Outside Bar Trading and Inside Bar Trading

Candlestick patterns are the most reliable tools Forex traders use. Outside bar trading and inside bar trading strategies are very often used by price action traders.

If you want to determine your entry points and exit points on the market, you need to understand these trading signals.

In this article, we will show you how these patterns form. Also, we will see how to spot and implement these patterns as they emerge in the chart.

Let’s get started with an explanation of bar charts in general.

What is a Bar Chart Used for?

Bar charts are useful tools in technical analysis and asset trading. It makes it possible to collect several useful pieces of information, particularly to identify market trends on prices and, therefore, facilitate decision-making between buying and selling in a given market.

A bar chart lets you know the opening and closing price and the price variation over a given period, depending on the chosen periodicity. Thus, reading a bar chart allows you to position yourself in a market with experience.

Inside bar and Outside bar trading Explained

What is an Outside Bar in Trading?

It’s a reversal pattern useful in precise action trading in the Forex market. This candlestick pattern engulfs the bar candle. It shows a significant reversal in the trending market.

Market Conditions for Outside Bar Trading

An outside bar pattern occurs in a chart once there is a small indecision in price movement. In general, the price gap goes away from the previous close price. And it gives traders the impression that the recent market trend is still on. Despite this impression, the price gap is filled very quickly. Once the time for closing has come, the price is outside the previous day’s open.

This sudden price fluctuation can make investors feel deceived and stuck when a price they thought followed a certain trend turns out to be incorrect by the end of the day. The formation of an outside bar candlestick signals a shift in the attitudes and beliefs of investors throughout the day.

Bullish and Bearish Outside Bar Trading

Bullish patterns follow two key rules. Firstly, they must emerge during a market decline (otherwise, they are considered continuation patterns).

Secondly, most bullish reversal patterns need confirmation from bullish signals to be confirmed as such. Conversely, like bullish patterns, bearish patterns need confirmation from bearish signals. One or more candlesticks can identify bearish reversal patterns. These patterns indicate that selling pressure surpassed buying pressure over several days.

Outside Bar Candles Entry and Exit Rules

Follow these rules in order: risk no more than 1% of your account, buy at one cent over bullish pattern, set stop loss at 2x ATR indicator value, first profit target at 2x ATR, close half position at initial profit target, use trailing stop loss, move stop loss to break even, manually close if the price reaches 7x original risk.

Outside Bar Trading Strategies

Reversal Strategy

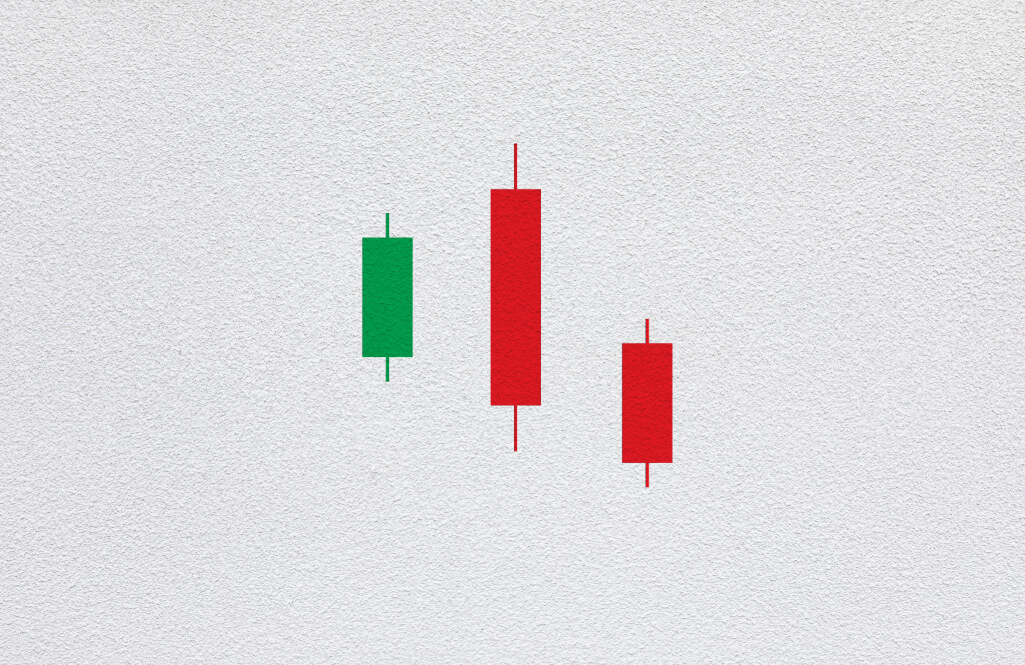

Once the trend is over, you can spot the following chart pattern: a long momentum candlestick is followed by a drop in momentum, indicating a lack of trend support.

A downtrend usually ends abruptly when several small inside bar candlesticks appear after the long momentum candlestick.

Following three consecutive inside bars, there is generally a sudden change in momentum, with a powerful outside bar driving the price higher. This is a common reversal pattern that demonstrates the change in momentum.

