benefits of frequent use of this Indicator, here are a few more valid benefits that we must not forget to mention:

- The ability to trade the currency pairs with the most movement and avoid the slow (worst) currency pairs.

- The strength vs. weakness analysis could be completed in nearly all time frames.

- This tool is accessible to any Forex trader.

- It could be used for multiple time-frame analyses and other MTF trading needs.

- With the Power Indicator, traders can scan the Forex market as quickly as possible and spot valuable currency pairs with the most potential.

- It assists traders in pointing their vision in the right direction almost immediately.

How to use the Power Indicator the best?

If this high-quality and beneficial tool has attracted you to the point that you want to learn how to use it, here are the simple steps you should take in that case:

- Pick a time frame you prefer the most.

- Find the strongest and nearly strongest currencies.

- Check also the weakest and nearly weakest ones.

- Examine the top five currencies and do an in-depth analysis of them.

- Afterward, analyze charts of the pre-selected currency pairs and see if they need a setup. Suppose multiple pairs show promise. In that case, the trader must select the most favorable one or allocate the risk across multiple setups following their risk management criteria.

What to keep in mind while using the Power Indicator?

It’s important to note that only some charts are set up for a proper trade because this Indicator clears that out. Traders must check it themselves with this tool. To comprehend the basic chart structure, it’s advisable to utilize technical analysis.

However, this Forex Power Indicator is a fantastic tool since it provides us with the currency pairs that have the most potential. So, instead of dealing with the wrong currencies, this Indicator will show us the strongest currencies we should focus on.

What are other Powerful Indicators you should know about?

Besides this great Power Indicator, we’ve prepared you with more information about other Powerful Indicators you should consider. Here are the top Powerful Indicators, besides the Power Indicator, that are beneficial for any trader in the Forex industry:

Bollinger Bands

The Bollinger bands indicator is utilized to identify the trade entry and exit points when gauging the price volatility of a given security. This Indicator comprises three bands, namely the upper, middle, and lower brands, frequently applied to ascertain the overbought and oversold conditions.

One of the most advantageous aspects of this Indicator is that it effectively characterizes the evolution of a financial instrument’s price and volatility over time.

Moving Average (MA)

The moving average (MA) is an essential forex indicator representing the average value of a particular security’s price over a specified period. The MA can indicate whether the buyers or sellers control the price, depending on whether the price trades above or below the moving average.

As part of their trading strategy, traders should concentrate on buying when the price exceeds the moving average. The moving average is an indispensable forex indicator that every trader should familiarize themselves with to develop a successful trading plan.

Fibonacci

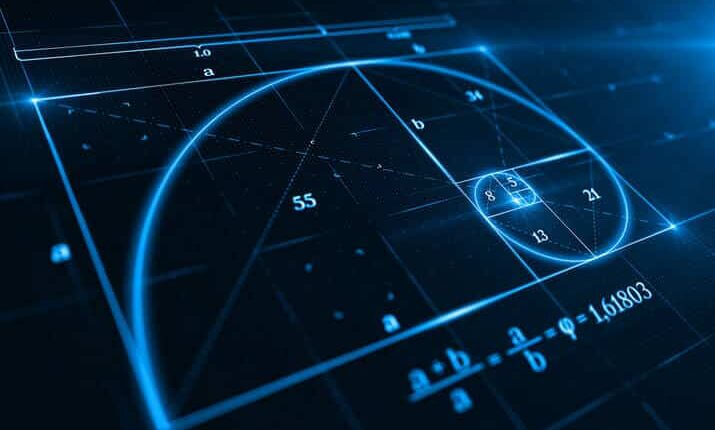

The Fibonacci forex indicator is a valuable tool used to identify the market’s direction with remarkable precision, based on the golden ratio, known as 1.618. Many forex traders rely on this Indicator to pinpoint potential areas of price reversals and take advantage of profitable opportunities.

Fibonacci levels are typically calculated after the market has made a significant move up or down and appears to have leveled off at a specific price level. By plotting the retracement levels of Fibonacci, traders can identify areas where the market may retrace before moving back to the original trend created by the initial price movement. In summary, the Fibonacci Indicator is an indispensable tool for traders seeking to improve their trading strategies and make informed trading decisions.

Stochastic

The Stochastic forex indicator is a potent instrument that enables traders to gauge momentum and pinpoint overbought or oversold zones in the market. It is widely recognized as among the best indicators for forex trading.

When used in actual trading scenarios, the stochastic oscillator is highly effective in identifying possible trend reversals in the market. It does so by contrasting the closing price against the trading range within a specified period, providing valuable insights into the market’s current momentum.

As a result, all Forex traders are able to make informed decisions based on the likelihood of future market movements.

Relative Strength Index (RSI)

The Relative Strength Index, commonly known as “RSI,” is one of the best indicators of power in the Forex market. It is included in the oscillator category and shows overbought and oversold conditions in the Forex market.

Pivot Point

This forex tool is designed to display a currency pair’s balance of demand and supply levels. The pivot point level is the crucial point where the supply and demand forces are in equilibrium.

A price above the pivot point indicates a high demand for the currency pair, while a price below the pivot point level indicates a greater supply. In forex trading, traders often use pivot points to identify possible trading opportunities based on the supply-demand balance of a currency pair.

Bottom Line

- The Power Indicator is a technical analysis tool utilized in the foreign exchange market to identify trends and reversals.

- It combines two indicators, the EMA (Exponential Moving Average) and RSI (Relative Strength Index).

- The Power Indicator helps traders to identify potential purchase and sell signals established on the direction and strength of the trend.

- It can also indicate overbought and oversold market conditions, allowing traders to act appropriately.

- The Power Indicator is easy to use and interpret, making it a popular tool for beginner and experienced traders.

- Traders can use the Power Indicator to develop and refine their trading strategies, potentially leading to greater success in the forex market.