Oil and Natural Gas: Fear of the recession

- During the Asian trading session, the price of oil fell from $ 110.00 to $ 103.25.

- During yesterday’s day, the price of natural gas ranged from $ 6.50 to $ 7.00.

- The EU is considering capping gas prices

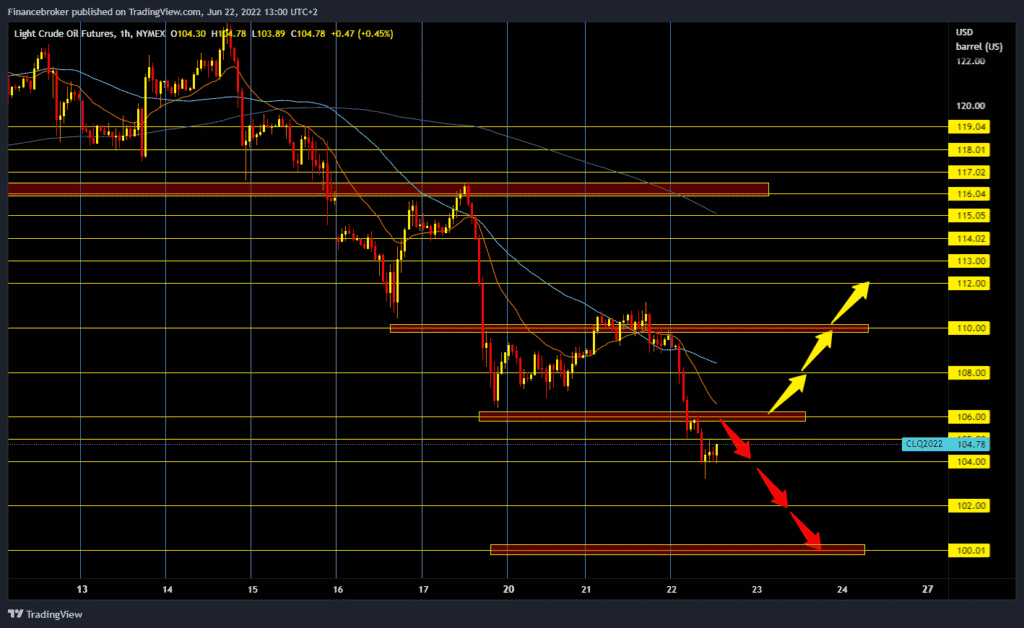

Oil chart analysis

During the Asian trading session, the price of oil fell from $ 110.00 to $ 103.25. Fear of the recession and the lower oil demand knock down the price of oil. Tomorrow, US President Biden is expected to meet with seven executive directors of the largest oil companies. It is rumored that some unconventional non-market measure will likely be introduced to curb the price of oil that fuels inflation. Crude oil traded at $ 104.53 a barrel, down 4.54% from trading tonight. Tonight, the issue of the American Petroleum Institute on the state of crude oil stocks in the USA will be published. The oil price somehow managed to stay above $ 104.00 and form the current bottom for a potential recovery. For the bullish option, we need a new positive consolidation and a return above the $ 106.00 level and the formation of a higher low on the chart. After that, we can expect further growth towards the next targets. Potential higher targets are $ 108.00 and $ 110.00 levels. We need continued negative consolidation and a fall below the $ 104.00 level for the bearish option. After that, we could expect the price to continue with the pullback. Potential lower targets are $ 103.00, $ 102.00 and $ 100.00 levels.

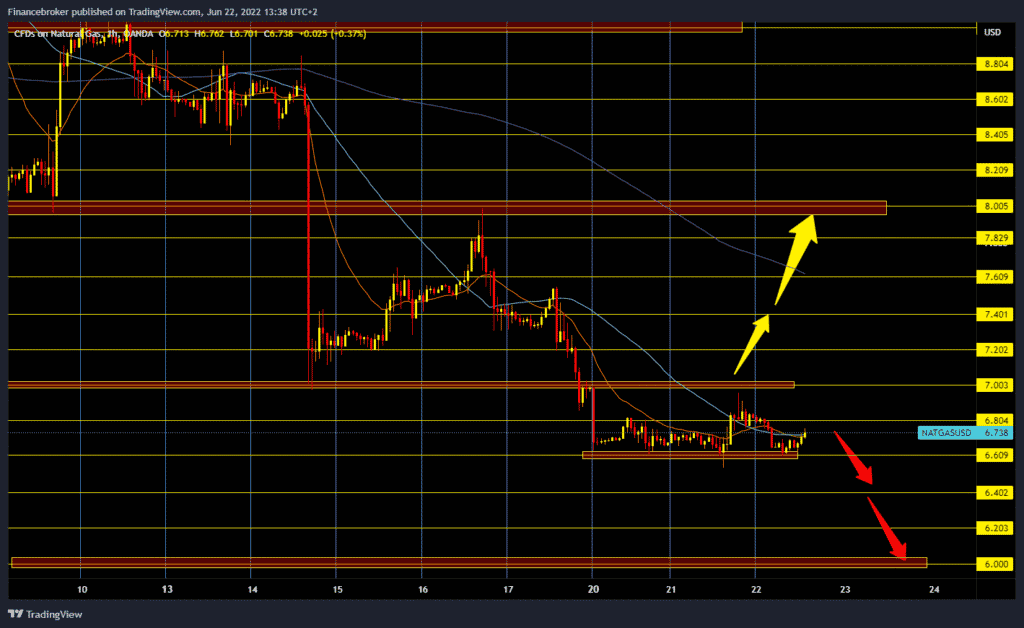

Natural gas chart analysis

During yesterday’s day, the price of natural gas ranged from $ 6.50 to $ 7.00. This morning, the pressure on the lower support zone was higher, but as the day wore on, the pressure eased, and the price is now at $ 6.73. For the bullish option, we need a further continuation of this less positive consolidation and a return above $ 6.80. After that, we could retest the $ 7.00 level. A break above would instil hope that recovery is still possible. Potential higher targets are $ 7.20, $ 7.40 and $ 7.60 levels. For the bearish option, we need a withdrawal of the gas price below the $ 6.60 level. After that, space opens up for us at the $ 6.00 level as the next target of this seven-day pullback.

Market overview

The EU is considering capping gas prices

Italy’s idea of the EU introducing a natural gas price cap has emerged as “the only sustainable solution” to rising energy prices, Italian Energy Transition Minister Roberto Chingolani told an energy conference in Rome on Tuesday.

A few weeks ago, Italy proposed to other EU member states to limit the price of gas in order to tame rising inflation and sharply rising energy prices in the 27-member bloc. Other EU countries have expressed doubts that the price cap would work.

In late May, Italian Prime Minister Mario Draghi said the European Commission would consider setting an upper limit on the price of imported Russian natural gas.

At a conference today, Minister Cingolani said that “the proposed price cap has gradually emerged as the only viable solution”.