Gold and Silver: Is the price going down again?

- During the Asian trading session, the price of gold fell slightly.

- During the Asian trading session, the price of silver hovered around $20.00, and as the day progressed, the price began to move towards the $19.75 support zone.

- The Federal Reserve’s daily talk of raising interest rates to curb rising inflation was a key factor that continued to act as a tailwind for underperforming gold

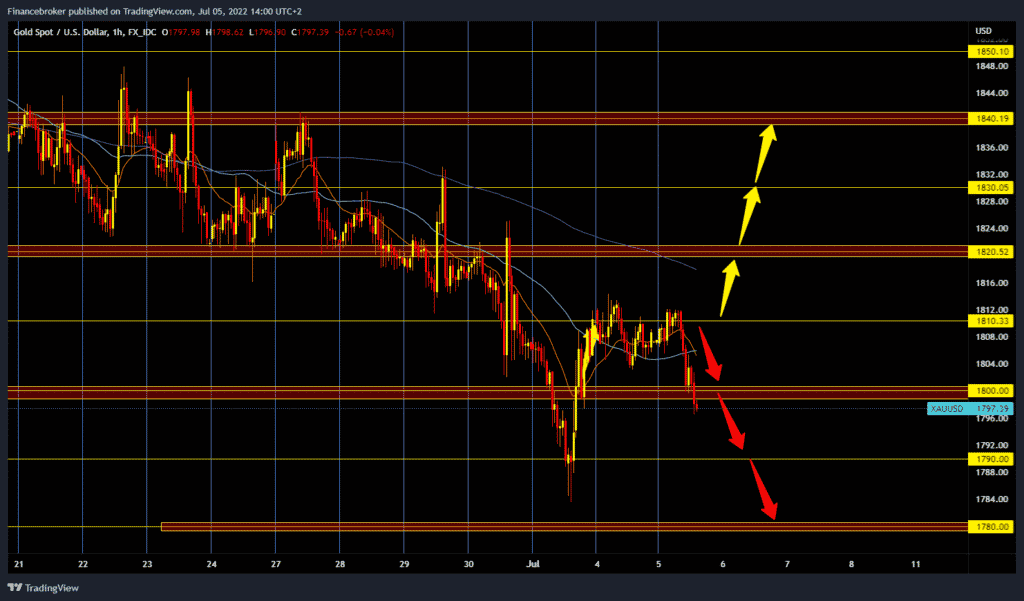

Gold chart analysis

During the Asian trading session, the price of gold fell slightly. The dollar strengthening and selling everything did not bypass gold last week. India, the world’s second-largest consumer of gold, then announced an increase in tariffs that dragged the price below 1800. The price of gold is trading around $1798 per fine ounce, a 0.47% drop since the start of trading tonight. Notes from the US Federal Reserve’s latest meeting are expected on Wednesday. This morning’s gold price failed to maintain the $1810 price, and a pullback to the $1800 support zone followed. We are moving around that level and further with increased bearish pressure. For the bearish option, we need a continuation of the negative consolidation and a deeper break below the $1800 level. Potential lower targets are $1790 and $1780. For a bullish option, we need a new positive consolidation and a return above the $1810 level. After that, the price of gold could continue its recovery. Our first next target is the $1820 level, and the additional resistance at that point is the MA200 moving average. A price break above would take us away from the critical support zone, which could push the price even higher.

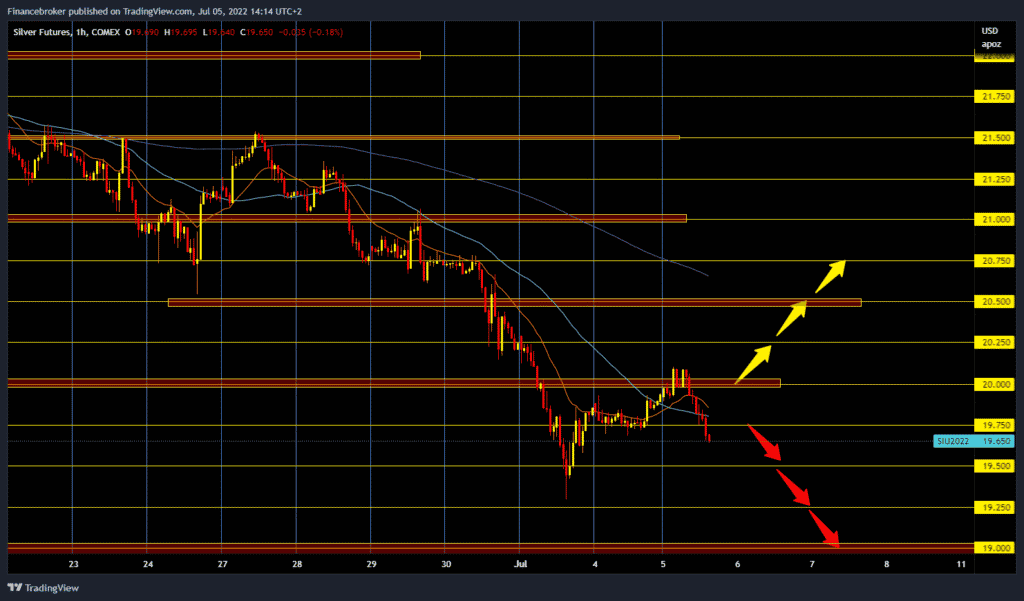

Silver chart analysis

During the Asian trading session, the price of silver hovered around $20.00, and as the day progressed, the price began to move towards the $19.75 support zone. We see a break below and a continuation of the pullback towards the $19.50 level. It is now very possible that we will soon test last week’s low at $19.30. Increased bearish pressure could lower the price to the $19.00 level by the end of this week. We first need a return above the $20.00 price for a bullish option. After that, with further consolidation, we could continue towards $20.25 and $20.50, the following resistance zones.

Market overview

The Federal Reserve’s daily talk of raising interest rates to curb rising inflation was a key factor that continued to act as a tailwind for underperforming gold. Fed Chairman Jerome Powell said last week that the US central bank remains focused on getting inflation under control and added that the US economy is well-positioned to pursue a tighter policy.

Reports that US President Joe Biden was proposing a measure to ease tariffs on goods from China offered a brief respite to jittery investors. Still, growing concerns about a global recession should keep a lid on any optimistic moves. Minutes from the FOMC’s latest monetary policy meeting are due on Wednesday, and the US monthly jobs report (NFP) is expected on Friday.