Candle pattern cheat sheet: Ultimate Candle Pattern Guide

Hey there, traders! Are you ready to crack the code of candlestick patterns? Whether you’re a newbie or a seasoned trader, understanding candlestick patterns is like having a secret weapon. In this ultimate candle pattern cheat sheet, we’re diving into the world of candlesticks. Those intriguing patterns that tell the story of the markets through their bullish and bearish dances.

Candlestick patterns are more than just a series of green and red or black candles on your chart. They’re the heartbeat of the market, revealing the ongoing tussle between buyers and sellers. From the bullish engulfing pattern, to the ominous bearish candlestick, each pattern provides valuable trading signals.

We’ll explore popular patterns like the Hammer Candlestick and the Doji Star, which are key indicators of price action and market trends. You’ll learn how to spot a bullish candle and its significance in predicting market movements.

We’ll also decode complex patterns like the Bearish Engulfing and the Morning Star, helping you understand what it means when a candle closes higher than the open.

This candle pattern cheat sheet is your ticket to identifying trading strategies that work. It’s all about reading candlesticks to predict future market behavior.

So, let’s get started and turn those candlestick chart patterns into actionable trading insights! Get ready to become a candle pattern pro and take your trading game to the next level!

Japanese candles technical analysis: What exactly are Doji candlesticks?

Japanese candlesticks have the advantage of being more visually appealing compared to the more common bar charts. In addition, they have the advantage of being less complicated. A candlestick, or also called a “candle”, includes the following elements:

A candle can be used at any time – for a single day, a week, a month or even short term (e.g. 5 minutes). The usefulness of Japanese candlesticks is almost always the same, this also applies to the signals listed below, which can be generated by Japanese candlesticks.

The color of the candles immediately indicates whether the trading day was positive (closing price higher than the opening price), or whether the trading day was negative (closing price lower than the opening price).

However, this is only the calculation of the trading day itself. The colors do not indicate whether the closing price was higher or lower than the previous day’s closing price! In general, bullish Japanese candlesticks are green or white, bearish Japanese candlesticks are red.

Trading Japanese candlestick signals: useful tips

It is important to note that Japanese candlestick signals do not claim to have a longer term reach. But in principle, signals have a temporal scope of four to five time units, in which they were created (in the case of a weekly signal: four or five weeks).

- However, Japanese candlestick analysis should never be an investor’s only tool. It is also important to apply the classic Japanese candlestick technique and analysis of technical market indicators.

- Japanese candlestick signals do not have a 100% rate, as is the case with all other technical analysis tools. This is why you should always use all technical analysis tools before making a buy or sell decision.

- Japanese candlesticks are rarely as perfect as described in the manual. It is therefore important to look carefully in order to recognize the signals and interpret them correctly.

- Additionally, Japanese candlesticks are always of great importance at the end of an upward or downward price movement!

- Japanese candlestick signals apply to all asset classes, whether indices, stocks, commodities, currencies or bonds.

- To be truly “valid,” Japanese candlestick signals must receive confirmation the next day if the stock price follows the direction indicated by the candlestick.

