Oil and Natural Gas: Lost of 20.0%

- Since the beginning of the week, oil has continued to withdraw due to concerns over fuel demand and the global economy ahead of the Fed’s expected significant increase in interest rates.

- Yesterday, the price of natural gas lost 20.0% of its value, falling from $ 8.80 to $ 7.00.

- Gazprom limits natural gas supply via the Nord Stream pipeline to Germany

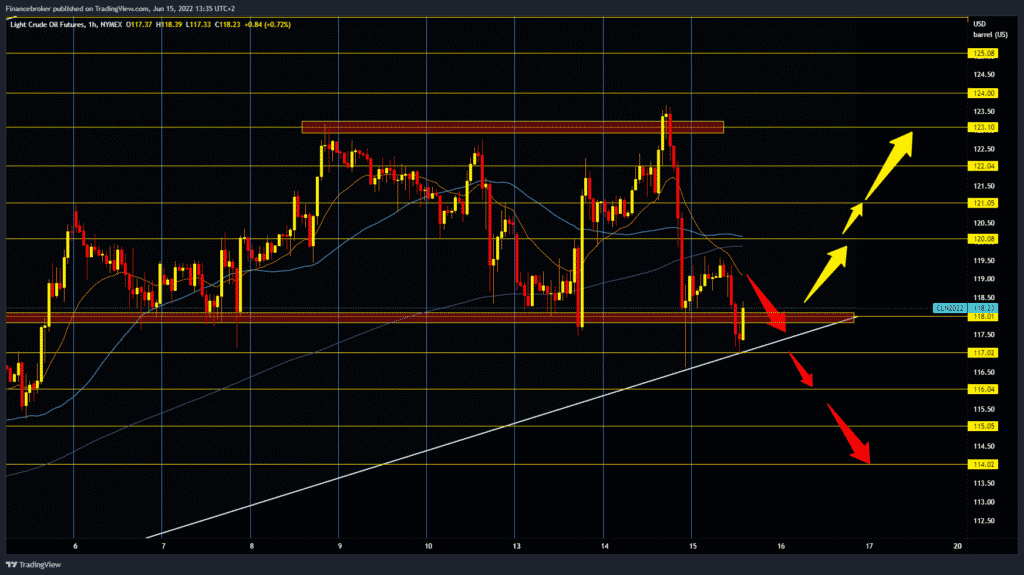

Oil chart analysis

Since the beginning of the week, oil has continued to withdraw due to concerns over fuel demand and the global economy ahead of the Fed’s expected significant increase in interest rates. Rising inflation has forced investors and oil traders to prepare for the Fed’s decisive move this week – raising interest rates by 75 basis points, the largest increase in US interest rates in 28 years. As for demand, the latest wave of epidemics in China has raised concerns about a new quarantine phase. However, the country’s economy showed signs of recovery in May after falling last month, as industrial production rose unexpectedly. In its monthly report, the Organization of the Petroleum Exporting Countries kept its forecasts that global oil demand would exceed the level before the 2022 pandemic.

However, limited supply provides limited price support, exacerbated by falling exports from Libya amid a political crisis that has hit manufacturing and ports. Also, data on crude oil reserves showed an increase of 0.7 million compared to expectations of a decline of 1.2 million. Today’s support found oil prices at the $ 117.00 level, and additional support is our lower trend line. We need the price to stabilize above $ 118.00, support zones in previous cases. If she succeeds, the price could recover to $ 120.00. For the bearish option, we need continued negative consolidation below the bottom line of support. After that, we can expect further price withdrawals towards $ 116.00 and $ 115.00.

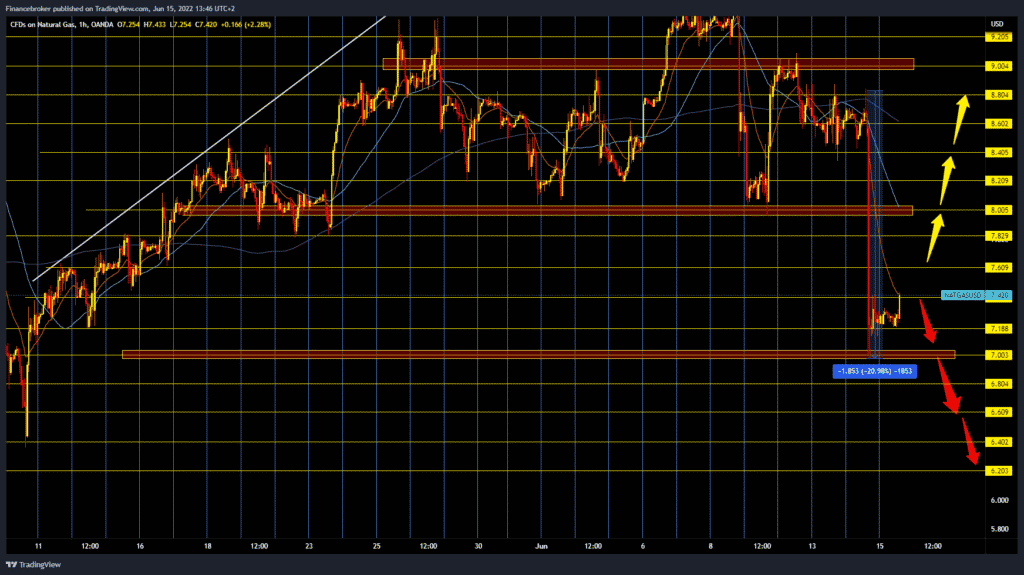

Natural gas chart analysis

Yesterday, the price of natural gas lost 20.0% of its value, falling from $ 8.80 to $ 7.00. Today, in the Asian session, the price of oil stabilized above $ 7.20, and the price began to recover. We are already testing the $ 7.40 level and need a break above for further price recovery. Potential higher targets are $ 7.60, $ 7.80, and $ 8.00 levels. For the bearish option, we need a new negative consolidation and a return to a new $ 7.00 level test. The price break below would bring us back to the movement zone from the beginning of May. Potential lower support targets are $ 6.80, $ 6.60, $ 6.40 and $ 6.20 levels.

Market overview

Gazprom limits natural gas supply via the Nord Stream pipeline to Germany

Russia’s Gazprom said on Tuesday that it would limit Germany’s supply of natural gas through the Nord Stream pipeline by 40% compared to the planned flow due to delays in repairing equipment, which has caused gas prices in Europe to rise by 13%.

Gazprom announced today on its Telegram channel that Siemens had postponed the return of gas compressor units from repair, and technical problems prevented it from sending the planned quantities of natural gas to the largest gas connection to Europe. Only three compressor units can currently be used to transport gas west of the Portovaja compressor station in the Baltic Sea, Gazprom said.

The Nord Stream gas pipeline supply can currently be provided in the amount of up to 100 million cubic meters per day, compared to the planned amount of 167 million cubic meters per day, the Russian gas giant announced.

Reduced gas supplies across the North Stream to Europe’s largest economy, Germany, boosted gas prices in Europe by double digits on Tuesday, with gas prices at the Dutch TTF hub, the reference gas price for Europe, up 13%.