Oil and Natural Gas: Prices continue to slide down

- The price of oil fell to an 11-month low this morning.

- During the Asian trading session, the gas price continues to fall from last week.

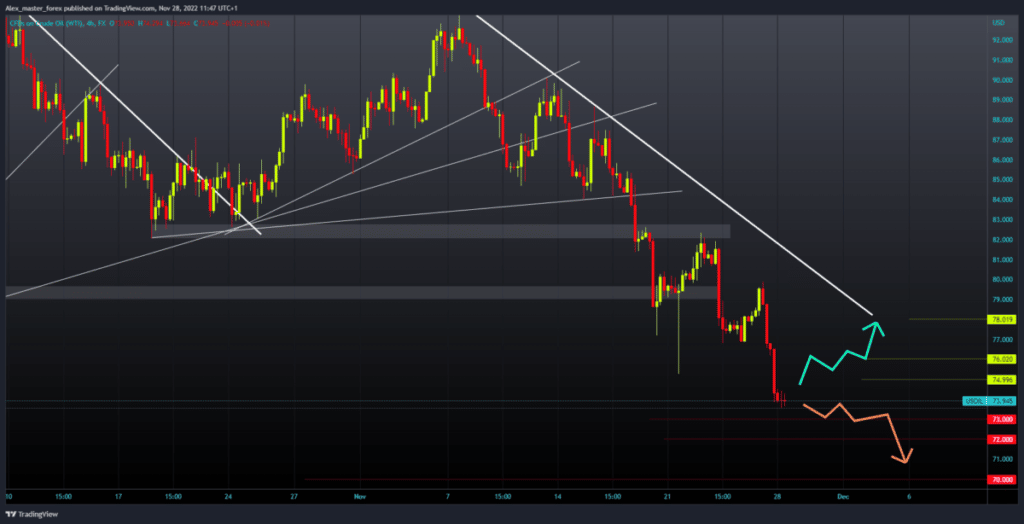

Oil chart analysis

The price of oil fell to an 11-month low this morning. Protests in China have heightened concerns about demand. China is sticking to President Xi Jinping’s policy to fight the coronavirus, despite much of the world lifting restrictions. The market can be expected to continue to move volatile depending on the outcome of the OPEC+ meeting and the cap on Russian oil prices.

The price of oil has fallen below $74.00, and it is highly likely that we will see a continuation of the decline until some further lower support. Potential lower targets are the $72.00 and $70.00 levels. For a bullish option, we need a positive consolidation and a return above the $75.00 level. After that, the price could form a new bottom, where a new bullish impulse would occur, and the oil price would continue to recover. Potential higher targets are $76.00-$78.00 levels.

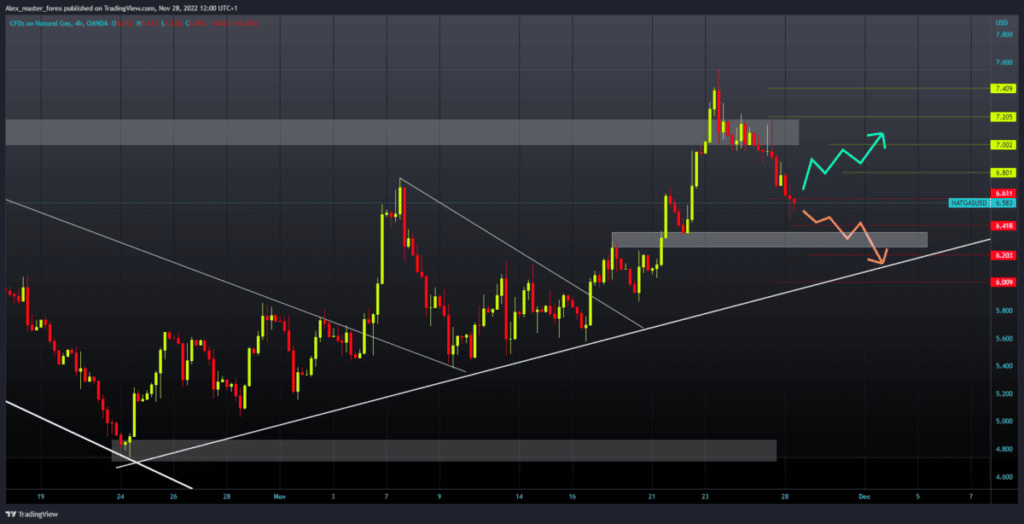

Natural gas chart analysis

During the Asian trading session, the gas price continues to fall from last week. The price fell to the $6.47 level this morning, and all the chances are that we could see a further continuation of the fall. We look for potential next support at the $6.40 level. A break below could lead to a further pullback. Potential lower targets are the $6.20 and $6.00 levels.

For a bullish option, we need a new positive consolidation. After that, we need to return to the zone around the $6.80 level. Then we would have a better position for a new bullish impulse and continued price recovery. Potential higher targets are the $7.00 and $7.20 levels.