Oil and Natural Gas: Shut down?

- During the Asian trading session, the price of crude oil fell from $111.40 to $108.10.

- During the Asian trading session, the price of natural gas retreated from the $5.80 level and found support at the $5.60 price.

- Bloomberg reported that gasoline prices in the UK hit their highest level this week.

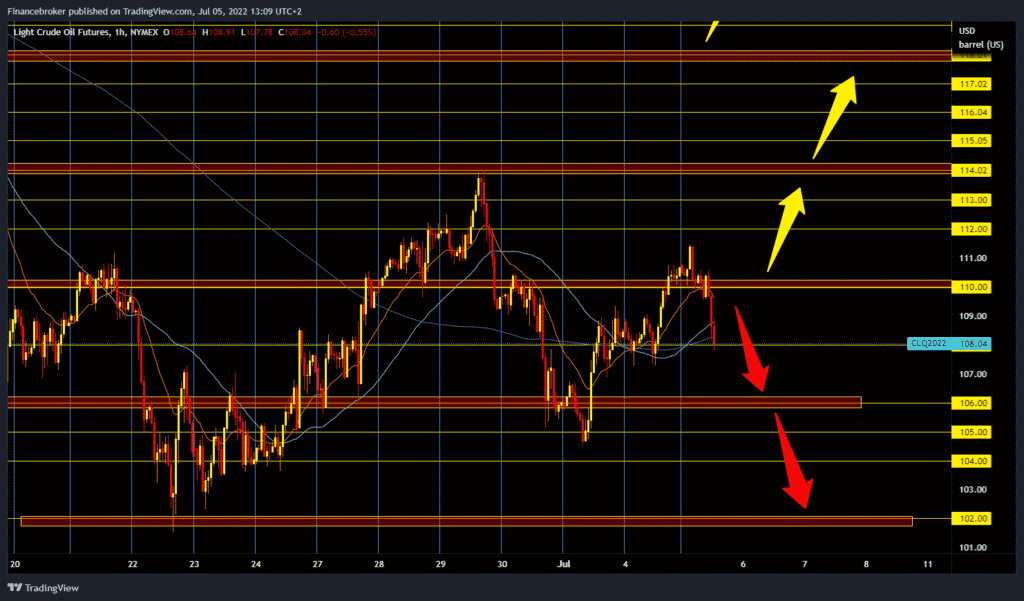

Oil chart analysis

During the Asian trading session, the price of crude oil fell from $111.40 to $108.10. Norway’s Equinor has closed Gudrun, Oseberg South, and Oseberg East in the North Sea due to a strike by Norwegian maritime workers. Tomorrow, three more fields are expected to be shut down, which would remove a total of about 130,000 barrels of oil from the market. The meeting of the OPEC+ initiative did not bring anything new on Thursday. The oil cartel decided to stick to the agreement from earlier to add about 650,000 barrels in August. However, the data for June show that at the level of ten OPEC members, production was not as much as it could have been.

Oil is trading at $108.10 a barrel, down 0.35% since trading began last night. In the Asian session, the price failed to break above $112.00, and a quick pullback followed. We are now testing support at the $108.00 level, and if we don’t get support here, the price could slide down to the $106.00 support zone. For a bullish option, we need a new positive consolidation and a return to the $110.00 level. Then we need a break above to continue towards the $112.00 level. A potential major resistance zone for us is around the $114.00 price point.

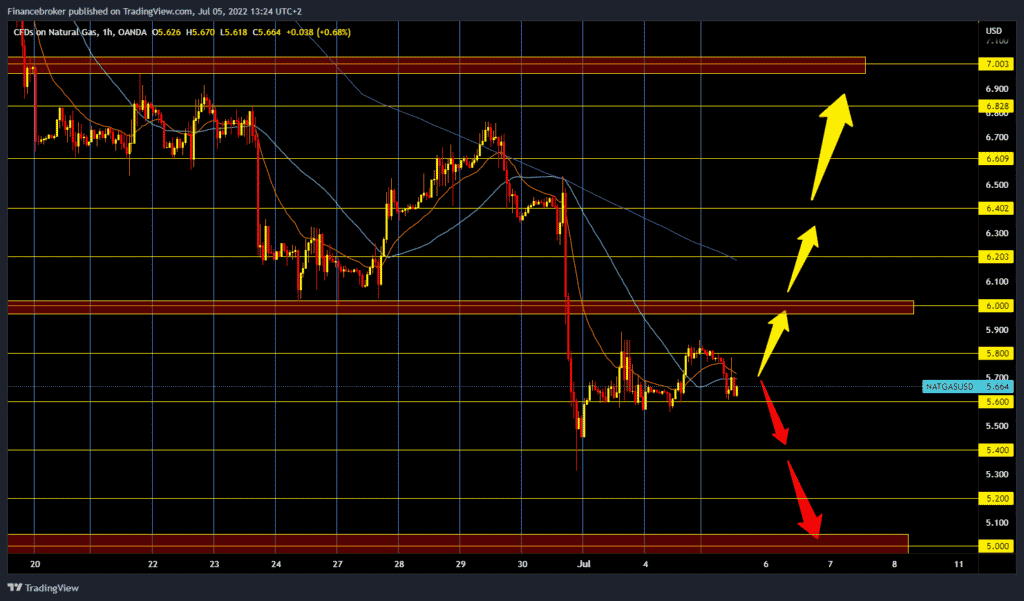

Natural gas chart analysis

During the Asian trading session, the price of natural gas retreated from the $5.80 level and found support at the $5.60 price. Once again, we turn to lower targets and now watch to see if the price will manage to make a break or hold above this support. For a bullish option, we need a new positive consolidation and a move above the $5.80 level. After that, we can attempt to climb up to the $6.00 price. A price break above could be above a longer recovery towards the following higher targets. We need a continuation of the negative consolidation and a drop below the $5.60 price for a bearish option. We will then retest support at $5.40. And if it doesn’t hold, we continue lower towards the $5.20 and $5.00 levels.

Market overview

Bloomberg reported that gasoline prices in the UK hit their highest level this week, with an average of more than $2.30 a liter, noting that it made UK petrol the most expensive in Europe’s five largest economies. The RAC, the motoring services organization, reported that retail petrol prices have diverged from wholesale prices, which have fallen for five consecutive weeks. “We would like to hear their reasoning for keeping their prices so high in this case,” said Simon Williams, a spokesman for the RAC. The rise in retail fuel prices sparked discontent, leading to protests.