Dojis: Special Japanese candlesticks

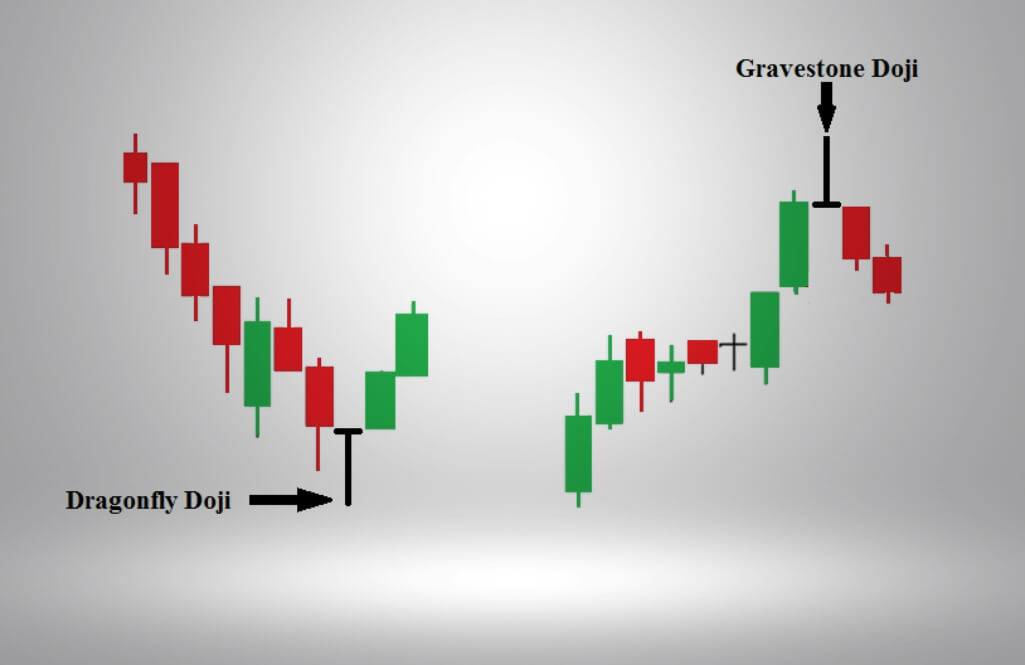

A special form of Japanese candlesticks are the “dojis”. These are candles that have little or no body. The following figure displays the different dojis:

The absence of the candle body means that the opening and closing prices of the trading day (or week or month) were exactly or almost exactly at the same level.

This often presents itself in sideways market trends. But at the end of a bull or bear move, it means that the previous dominance of the bull market (uptrend) or bear market (downtrend) no longer exists and an equilibrium is maintained.

Dojis, also called “spinning tops”, are characterized by a candle whose body is small and whose wicks are long.

Japanese candlesticks: bullish and bearish candles

Here are two typical candles: one up, the second down. Bullish candle vs Bearish candle. As shown in these drawings, the rectangular body represents the interval between the opening price and the closing price.

If the body color is white or green, there was an increase during the day. Otherwise, the body is black or red and there is a drop between open and close. Traditionally, we use a light color for the rise and a dark one for the decline, often white and black called white candle and black candle. Also it’s common to see green for bullish candlestick patterns and red for bearish candlestick patterns like in this image.

Let’s now look at the essential figures, those which have the most predictive power. We explain them separately so that you have time to better understand each configuration.

Bullish candlestick patterns cheat sheet

Here’s a list of some of the most popular bullish candlestick patterns that traders often look for in the market:

- Bullish Engulfing Pattern

This pattern occurs when a small bearish candle is followed by a large bullish candle that completely engulfs the previous day’s candle. It signals a strong reversal from bearish to bullish sentiment.

- Hammer

The hammer is a single candle pattern with a small body and a long lower wick. It indicates that despite selling pressure, the bulls managed to push the price back up, suggesting a potential reversal upward.

- Morning Star

This is a three-candle pattern with a small-bodied candle between a long bearish candle and a long bullish candle. It signifies the end of a downtrend and the beginning of an upward climb.

- Three White Soldiers

This pattern is made up of three consecutive long-bodied bullish candles. It shows a strong shift in momentum from the bears to the bulls.

- Piercing Line

This two-candle pattern starts with a bearish candle followed by a bullish candle. The second candle opens lower than the first but closes more than halfway up the body of the first candle, indicating a potential bullish reversal.

- Inverted Hammer

Similar to the hammer, this pattern has a small body and a long upper wick. It suggests that buyers are attempting to gain control and may signal a bullish reversal.

- Bullish Harami

This is a two-candle pattern where a small bullish candle forms within the range of a larger bearish candle. It indicates a possible turnaround in bearish sentiment.

- Bullish Doji

A Doji is a candlestick with an open and close near the same point, showing indecision. A bullish Doji occurs near the bottom of a downtrend and may signal a reversal to the upside.

- Dragonfly Doji

This is a specific type of Doji where the open, high, and close prices are the same. It has a long lower wick and no upper wick, indicating strong buying pressure after the open and potential for a bullish reversal.

Bearish candle patterns cheat sheet

Here’s a rundown of some of the most commonly recognized bearish candlestick patterns, which traders often look out for as signals of potential downtrends in the market:

- Bearish Engulfing Pattern

This pattern occurs when a small bullish candle is followed by a large bearish candle that completely engulfs the first one. It indicates a strong shift from bullish to bearish sentiment.

- Shooting Star

Characterized by a small lower body and a long upper wick, the shooting star appears during an uptrend, indicating that the bulls may have lost control and a reversal downward might be imminent.

- Evening Star

This is a three-candle pattern typically spotted at the end of an uptrend. It consists of a large bullish candle, a small-bodied candle, and a large bearish candle, signaling a potential bearish reversal.

- Three Black Crows

This pattern features three long, consecutive bearish candles after an uptrend, suggesting a strong reversal from bullish to bearish momentum.

- Hanging Man

The hanging man is a bearish reversal pattern that appears at the end of an uptrend. It has a small body and a long lower wick, indicating that selling pressure is starting to outweigh buying pressure.

- Bearish Harami

This pattern consists of a large bullish candle followed by a small bearish candle. It indicates that the bullish trend may be losing steam and a bearish reversal could be on the way.