Trend Continuation Strategy

Outside bar sequences can signal that the trend will continue during pullback phases. Consolidations happen when the market moves sideways temporarily during a trend.

The trend resumes when buyers or sellers regain control and push the price toward the original trend. Outside bars often indicate momentum in the trend direction, suggesting more momentum is likely to follow.

Naturally, market trends don’t last, so limiting trading on first and second pullbacks can neutralize the risk of jumping on trend when it’s too late.

What is an Inside Bar?

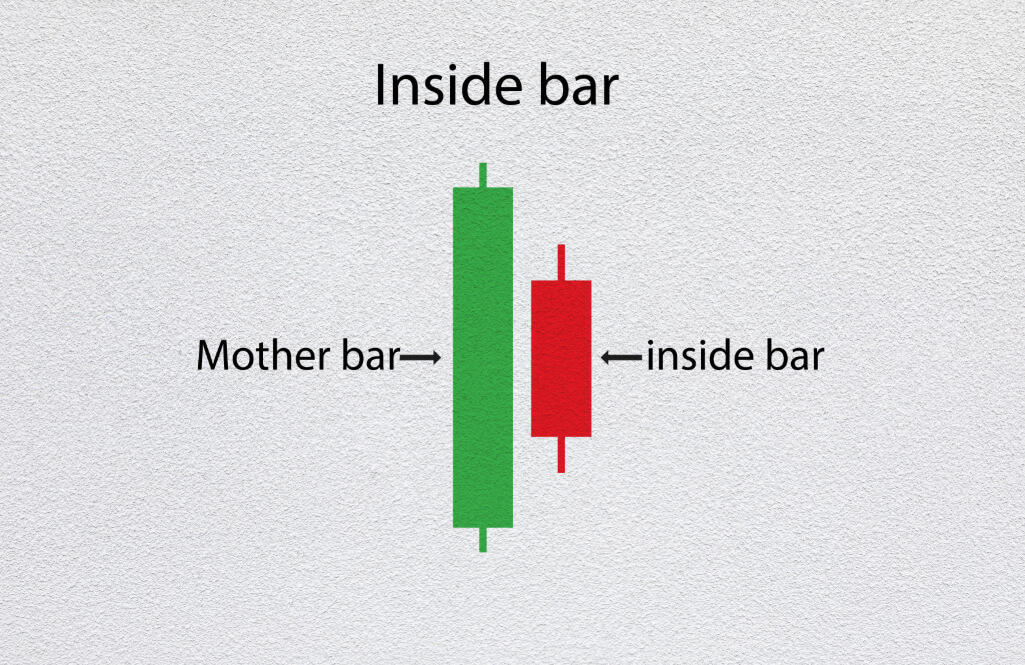

The inside bar is a technical figure composed of two candles. A first candle (A) is followed by a candle (B) whose height is lower than the height of the first candle and the low is higher than the low of the first candle.

The price accelerates when an inside bar pattern is broken. This is explained by the inside bar indicating a consolidation phase. A consolidation phase is a bit like the calm before the storm. The inside bar can serve as a trend reversal pattern. But we will use it as a continuation figure.

Just as for outside bars, you can find bullish outside bars and bearish.

In a bullish outside bar candlestick pattern, the price falls below the lows of the previous candle before closing higher than the highs of that candle. Conversely, in a bearish outside bar pattern, the price rises above the highs of the previous candle before closing lower than its lows.

Inside Bar Strategies

In trading, the inside bar strategy is a simple approach that allows you to obtain good results when properly applied.

This strategy can be used alone, but combining it with other strategies is possible.

Range Trading

The inside bar pattern can be traded in a ranging market. The Relative Strength Index (RSI) can confirm trends or reversals. The pattern consists of a sharp move followed by a bullish candle and then a bearish candle.

When the inside bar pattern emerges, the RSI hovers around 40-45, showing uncertainty in the market and the potential for consolidation.

In such situations, you can enter a trade to profit from minor price fluctuations within a specific range, focusing on support and resistance levels.

Breakout Trading

The inside bar breakout trading method involves identifying an inside bar formation with a large bullish candle followed by a smaller bearish candle and then looking for a third candlestick that rises above the second candle to indicate a likely price increase.

The Trend Filter: the 21-day EMA

Moving average (EMA) allows us to detect the trend. If the EMA is moving upward, then it is a bullish trend. If the EMA is moving downward, then it is a downtrend. An EMA that moves horizontally means that the price is in a period of consolidation. In this case, an “inside bar strategy” does not apply.

The Best Time Frame for Inside Bar Trading

The inside bar pattern will provide a better signal in a longer time frame. But this pattern is more convenient for scalpers and short term trades in general. Use this bar in a 15-minute time frame or lower for optimal results. Relying on this Forex strategy, you search for the inside bar in a downtrend or uptrend. Then, wait for the pattern competition and double-check price action using the support/ resistance levels indicator. After that, you can spot an inside bar trade.

The Bottom Line

Inside and Outside Bars are two prevalent candlestick patterns in technical trading. Understanding the inside and outside bar pattern is crucial for Forex traders. Knowing to spot them right aways as they start to form can immensely improve any technical analysis.