- Gravestone Doji

This is a specific type of Doji where the open, low, and close prices are the same. It has a long upper wick and no lower wick, signaling a failed rally and potential for a bearish reversal.

- Bearish Doji Star

A bearish Doji Star occurs during an uptrend and represents indecision in the market, which could be a precursor to a reversal in the downward direction.

Most Popular Candle Patterns

Let’s look in detail at some of the most popular candle patterns that day traders use.

Hammer

Japanese candlesticks with a small body and a long lower wick. A trading day with sometimes heavy losses turns out favorably. Similar to the Dragonfly Doji.

The figure of the hammer is all the more positive if its body is white or green. However, this is not obligatory.

Shooting star

Japanese candlesticks with a small body and a long upper wick. It is a variation of the “Gravestone Doji”, but with a visible candle body.Sometimes significant price gains are sold.

The figure of the shooting star is more relevant if the body of the candle is red.

Haramis candlestick patterns

Haramis indicate the possibility of a trend reversal. Namely, the moment a previous dynamic movement suddenly stops, it suggests that those who previously determined the direction of the trend are losing power. This situation is displayed by two candles.

Bullish harami and bearish harami

Bullish Harami

Japanese candlesticks with a small body whose edges do not exceed the body of the red candle which precedes it and which is part of a downward movement. It indicates a bearish trend.

The bearish momentum could be over. However, confirmation is necessary due to the attractive prices that could occur immediately in the following days. The smaller the second body of the candle, the higher its utility.

Bearish Harami

Japanese candlesticks with a small body whose range does not exceed the body of the green candle which precedes it and which is part of an upward movement.

The bullish momentum could be over. However, confirmation is necessary due to a drop in prices which could occur immediately in the following days. The smaller the body of the candle, the higher its utility.

Bearish or bullish engulfing formation

Bullish engulfing formation

A white candle which completely envelops the body of a red candle which is located just in front.

The bull market was able to force a positive day by breaking out of the red zone. This can cause an upward change in direction.

The first body of the candle should ideally be red, but this is not necessary. It is important that it only becomes truly significant after a downward movement. If the white candle envelops not only the body of the previous candle, but also the entire trading range (including the upper and lower wick), its usefulness is even higher.

Bearish engulfing formation

A red candle which completely envelops the body of a white candle which is located just in front.

The bear market was able to force a negative day by releasing positive capital gains. This can cause a downward change in direction.

The first body of the candle should be white, but this is not required. It is important that it only becomes truly significant after an upward movement. If the red candle not only envelops the body of the previous candle, but also the entire trading range (including the upper and lower wick), its usefulness is even higher.

Candle Pattern cheat sheet: Bullish Piercing Line

A lighter version of the bullish engulfing formation. A white candle, whose lower body begins below the body of the previous red candle and extends past half of the body of the previous candle. It shows that the bull market has reached a change of direction moving out of the red zone. Since a closing price has not been reached above the opening price, the signal is slightly weaker than that of a bullish engulfing formation.

Candle Pattern cheat sheet: Bearish Piercing

A lighter version of the bearish engulfing formation. A red candle, the upper body of which begins above the body of the previous white candle and exceeds half of the body of the previous candle.

The bear market has reached a change of direction moving out of the red zone. Since a closing price has not been reached below the previous opening price, the signal is weaker than that of a bearish engulfing formation.

Morning Star

The Morning Star is an upward trend reversal pattern. It consists of three candles: a red candle, a Doji and a white candle.

After a downtrend, it is possible to break the dominance of downtrends by a Doji located below or near the bottom of the previous red candle. An immediately following white candle confirms that an uptrend may be occurring. Please note: In order to be truly useful, in a timely manner, increasing prices as confirmation is necessary.

There are many variations possible regarding the size of the red and white candle and the position of the central Doji, which may have a small body. It is important that the change of direction in this combination of three candles is clearly visible.

Evening star

The Evening Star is a downward trend reversal pattern. It consists of three candles: a white candle, a Doji and a red candle.

After an uptrend, it is possible to break the dominance of uptrends by a Doji located below or near the top of the previous white candle. An immediately following red candle confirms that a downtrend may be occurring. Attention: In order to be truly useful, in good time, falling prices as confirmation are necessary.

There are many variations possible regarding the size of the red and white candle and the position of the central Doji, which may have a small body. It is important that the change of direction in this combination of three candles is clearly visible.

Conclusion

Japanese candlestick signals… They are everywhere! In this article, we have presented you with a selection of the Japanese candlestick signals that we consider to be the most important in technical analysis. Of course, there are a few others that we haven’t covered in this article. It is important to always follow the basic rules of Japanese candlestick analysis and go through the charts with your eyes open.